Question: Need help on quick problem, will give thumbs up rating. Thanks. Heavy Metal Corporation is expected to generate the following free cash flows over the

Need help on quick problem, will give thumbs up rating. Thanks.

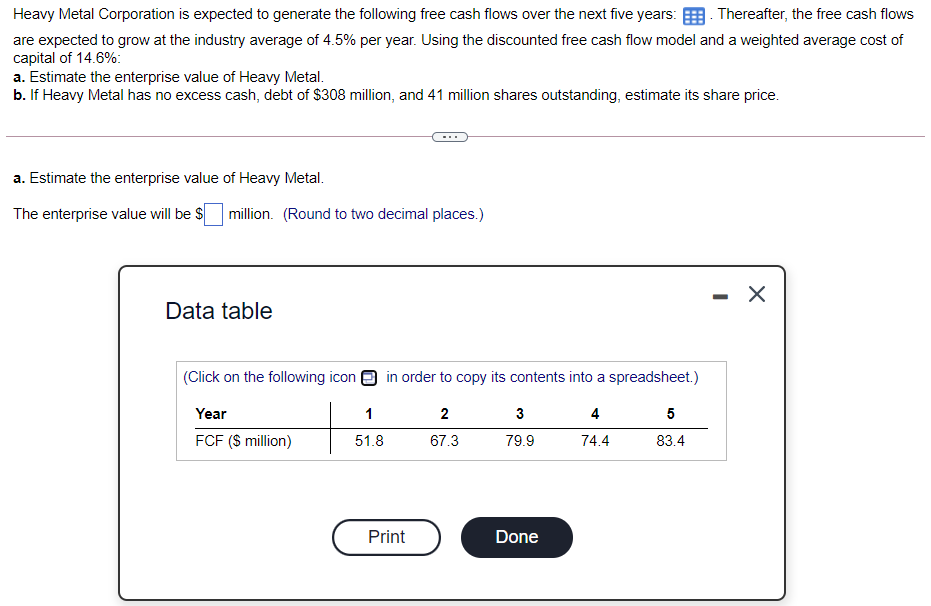

Heavy Metal Corporation is expected to generate the following free cash flows over the next five years: B. Thereafter, the free cash flows are expected to grow at the industry average of 4.5% per year. Using the discounted free cash flow model and a weighted average cost of capital of 14.6% a. Estimate the enterprise value of Heavy Metal. b. If Heavy Metal has no excess cash, debt of $308 million, and 41 million shares outstanding, estimate its share price. a. Estimate the enterprise value of Heavy Metal. The enterprise value will be $ million. (Round to two decimal places.) - Data table (Click on the following icon in order to copy its contents into a spreadsheet.) 1 2 4 5 Year FCF (S million) 3 79.9 51.8 67.3 74.4 83.4 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts