Question: Need help recording for the Allowance Method, The Date and Debit amount on Line 3 is INCORRECT The Inventory Credit amount on Line 5 is

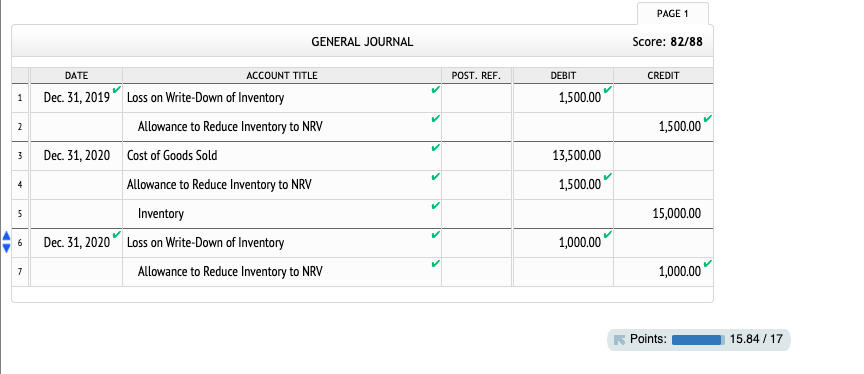

Need help recording for the Allowance Method,

The Date and Debit amount on Line 3 is INCORRECT

The Inventory Credit amount on Line 5 is also INCORRECT

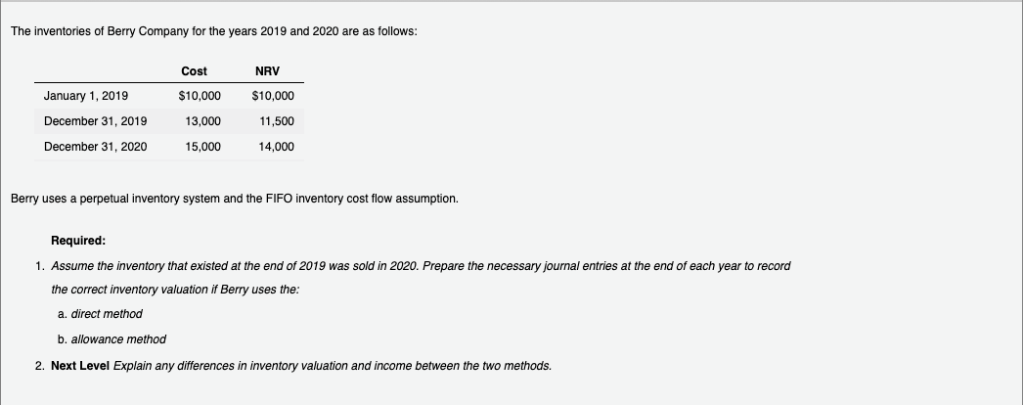

The inventories of Berry Company for the years 2019 and 2020 are as follows Cost NRV January 1, 2019 $10,000 $10,000 December 31, 2019 13,000 11,500 December 31, 2020 15.000 14,000 Berry uses a perpetual inventory system and the FIFO inventory cost flow assumption. Required: 1. Assume the inventory that existed t the end of 2019 was sold in 2020. Prepare the necessary journal entries at the end of each year to record the correct inventory valuation if Berry uses the: a. direct method b. allowance method 2. Next Level Explain any differences in inventory valuation and income between the two methods. PAGE 1 GENERAL JOURNAL Score: 82/88 POST. REF DATE ACCOUNT TITLE DEBIT CREDIT Dec. 31, 2019 Loss on Write-Down of Inventory 1,500.00 1 1,500.00 Allowance to Reduce Inventory to NRV Dec. 31, 2020 Cost of Goods Sold 13,500.00 3 1,500.00 Allowance to Reduce Inventory to NRV 4 Inventory 15,000.00 5 Dec. 31, 2020 Loss on Write-Down of Inventory 1,000.00 6 1,000.00 Allowance to Reduce Inventory to NRV 7 Points: 15.84 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts