Question: need help solving these. The yield on a one-year Treasury security is 4.0000%, and the two year Treasury security has a 5.4000% yield. Assturning that

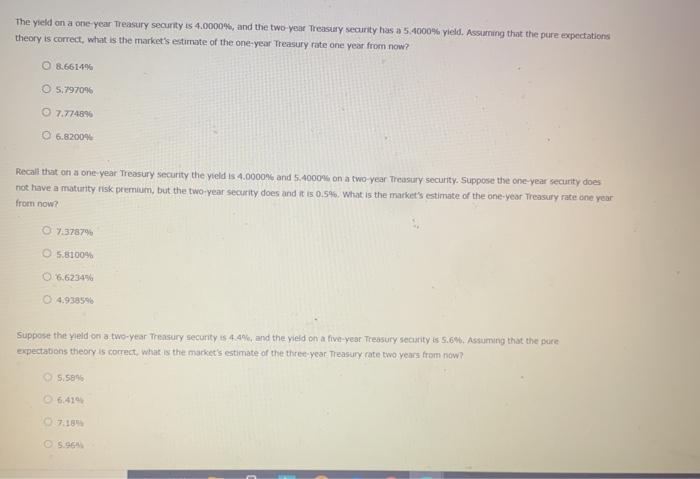

The yield on a one-year Treasury security is 4.0000%, and the two year Treasury security has a 5.4000% yield. Assturning that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? 8.6614% 5,7970% 7.774896 6.82004 Recall that on a one year Treasury Security the yield is 4.0000% and 5.4000 on a two year Treasury security. Suppose the one year security does not have a maturity risk premium, but the two-year security does and it is 0.5%. What is the market's estimate of the one-year Treasury rate one year from now? 7.37879 5.8100% 0.6.6234% 4.938596 Suppost the yield on a two-year Treasury securty is 4.4%, and the yield on a five-year Treasury security is 5.6. Assuming that the pure expectations theory is correct, what is the market's estimate of the three year. Treasury rate two years from now? 5.5896 6.419 S.96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts