Question: need help solving Exactly five years ago The Storehouse Ltd borrowed $10,000,000 through a 10-year bond issue. The face value (and sale price) of each

need help solving

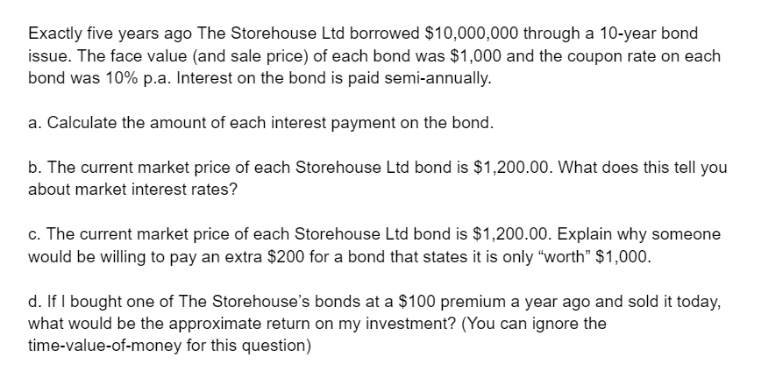

Exactly five years ago The Storehouse Ltd borrowed $10,000,000 through a 10-year bond issue. The face value (and sale price) of each bond was $1,000 and the coupon rate on each bond was 10% p.a. Interest on the bond is paid semi-annually. a. Calculate the amount of each interest payment on the bond. b. The current market price of each Storehouse Ltd bond is $1,200.00. What does this tell you about market interest rates? c. The current market price of each Storehouse Ltd bond is $1,200.00. Explain why someone would be willing to pay an extra $200 for a bond that states it is only "worth" $1,000. d. If I bought one of The Storehouse's bonds at a $100 premium a year ago and sold it today, what would be the approximate return on my investment? (You can ignore the time-value-of-money for this question)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts