Question: Need help solving this hedging problem Bayer AG in Germany has sent you a confirmation for a large order worth 100 million Euros for chemicals

Need help solving this hedging problem

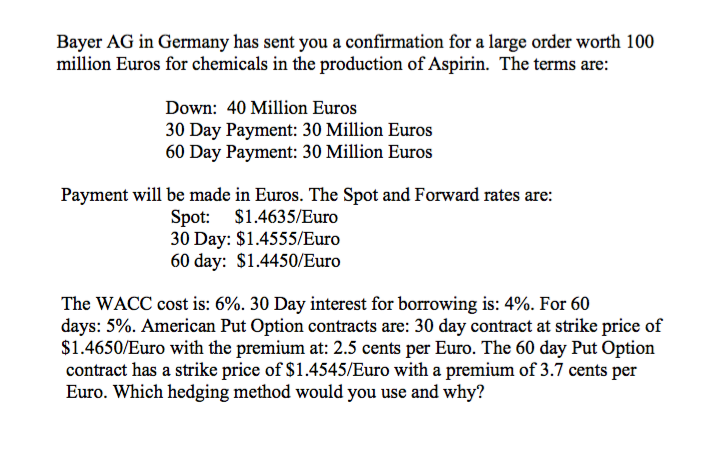

Bayer AG in Germany has sent you a confirmation for a large order worth 100 million Euros for chemicals in the production of Aspirin. The terms are: Down: 40 Million Euros 30 Day Payment: 30 Million Euros 60 Day Payment: 30 Million Euros Payment will be made in Euros. The Spot and Forward rates are: Spot: $ 1.4635/Euro 30 Day: $ 1.4555/Euro 60 day: $ 1.4450/Euro The WACC cost is: 6%. 30 Day interest for borrowing is: 4%. For 60 days: 5%. American Put Option contracts are: 30 day contract at strike price of $ 1.4650/Euro with the premium at: 2.5 cents per Euro. The 60 day Put Option contract has a strike price of $ 1.4545/Euro with a premium of 3.7 cents per Euro. Which hedging method would you use and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts