Question: NEED HELP PLEASE!!!!!! Rules: 1. Each team is provided with incomplete financial information about a fictional family's financial situation. You are not given all information

NEED HELP PLEASE!!!!!!

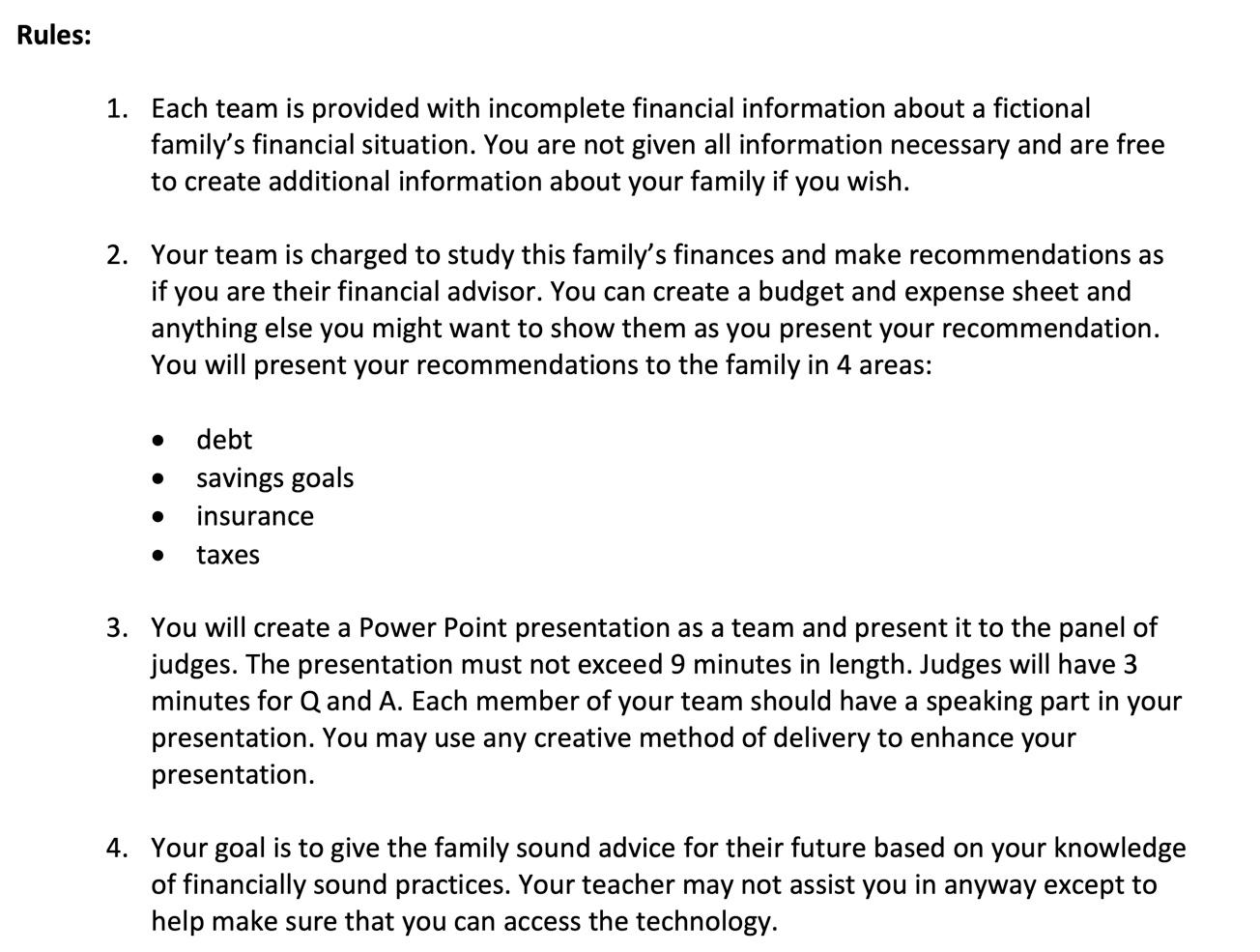

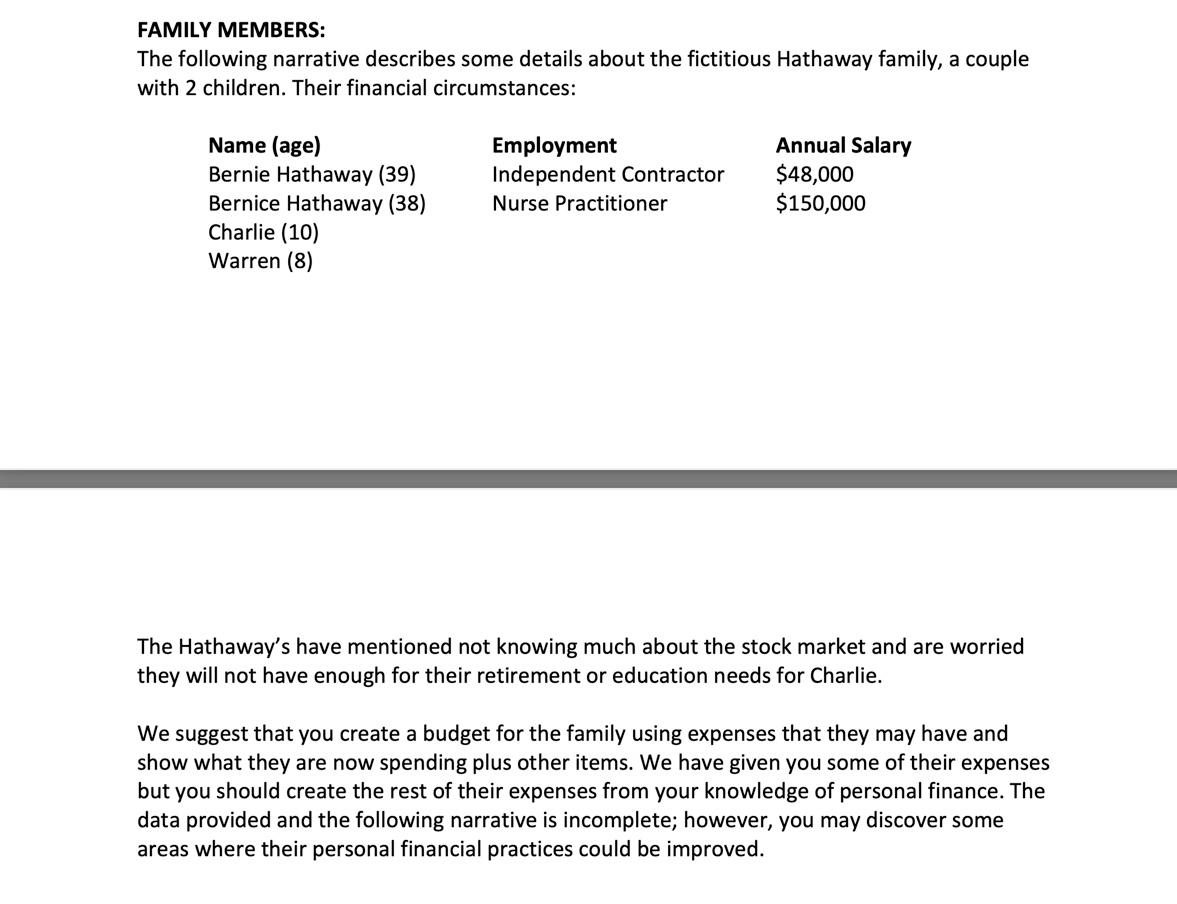

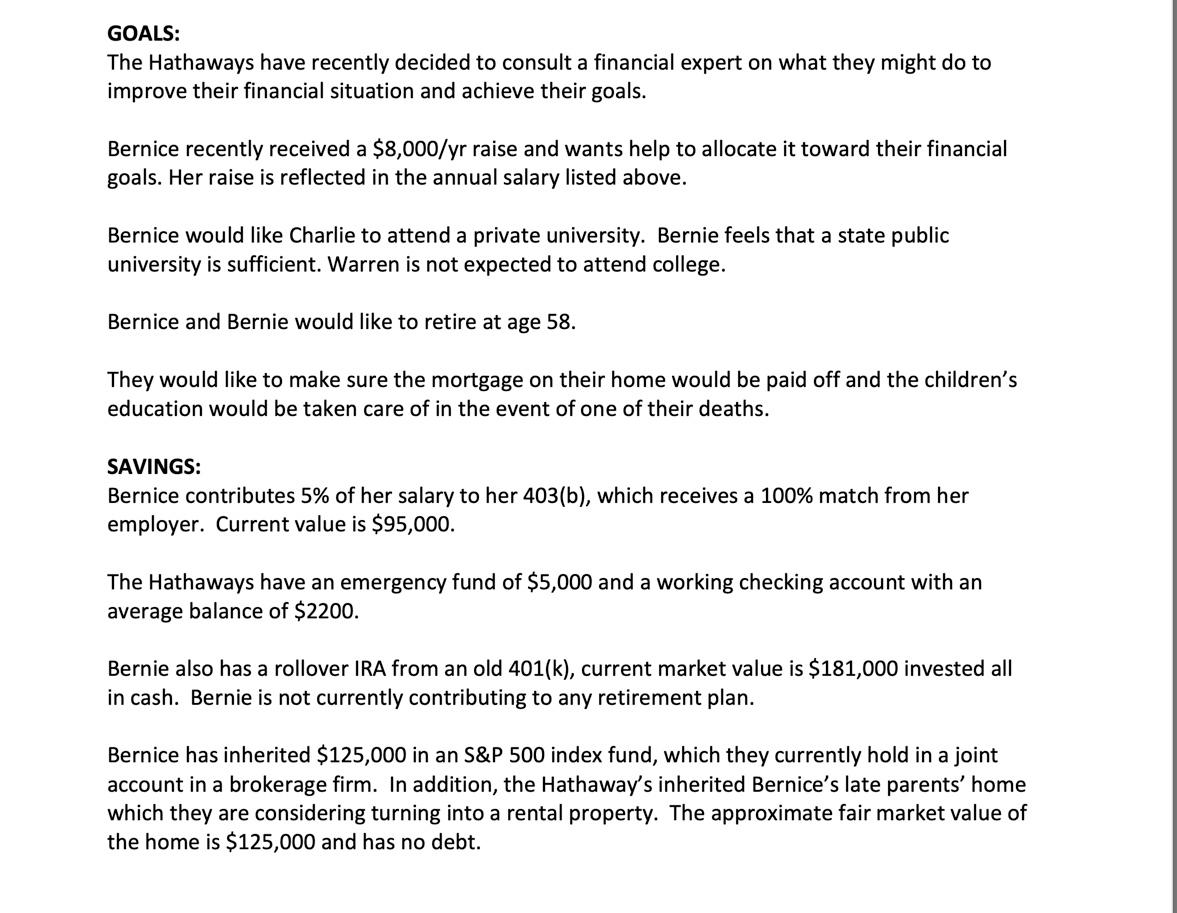

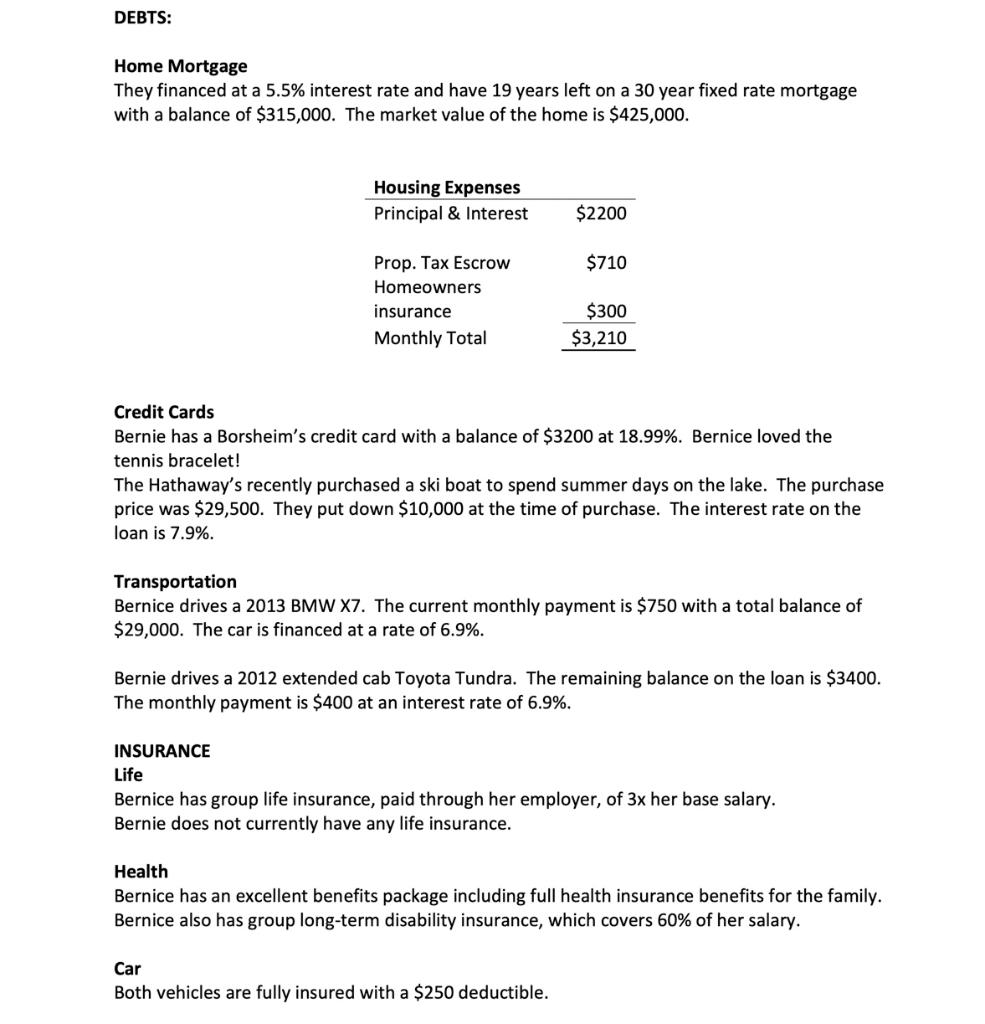

Rules: 1. Each team is provided with incomplete financial information about a fictional family's financial situation. You are not given all information necessary and are free to create additional information about your family if you wish. 2. Your team is charged to study this family's finances and make recommendations as if you are their financial advisor. You can create a budget and expense sheet and anything else you might want to show them as you present your recommendation. You will present your recommendations to the family in 4 areas: . . debt savings goals insurance . taxes 3. You will create a Power Point presentation as a team and present it to the panel of judges. The presentation must not exceed 9 minutes in length. Judges will have 3 minutes for Q and A. Each member of your team should have a speaking part in your presentation. You may use any creative method of delivery to enhance your presentation. 4. Your goal is to give the family sound advice for their future based on your knowledge of financially sound practices. Your teacher may not assist you in anyway except to help make sure that you can access the technology. FAMILY MEMBERS: The following narrative describes some details about the fictitious Hathaway family, a couple with 2 children. Their financial circumstances: Name (age) Bernie Hathaway (39) Bernice Hathaway (38) Charlie (10) Warren (8) Employment Independent Contractor Nurse Practitioner Annual Salary $48,000 $150,000 The Hathaway's have mentioned not knowing much about the stock market and are worried they will not have enough for their retirement or education needs for Charlie. We suggest that you create a budget for the family using expenses that they may have and show what they are now spending plus other items. We have given you some of their expenses but you should create the rest of their expenses from your knowledge of personal finance. The data provided and the following narrative is incomplete; however, you may discover some areas where their personal financial practices could be improved. GOALS: The Hathaways have recently decided to consult a financial expert on what they might do to improve their financial situation and achieve their goals. Bernice recently received a $8,000/yr raise and wants help to allocate it toward their financial goals. Her raise is reflected in the annual salary listed above. Bernice would like Charlie to attend a private university. Bernie feels that a state public university is sufficient. Warren is not expected to attend college. Bernice and Bernie would like to retire at age 58. They would like to make sure the mortgage on their home would be paid off and the children's education would be taken care of in the event of one of their deaths. SAVINGS: Bernice contributes 5% of her salary to her 403(b), which receives a 100% match from her employer. Current value is $95,000. The Hathaways have an emergency fund of $5,000 and a working checking account with an average balance of $2200. Bernie also has a rollover IRA from an old 401(k), current market value is $181,000 invested all in cash. Bernie is not currently contributing to any retirement plan. Bernice has inherited $125,000 in an S&P 500 index fund, which they currently hold in a joint account in a brokerage firm. In addition, the Hathaway's inherited Bernice's late parents' home which they are considering turning into a rental property. The approximate fair market value of the home is $125,000 and has no debt. DEBTS: Home Mortgage They financed at a 5.5% interest rate and have 19 years left on a 30 year fixed rate mortgage with a balance of $315,000. The market value of the home is $425,000. Housing Expenses Principal & Interest $2200 $710 Prop. Tax Escrow Homeowners insurance Monthly Total $300 $3,210 Credit Cards Bernie has a Borsheim's credit card with a balance of $3200 at 18.99%. Bernice loved the tennis bracelet! The Hathaway's recently purchased a ski boat to spend summer days on the lake. The purchase price was $29,500. They put down $10,000 at the time of purchase. The interest rate on the loan is 7.9%. Transportation Bernice drives a 2013 BMW X7. The current monthly payment is $750 with a total balance of $29,000. The car is financed at a rate of 6.9%. Bernie drives a 2012 extended cab Toyota Tundra. The remaining balance on the loan is $3400. The monthly payment is $400 at an interest rate of 6.9%. INSURANCE Life Bernice has group life insurance, paid through her employer, of 3x her base salary. Bernie does not currently have any life insurance. Health Bernice has an excellent benefits package including full health insurance benefits for the family. Bernice also has group long-term disability insurance, which covers 60% of her salary. Car Both vehicles are fully insured with a $250 deductible. Taxes Bernie and Bernice are expecting a tax return of $7100 from the federal government and owe the state of Nebraska $900. OTHER THINGS TO CONSIDER Warren, the Hathaway's 8 year old son is autistic, on the higher functioning spectrum. He is expected to be able to live semi-independently as an adult. The Hathaway's want to ensure his long term financial security while ensuring he does not lose out on any state benefits he may be eligible for In your presentation, you should consider covering the following questions and any other additional recommendations for the Hathaway family. 1. How can they be more efficient in handling their debts? 2. What can they do to better address their goals, including taking care of Warren? Are there any cha needed their insurance? 4. Should they increase their retirement savings? 5. What's the best use of the family's tax return? 6. What should they do with the inherited assets? Rules: 1. Each team is provided with incomplete financial information about a fictional family's financial situation. You are not given all information necessary and are free to create additional information about your family if you wish. 2. Your team is charged to study this family's finances and make recommendations as if you are their financial advisor. You can create a budget and expense sheet and anything else you might want to show them as you present your recommendation. You will present your recommendations to the family in 4 areas: . . debt savings goals insurance . taxes 3. You will create a Power Point presentation as a team and present it to the panel of judges. The presentation must not exceed 9 minutes in length. Judges will have 3 minutes for Q and A. Each member of your team should have a speaking part in your presentation. You may use any creative method of delivery to enhance your presentation. 4. Your goal is to give the family sound advice for their future based on your knowledge of financially sound practices. Your teacher may not assist you in anyway except to help make sure that you can access the technology. FAMILY MEMBERS: The following narrative describes some details about the fictitious Hathaway family, a couple with 2 children. Their financial circumstances: Name (age) Bernie Hathaway (39) Bernice Hathaway (38) Charlie (10) Warren (8) Employment Independent Contractor Nurse Practitioner Annual Salary $48,000 $150,000 The Hathaway's have mentioned not knowing much about the stock market and are worried they will not have enough for their retirement or education needs for Charlie. We suggest that you create a budget for the family using expenses that they may have and show what they are now spending plus other items. We have given you some of their expenses but you should create the rest of their expenses from your knowledge of personal finance. The data provided and the following narrative is incomplete; however, you may discover some areas where their personal financial practices could be improved. GOALS: The Hathaways have recently decided to consult a financial expert on what they might do to improve their financial situation and achieve their goals. Bernice recently received a $8,000/yr raise and wants help to allocate it toward their financial goals. Her raise is reflected in the annual salary listed above. Bernice would like Charlie to attend a private university. Bernie feels that a state public university is sufficient. Warren is not expected to attend college. Bernice and Bernie would like to retire at age 58. They would like to make sure the mortgage on their home would be paid off and the children's education would be taken care of in the event of one of their deaths. SAVINGS: Bernice contributes 5% of her salary to her 403(b), which receives a 100% match from her employer. Current value is $95,000. The Hathaways have an emergency fund of $5,000 and a working checking account with an average balance of $2200. Bernie also has a rollover IRA from an old 401(k), current market value is $181,000 invested all in cash. Bernie is not currently contributing to any retirement plan. Bernice has inherited $125,000 in an S&P 500 index fund, which they currently hold in a joint account in a brokerage firm. In addition, the Hathaway's inherited Bernice's late parents' home which they are considering turning into a rental property. The approximate fair market value of the home is $125,000 and has no debt. DEBTS: Home Mortgage They financed at a 5.5% interest rate and have 19 years left on a 30 year fixed rate mortgage with a balance of $315,000. The market value of the home is $425,000. Housing Expenses Principal & Interest $2200 $710 Prop. Tax Escrow Homeowners insurance Monthly Total $300 $3,210 Credit Cards Bernie has a Borsheim's credit card with a balance of $3200 at 18.99%. Bernice loved the tennis bracelet! The Hathaway's recently purchased a ski boat to spend summer days on the lake. The purchase price was $29,500. They put down $10,000 at the time of purchase. The interest rate on the loan is 7.9%. Transportation Bernice drives a 2013 BMW X7. The current monthly payment is $750 with a total balance of $29,000. The car is financed at a rate of 6.9%. Bernie drives a 2012 extended cab Toyota Tundra. The remaining balance on the loan is $3400. The monthly payment is $400 at an interest rate of 6.9%. INSURANCE Life Bernice has group life insurance, paid through her employer, of 3x her base salary. Bernie does not currently have any life insurance. Health Bernice has an excellent benefits package including full health insurance benefits for the family. Bernice also has group long-term disability insurance, which covers 60% of her salary. Car Both vehicles are fully insured with a $250 deductible. Taxes Bernie and Bernice are expecting a tax return of $7100 from the federal government and owe the state of Nebraska $900. OTHER THINGS TO CONSIDER Warren, the Hathaway's 8 year old son is autistic, on the higher functioning spectrum. He is expected to be able to live semi-independently as an adult. The Hathaway's want to ensure his long term financial security while ensuring he does not lose out on any state benefits he may be eligible for In your presentation, you should consider covering the following questions and any other additional recommendations for the Hathaway family. 1. How can they be more efficient in handling their debts? 2. What can they do to better address their goals, including taking care of Warren? Are there any cha needed their insurance? 4. Should they increase their retirement savings? 5. What's the best use of the family's tax return? 6. What should they do with the inherited assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts