Question: need help pls ! will give up vote !! Oriole Industries incurs unit costs of $6 (84 variable and $2 fixed) in making an assembly

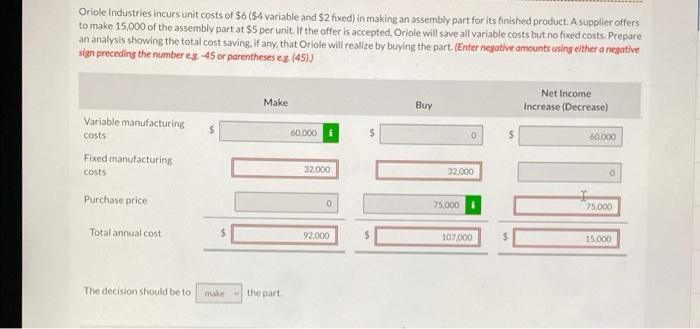

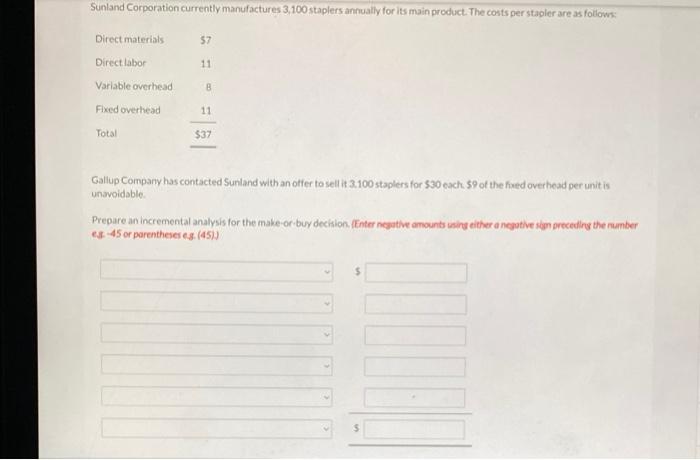

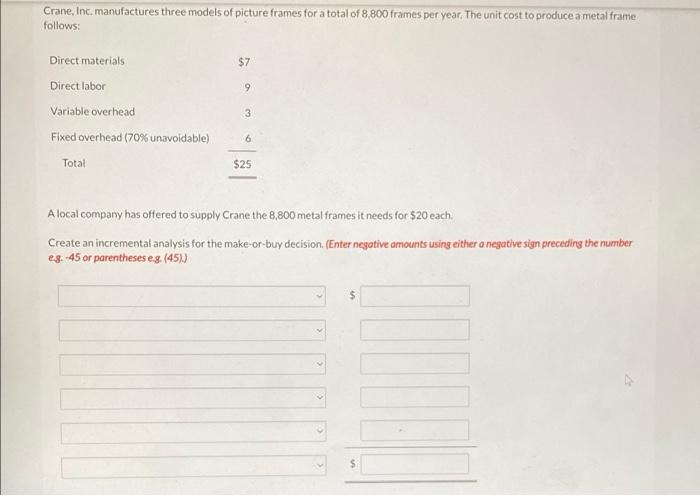

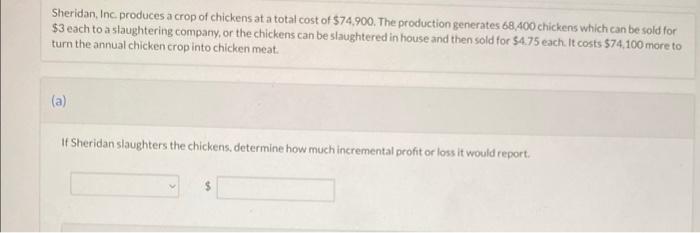

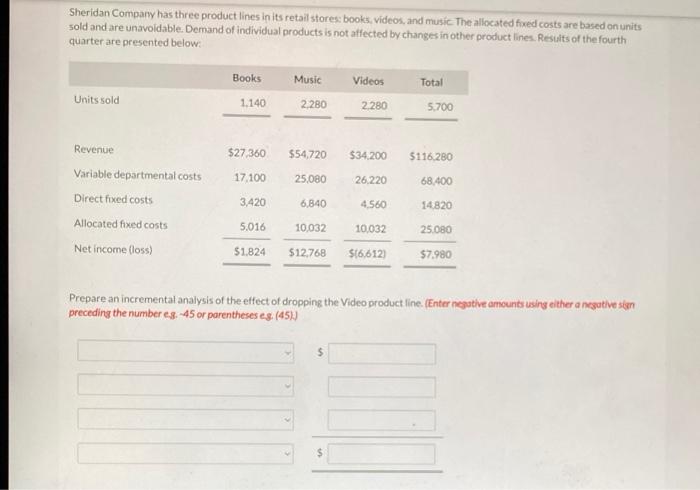

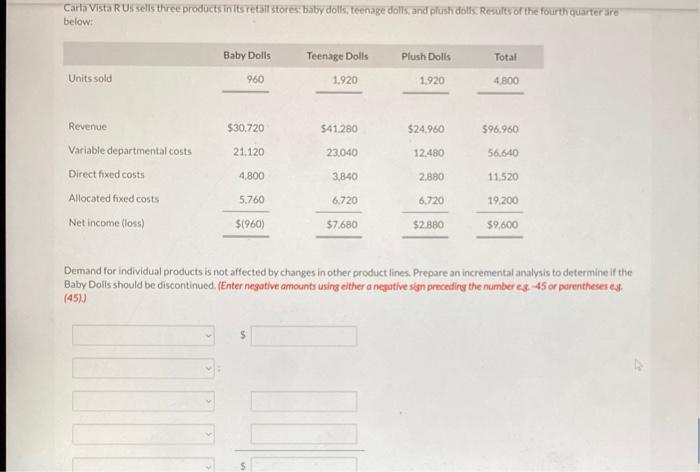

Oriole Industries incurs unit costs of $6 (84 variable and $2 fixed) in making an assembly part for its finished product. A supplier offers to make 15,000 of the assembly part at $5 per unit. If the offer is accepted, Oriole will save all variable costs but no fixed costs. Prepare an analysis showing the total cost saving, if any, that Oriole will realize by buying the part. (Enter negative amounts using either a negative sign preceding the number es. -45 or parentheses es: (451) Make Net Income Increase (Decrease) Buy $ 60.0001 0 60.000 Variable manufacturing costs Fixed manufacturing costs 32,000 32.000 Purchase price 0 75.000 75,000 Total annual cost $ 92.000 107.000 15.000 The decision should be to make the part Sunland Corporation currently manufactures 3,100 staplers annually for its main product. The costs per stapler are as follows: 57 11 Direct materials Direct labor Variable overhead Fixed overhead 11 Total $37 Gallup Company has contacted Sunland with an offer to set it 3.100 staplers for $30 cach 5% of the fixed overhead per unitis unavoidable Prepare an incremental analysis for the make-or-buy decision, Enter negative amounts using either a negative son preceding the rumber 43-45 or parentheses (451) Crane, Inc. manufactures three models of picture frames for a total of 8.800 frames per year. The unit cost to produce a metal frame follows: $7 9 Direct materials Direct labor Variable overhead Fixed overhead (70% unavoidable) 3 6 Total $25 A local company has offered to supply Crane the 8,800 metal frames it needs for $20 each. Create an incremental analysis for the make-or-buy decision. (Enter negative amounts using either a negative sign preceding the number 2.8. -45 or parentheses eg (45)) $ Sheridan, Inc. produces a crop of chickens at a total cost of $74.900. The production generates 68,400 chickens which can be sold for $3 each to a slaughtering company, or the chickens can be slaughtered in house and then sold for 34.75 each. It costs $74.100 more to turn the annual chicken crop into chicken meat. (a) if Sheridan slaughters the chickens, determine how much incremental profit or loss it would report. Sheridan Company has three product lines in its retail stores: books, videos, and music The allocated foved costs are based on units sold and are unavoidable. Demand of individual products is not affected by changes in other product lines. Results of the fourth quarter are presented below: Books Music Videos Total Units sold 1.140 2.280 2.280 5.700 Revenue $27.360 $54,720 $34.200 $116.280 17.100 25.080 26.220 68.400 3,420 6,840 4.560 14820 Variable departmental costs Direct fixed costs Allocated fixed costs Net income (loss) 5,016 10,032 10,032 25.080 51.824 $12.768 $(6.612) $7.980 Prepare an incremental analysis of the effect of dropping the Video product line. (Enter negative amounts using either a negative son preceding the number 4.8 -45 or parentheses es. (451) Carla Vista Russells three products in its retsil stores baby dolls, Teenage dolls, and plush dolls. Results of the fourth quarter Sre below: Baby Dolls Plush Dolls Total Teenage Dolls 1.920 Units sold 960 1.920 4800 Revenue $30.720 541.280 $24.960 $96.960 21.120 23.040 12.480 56,640 4.800 3,840 2.880 11.520 Variable departmental costs Direct fixed costs Allocated fixed costs Net income (loss) 5.760 6.720 6.720 19.200 $1960) 57680 $2880 59,600 Demand for individual products is not affected by changes in other product lines. Prepare an incremental analysis to determine if the Baby Dolls should be discontinued (Enter negative amounts using either a negative sign preceding the number eg 45 or parentheses es (451) $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts