Question: Need help solving practice question, cant seem to figure out the present value #. Please show your work to help see what I did wrong.

Need help solving practice question, cant seem to figure out the present value #. Please show your work to help see what I did wrong.

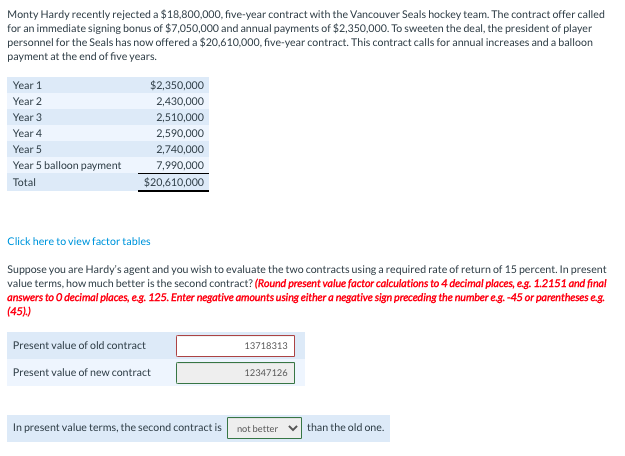

Monty Hardy recently rejected a $18,800,000, five-year contract with the Vancouver Seals hockey team. The contract offer called for an immediate signing bonus of $7,050,000 and annual payments of $2,350,000. To sweeten the deal, the president of player personnel for the Seals has now offered a $20,610,000, five-year contract. This contract calls for annual increases and a balloon payment at the end of five years. Year 1 $2,350,000 Year 2 2,430,000 Year 3 2,510,000 Year 4 2,590,000 Year 5 2,740,000 Year 5 balloon payment 7,990,000 Total $20,610,000 Click here to view factor tables Suppose you are Hardy's agent and you wish to evaluate the two contracts using a required rate of return of 15 percent. In present value terms, how much better is the second contract? (Round present value factor calculations to 4 decimal places, eg. 1.2151 and final answers to decimal places, eg. 125. Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (451) 13718313 Present value of old contract Present value of new contract 12347126 In present value terms, the second contract is not better than the old one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts