Question: Need to re-ask this question. Two times it was incorrect. I came up with 6.08 and I was told the calculations are incorrect. Thanks! Thanks!

Need to re-ask this question. Two times it was incorrect. I came up with 6.08 and I was told the calculations are incorrect. Thanks! Thanks!

Thanks!

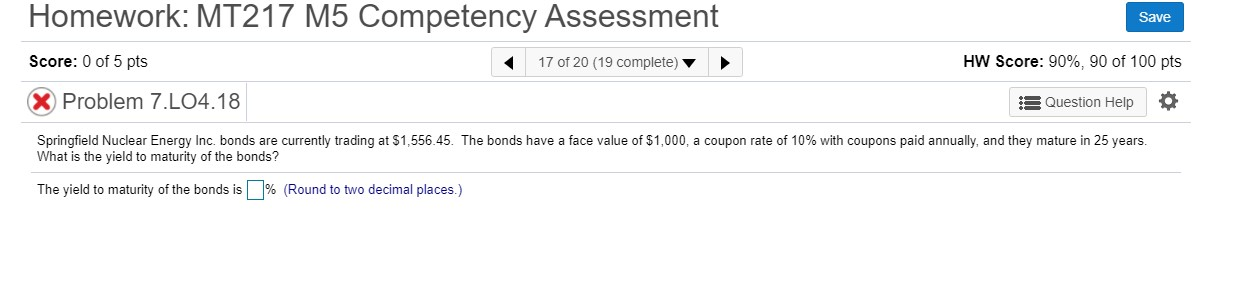

Homework: MT217 M5 Competency Assessment Save Score: 0 of 5 pts 17 of 20 (19 complete) HW Score: 90%, 90 of 100 pts X Problem 7.LO4.18 s Question Help Springfield Nuclear Energy Inc. bonds are currently trading at $1,556.45. The bonds have a face value of $1,000, a coupon rate of 10% with coupons paid annually, and they mature in 25 years. What is the yield to maturity of the bonds? The yield to maturity of the bonds is % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock