Question: Need help solving this problem by using excel. The second picture is the excel template. Thank you! Excel Online Structured Activity: Foreign Imvestment Analysis Chapman,

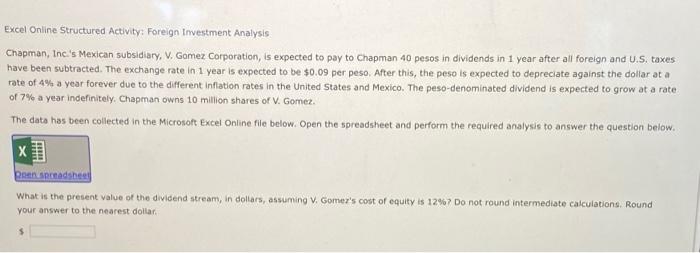

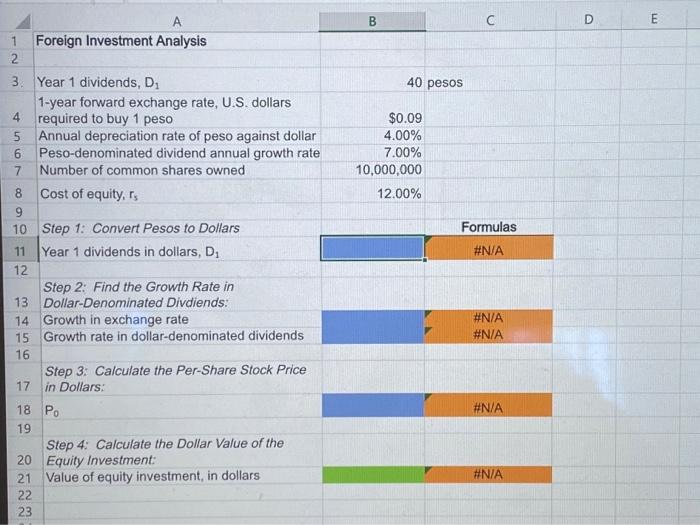

Excel Online Structured Activity: Foreign Imvestment Analysis Chapman, Inc's Mexican subsidiary, V. Gomez Corporation, is expected to pay to Chapman 40 pesos in dividends in 1 year after all foreign and U.S. taxes have been subtracted. The exchange rate in 1 year is expected to be $0.09 per peso. After this, the peso is expected to depreciate against the dollar at a rate of 4% a year forever due to the different inflation rates in the United 5 tates and Mexico. The peso-denominated dividend is expected to grow at a rate. of 7% a year indefinitely. Chapman owns 10 million shares of V. Gomez. The data has been collected in the Microsort Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. What is the present value of the dividend stream, in dollars, assuming V. Gomez's cost of equity is 12% Do not round intermediate calculations. Round your answer to the nearest dollar. \begin{tabular}{|llll} B & C & D & E \\ \hline \end{tabular} \begin{tabular}{l|l} 1 & Foreign Investment Analysis \\ 2 & \\ 3 & Year 1 dividends, D1 \\ \hline \end{tabular} 40 pesos 1-year forward exchange rate, U.S. dollars \begin{tabular}{l|rr} \hline 4 & required to buy 1 peso & $0.09 \\ \hline 5 & Annual depreciation rate of peso against dollar & 4.00% \\ 6 & Peso-denominated dividend annual growth rate & 7.00% \\ 7 & Number of common shares owned & 10,000,000 \\ \hline 8 & Cost of equity, rs & 12.00% \\ \hline \end{tabular} 10 Step 1: Convert Pesos to Dollars 11 Year 1 dividends in dollars, D1 Step 2: Find the Growth Rate in 13 Dollar-Denominated Divdiends: 14 Growth in exchange rate 15 Growth rate in dollar-denominated dividends 16 Step 3: Calculate the Per-Share Stock Price 17 in Dollars: 18P0 Step 4: Calculate the Dollar Value of the Equity Investment: Value of equity investment, in dollars \#N/A Excel Online Structured Activity: Foreign Imvestment Analysis Chapman, Inc's Mexican subsidiary, V. Gomez Corporation, is expected to pay to Chapman 40 pesos in dividends in 1 year after all foreign and U.S. taxes have been subtracted. The exchange rate in 1 year is expected to be $0.09 per peso. After this, the peso is expected to depreciate against the dollar at a rate of 4% a year forever due to the different inflation rates in the United 5 tates and Mexico. The peso-denominated dividend is expected to grow at a rate. of 7% a year indefinitely. Chapman owns 10 million shares of V. Gomez. The data has been collected in the Microsort Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. What is the present value of the dividend stream, in dollars, assuming V. Gomez's cost of equity is 12% Do not round intermediate calculations. Round your answer to the nearest dollar. \begin{tabular}{|llll} B & C & D & E \\ \hline \end{tabular} \begin{tabular}{l|l} 1 & Foreign Investment Analysis \\ 2 & \\ 3 & Year 1 dividends, D1 \\ \hline \end{tabular} 40 pesos 1-year forward exchange rate, U.S. dollars \begin{tabular}{l|rr} \hline 4 & required to buy 1 peso & $0.09 \\ \hline 5 & Annual depreciation rate of peso against dollar & 4.00% \\ 6 & Peso-denominated dividend annual growth rate & 7.00% \\ 7 & Number of common shares owned & 10,000,000 \\ \hline 8 & Cost of equity, rs & 12.00% \\ \hline \end{tabular} 10 Step 1: Convert Pesos to Dollars 11 Year 1 dividends in dollars, D1 Step 2: Find the Growth Rate in 13 Dollar-Denominated Divdiends: 14 Growth in exchange rate 15 Growth rate in dollar-denominated dividends 16 Step 3: Calculate the Per-Share Stock Price 17 in Dollars: 18P0 Step 4: Calculate the Dollar Value of the Equity Investment: Value of equity investment, in dollars \#N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts