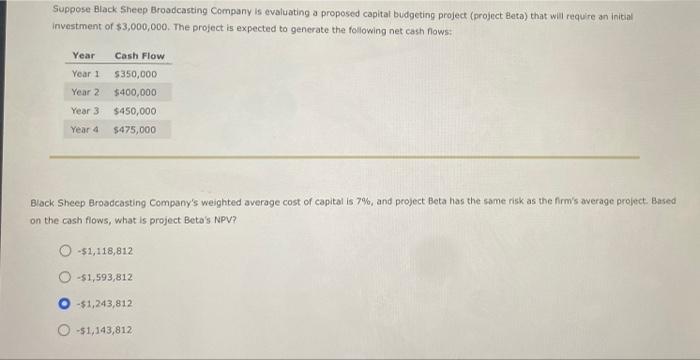

Question: need help please Suppose Black Sheep Broadcasting Company is evaluating a proposed capital budgeting project (project Beta) that will require an inition investment of $3,000,000.

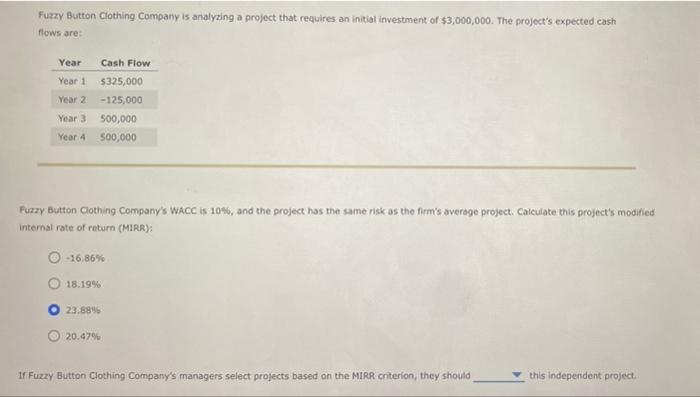

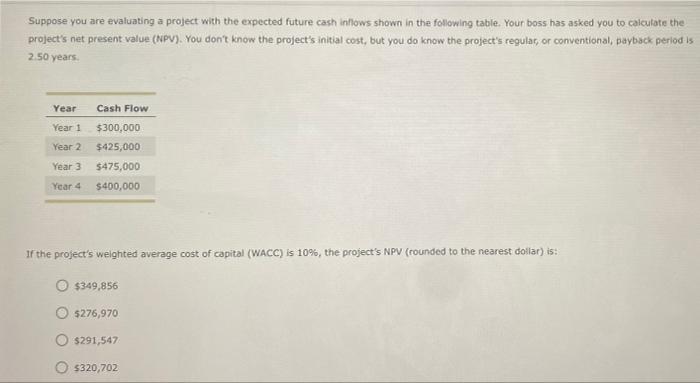

Suppose Black Sheep Broadcasting Company is evaluating a proposed capital budgeting project (project Beta) that will require an inition investment of $3,000,000. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 Year 2 $350,000 $400,000 $450,000 Year 3 Year 4 $475,000 Black Sheep Broadcasting Company's weighted average cost of capital is 7%, and project Beta has the same risk as the firm's average project. Based on the cash flows, what is project Beta's NPV? -$1,118,812 -$1,593,812 O -$1,243,812 0-$1,143,812 Fuzzy Button Clothing Company is analyzing a project that requires an initial investment of $3,000,000. The project's expected cash flows are Year Cash Flow Year 1 $325,000 -125,000 Year 2 Year 3 500,000 Year 4 500,000 Fuzzy Button Clothing Company's WACC IS 104, and the project has the same risk as the firm's average project. Calculate this project's modified Internal rate of return (MIRR); -16.86% 18.19% 23.8896 20.47% If Fuzzy Button Clothing Company's managers select projects based on the MIRR criterion, they should this independent project Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regulat, or conventional, payback period is 2.50 years Year Cash Flow Year 1 $300,000 $425,000 Year 2 Year 3 $475,000 Year 4 $400,000 If the project's weighted average cost of capital (WACC) is 10%, the project's NPV (rounded to the nearest dollar) is: $349,856 5276,970 $291,547 $320,702

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts