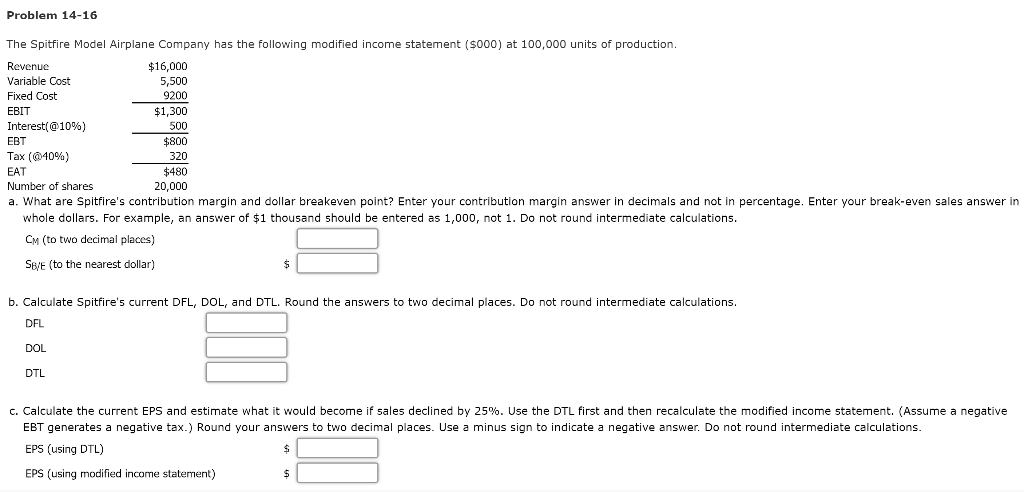

Question: NEED HELP ON PART C. THANKS. Problem 14-16 The Spitfire Model Airplane Company has the following modified income statement ($000) at 100,000 units of production.

NEED HELP ON PART C. THANKS.

Problem 14-16 The Spitfire Model Airplane Company has the following modified income statement ($000) at 100,000 units of production. Revenue $16,000 Variable Cost 5,500 Fixed Cost 9200 EBIT $1,300 Interest(@10%) EBT Tax (40%) 320 EAT $480 Number of shares 20,000 a. What are Spitfire's contribution margin and dollar breakeven point? Enter your contribution margin answer in decimals and not in percentage. Enter your break-even sales answer in whole dollars. For example, an answer of $1 thousand should be entered as 1,000, not 1. Do not round intermediate calculations. CM (to two decimal places) 500 $800 SB/E (to the nearest dollar) b. Calculate Spitfire's current DFL, DOL, and DTL. Round the answers to two decimal places. Do not round intermediate calculations. DFL DOL DTL C. Calculate the current EPS and estimate what it would become if sales declined by 25%. Use the DTL first and then recalculate the modified income statement. (Assume a negative EBT generates a negative tax.) Round your answers to two decimal places. Use a minus sign to indicate a negative answer. Do not round intermediate calculations. EPS (using DTL) EPS (using modified income statement)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts