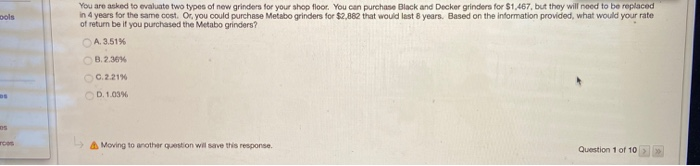

Question: need help ools You are asked to evaluate two types of new grinders for your shop floor. You can purchase Black and Decker grinders for

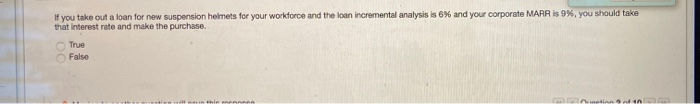

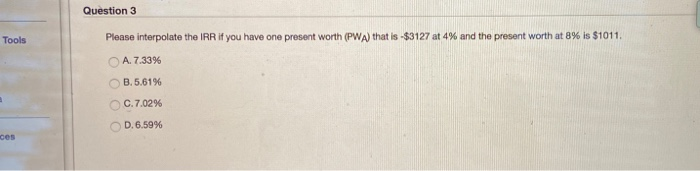

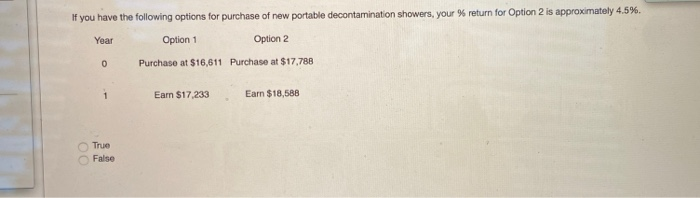

ools You are asked to evaluate two types of new grinders for your shop floor. You can purchase Black and Decker grinders for $1,467, but they will nood to be replaced in 4 years for the same cost. Or you could purchase Metabo grinders for $2,882 that would last 8 years. Based on the information provided, what would your rate of return be if you purchased the Metabo grinders? A. 3.51% 3.2.36% 0.2.21% D. 1.03% Moving to another question will save this response Question 1 of 10 > >> If you take out a loan for new suspension helmets for your workforce and the loan incremental analysis is 6% and your corporate MARR is 9%, you should take that interest rate and make the purchase. True False Question 3 Tools Please interpolate the IRR if you have one present worth (PWA) that is -$3127 at 4% and the present worth at 8% is $1011 A. 7.33% B.5.61% C.7.02% D. 6.59% ces If you have the following options for purchase of new portable decontamination showers, your % return for Option 2 is approximately 4.5%. Year Option 1 Option 2 0 P urchase at $16,611 Purchase at $17,788 Earn $17.233 Earn $18,588 True False ools You are asked to evaluate two types of new grinders for your shop floor. You can purchase Black and Decker grinders for $1,467, but they will nood to be replaced in 4 years for the same cost. Or you could purchase Metabo grinders for $2,882 that would last 8 years. Based on the information provided, what would your rate of return be if you purchased the Metabo grinders? A. 3.51% 3.2.36% 0.2.21% D. 1.03% Moving to another question will save this response Question 1 of 10 > >> If you take out a loan for new suspension helmets for your workforce and the loan incremental analysis is 6% and your corporate MARR is 9%, you should take that interest rate and make the purchase. True False Question 3 Tools Please interpolate the IRR if you have one present worth (PWA) that is -$3127 at 4% and the present worth at 8% is $1011 A. 7.33% B.5.61% C.7.02% D. 6.59% ces If you have the following options for purchase of new portable decontamination showers, your % return for Option 2 is approximately 4.5%. Year Option 1 Option 2 0 P urchase at $16,611 Purchase at $17,788 Earn $17.233 Earn $18,588 True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts