Question: Need help on the remaining boxes. Thank you! Ms. S owns a portfolio containing some special securities that she believes will perform well compared to

Need help on the remaining boxes. Thank you!

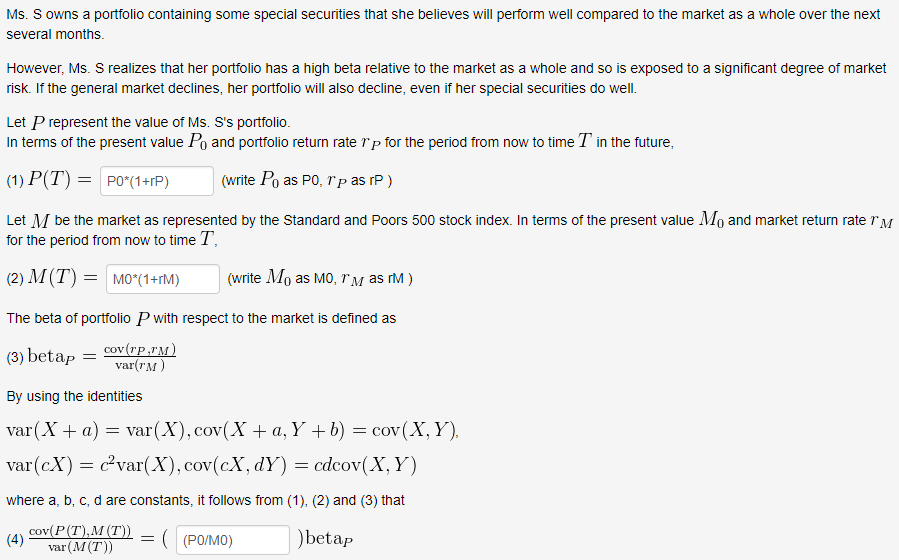

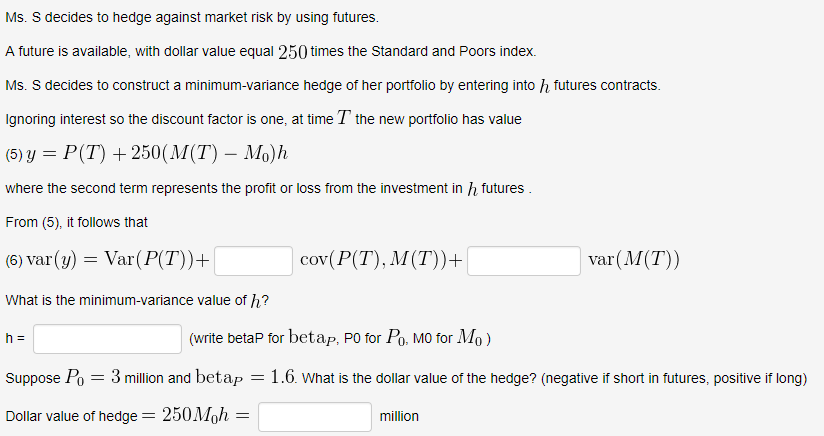

Ms. S owns a portfolio containing some special securities that she believes will perform well compared to the market as a whole over the next several months However, Ms. S realizes that her portfolio has a high beta relative to the market as a whole and so is exposed to a significant degree of market risk. If the general market declines, her portfolio will also decline, even if her special securities do well Let P represent the value of Ms. S's portfolio in terms of the present value Po and portfolio return rate r p for the period from now to time T in the future (1) P(T) PO(1+P) (rite Po as PO, T p as rP) Let M be the market as represented by the Standard and Poors 500 stock index. In terms of the present value Mo and market return rate rM for the period from now to time . (2) M(T) =MO*(1+rM) The beta of portfolio P with respect to the market is defined as (write Mo as MO, rM as rM) 3) betaparM COV TP,TM By using the identities var(X + a) = var(X), cov(X + a, y + b) = cov(x, y) val COV , COV where a, b, c, d are constants, it follows from (1), (2) and (3) that P(T),M (T) 4var(M(T)) ( )betap (PO/MO)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts