Question: Need help solving question 2 1 Accounts receivable increased $500,000 during the vear 2. Inventory increased $250,000 during the year. 3. Prepaid expenses increased $200,000

Need help solving question 2

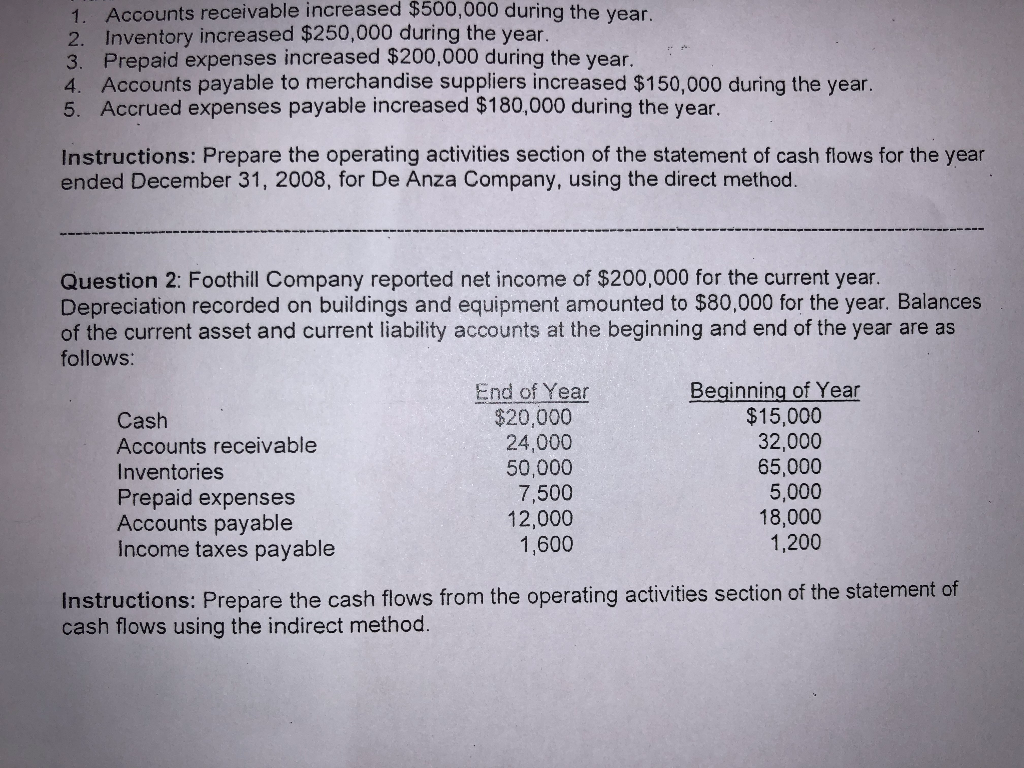

1 Accounts receivable increased $500,000 during the vear 2. Inventory increased $250,000 during the year. 3. Prepaid expenses increased $200,000 during the year. 4 Accounts payable to merchandise suppliers increased $150,000 during the year. 5. Accrued expenses payable increased $180,000 during the year. Instructions: Prepare the operating activities section of the statement of cash flows for the year ended December 31, 2008, for De Anza Company, using the direct method. Question 2: Foothill Company reported net income of $200,000 for the current year. Depreciation recorded on buildings and equipment amounted to $80,000 for the year. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $20,000 $15,000 Accounts receivable 24,000 32,000 Inventories 50,000 65,000 Prepaid expenses 7,500 5,000 Accounts payable 12,000 18,000 Income taxes payable 1,600 1,200 Instructions: Prepare the cash flows from the operating activities section of the statement of cash flows using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts