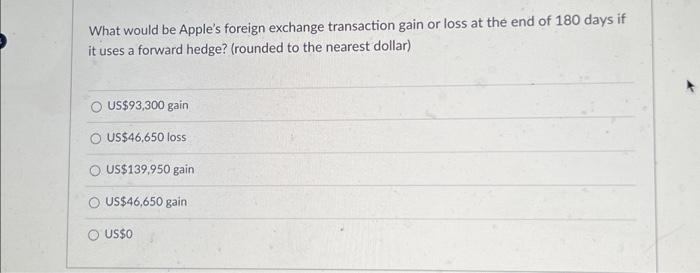

Question: NEED HELP PLEASE. What would be Apple's foreign exchange transaction gain or loss at the end of 180 days if it uses a forward hedge?

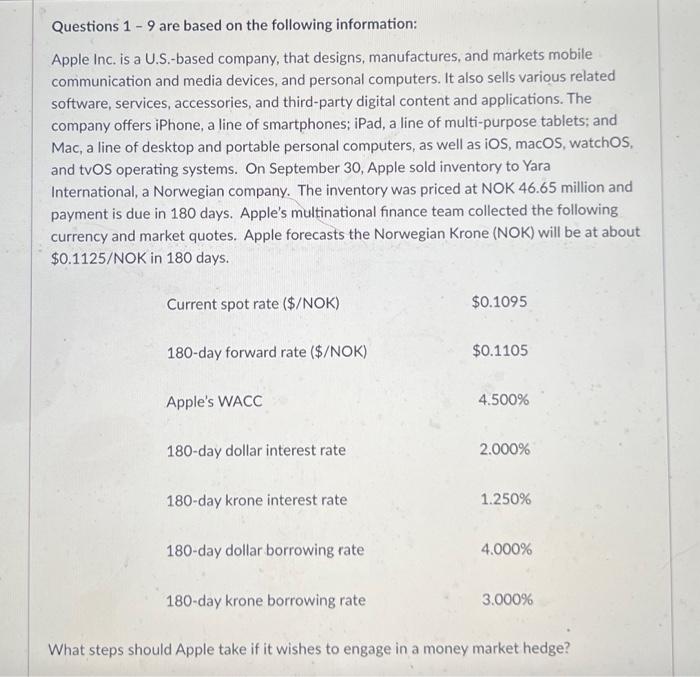

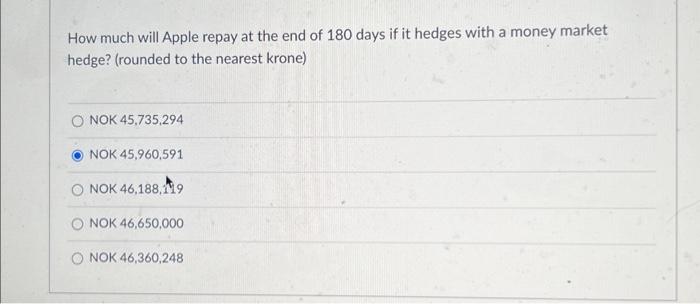

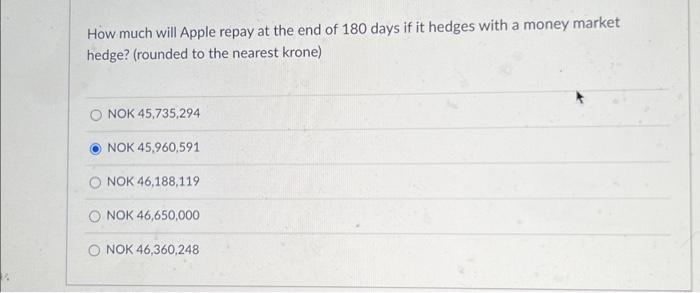

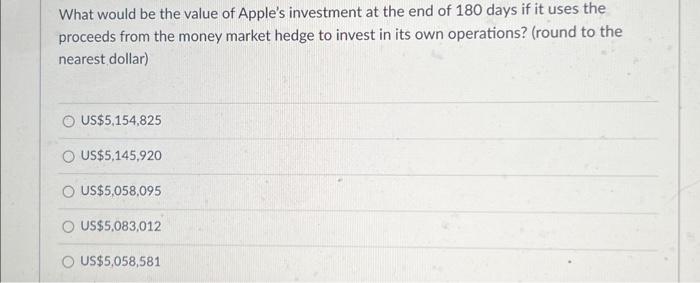

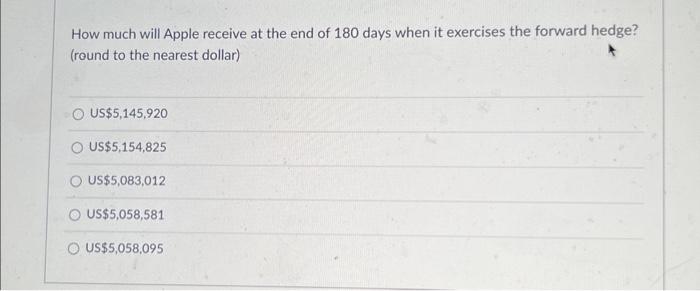

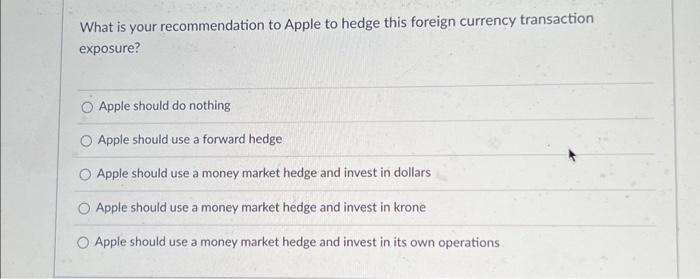

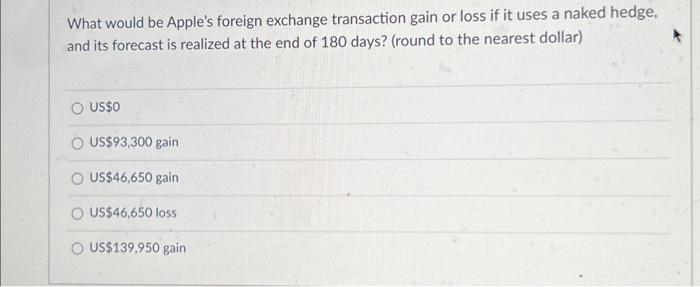

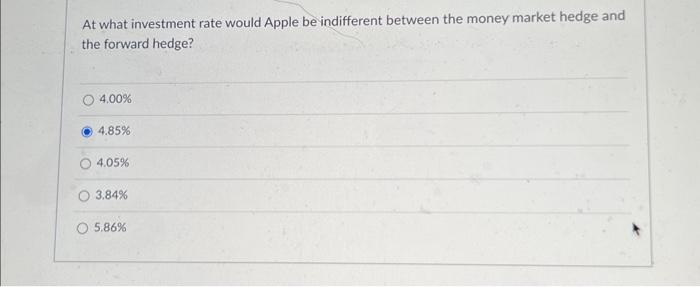

What would be Apple's foreign exchange transaction gain or loss at the end of 180 days if it uses a forward hedge? (rounded to the nearest dollar) US\$93,300 gain US\$46,650 loss US\$139,950 gain US\$46,650 gain us\$o What would be the value of Apple's investment at the end of 180 days if it uses the proceeds from the money market hedge to invest in its own operations? (round to the nearest dollar) US $5,154,825 US $5,145,920 US $5,058,095 US\$5,083,012 US $5,058,581 Questions 19 are based on the following information: Apple Inc. is a U.S.-based company, that designs, manufactures, and markets mobile communication and media devices, and personal computers. It also sells various related software, services, accessories, and third-party digital content and applications. The company offers iPhone, a line of smartphones; iPad, a line of multi-purpose tablets; and Mac, a line of desktop and portable personal computers, as well as iOS, macOS, watchOS, and tvOS operating systems. On September 30, Apple sold inventory to Yara International, a Norwegian company. The inventory was priced at NOK 46.65 million and payment is due in 180 days. Apple's multinational finance team collected the following currency and market quotes. Apple forecasts the Norwegian Krone (NOK) will be at about $0.1125/ NOK in 180 days. What steps should Apple take if it wishes to engage in a money market hedge? How much will Apple repay at the end of 180 days if it hedges with a money market hedge? (rounded to the nearest krone) NOK 45,735,294 NOK 45,960,591 NOK 46,188,119 NOK 46,650,000 NOK 46,360,248 How much will Apple receive at the end of 180 days when it exercises the forward hedge? (round to the nearest dollar) US $5,145,920 US $5,154,825 US\$5,083,012 US\$5,058,581 US\$5,058,095 What is your recommendation to Apple to hedge this foreign currency transaction exposure? Apple should do nothing Apple should use a forward hedge Apple should use a money market hedge and invest in dollars Apple should use a money market hedge and invest in krone Apple should use a money market hedge and invest in its own operations What would be Apple's foreign exchange transaction gain or loss if it uses a naked hedge, and its forecast is realized at the end of 180 days? (round to the nearest dollar) US\$O US\$93,300 gain US\$46,650 gain US\$46,650 loss US\$139,950 gain At what investment rate would Apple be indifferent between the money market hedge and the forward hedge? 4.00% 4.85% 4.05% 3.84% 5.86% How much will Apple repay at the end of 180 days if it hedges with a money market hedge? (rounded to the nearest krone) NOK 45,735,294 NOK 45,960,591 NOK 46,188,19 NOK 46,650,000 NOK 46,360,248

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts