Question: please answer part a, b, and c In 2000, Ms. Ennis, a head of household, contributed $63,000 in exchange for 630 shares of Seta stock.

please answer part a, b, and c

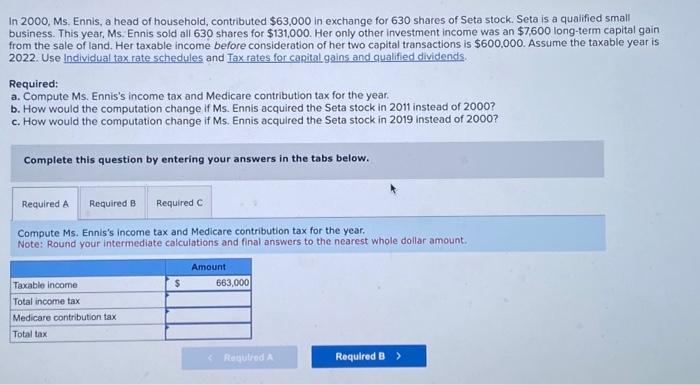

please answer part a, b, and cIn 2000, Ms. Ennis, a head of household, contributed $63,000 in exchange for 630 shares of Seta stock. Seta is a qualified small business. This year. Ms. Ennis sold all 630 shares for $131,000. Her only other investment income was an $7,600 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $600,000. Assume the taxable year is 2022. Use Individual tax rate schedules and Tax rates for capitalgains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Complete this question by entering your answers in the tabs below. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts