Question: Need help solving this. Variable and Absorption Costing Summarized data for 2016 (the first year of operations) for Gorman Products, Inc., are as follows: Sales

Need help solving this.

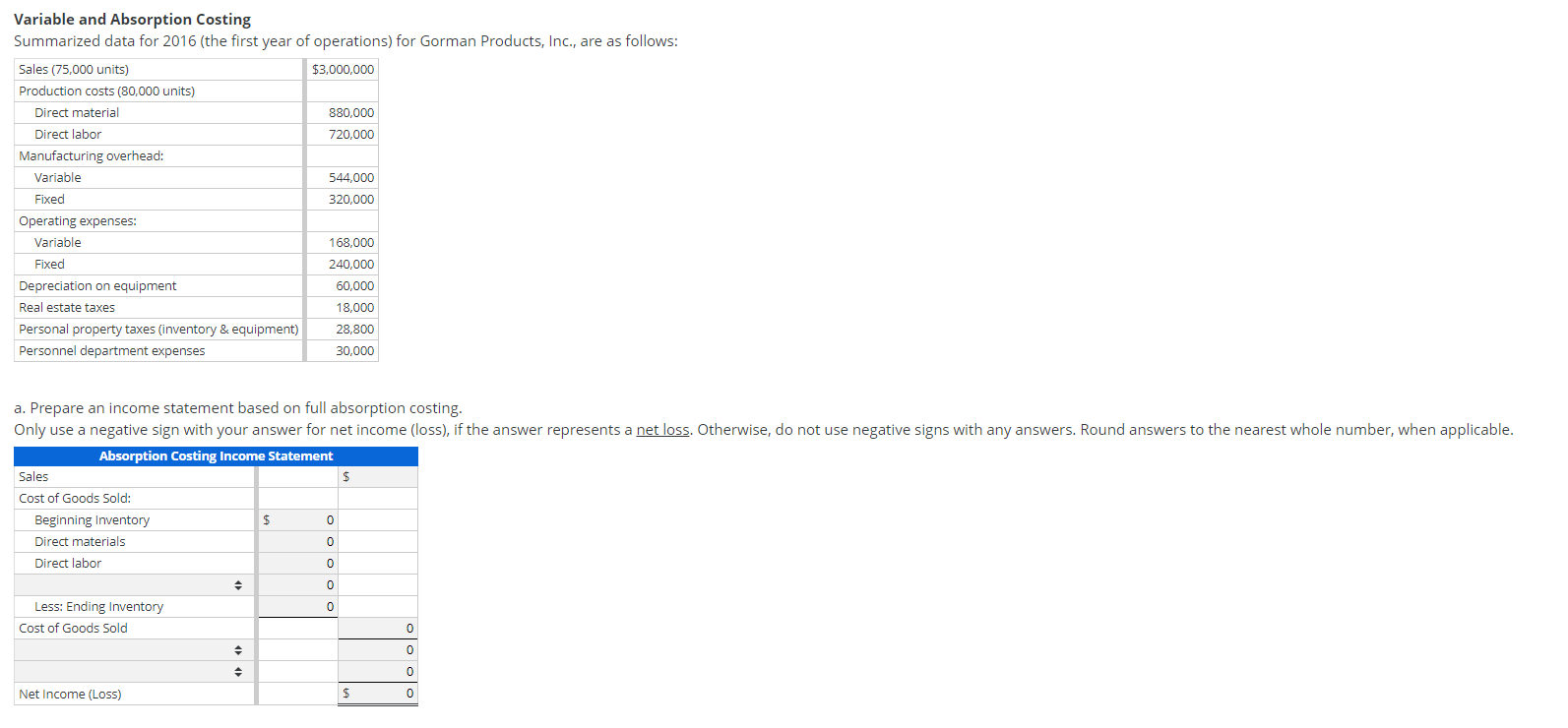

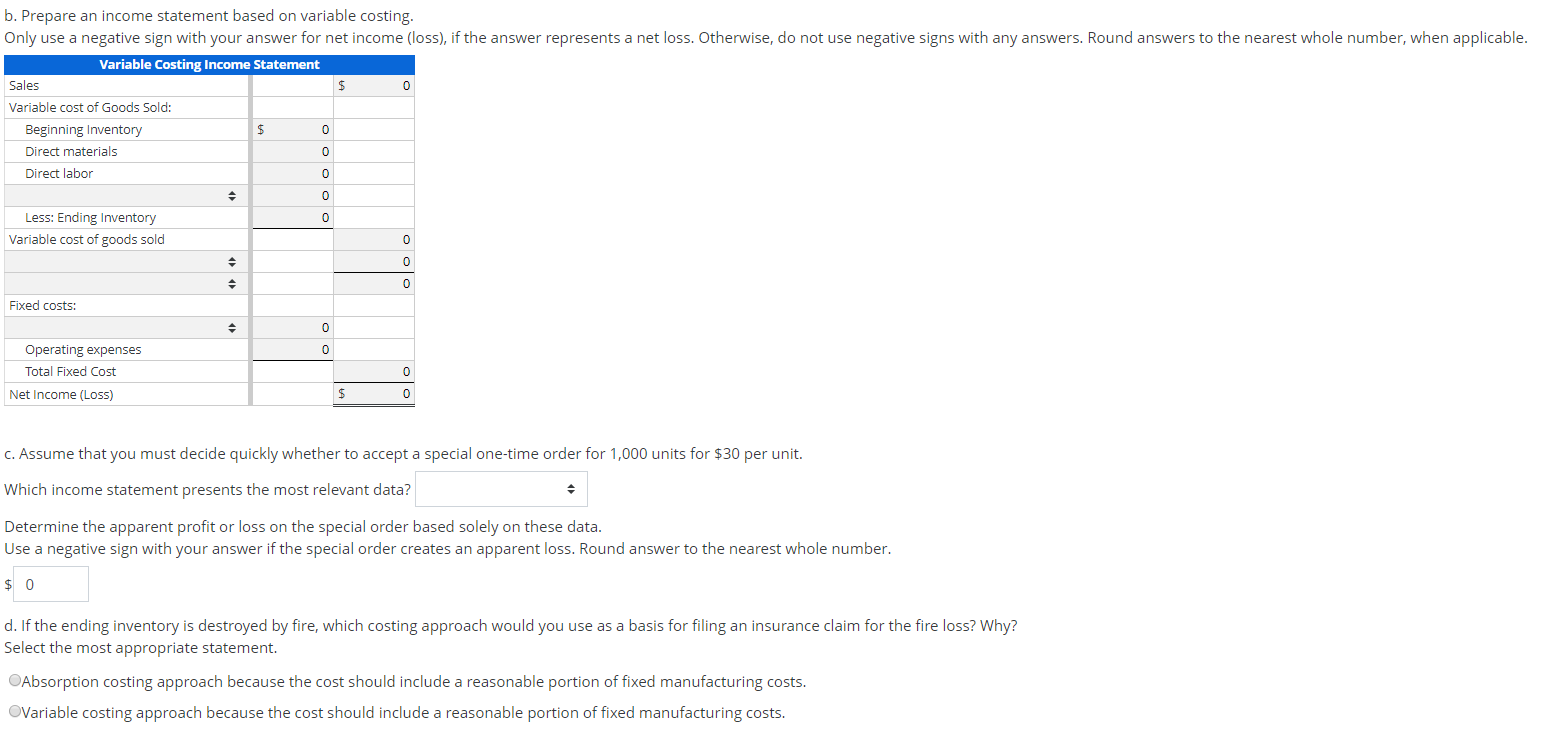

Variable and Absorption Costing Summarized data for 2016 (the first year of operations) for Gorman Products, Inc., are as follows: Sales (75,000 units) $3,000,000 Production costs (80,000 units) Direct material 880,000 Direct labor 720,000 Manufacturing overhead: Variable 544,000 Fixed 320,000 Operating expenses: Variable 168,000 Fixed 240,000 Depreciation on equipment 60,000 Real estate taxes 18,000 Personal property taxes (inventory & equipment) 28,800 Personnel department expenses 30,000 a. Prepare an income statement based on full absorption costing. Only use a negative sign with your answer for net income (loss), if the answer represents a net loss. Otherwise, do not use negative signs with any answers. Round answers to the nearest whole number, when applicable. Absorption Costing Income Statement Sales Cost of Goods Sold: Beginning Inventory Direct materials Direct labor Less: Ending Inventory Cost of Goods Sold Net Income (Loss) b. Prepare an income statement based on variable costing. Only use a negative sign with your answer for net income (loss), if the answer represents a net loss. Otherwise, do not use negative signs with any answers. Round answers to the nearest whole number, when applicable. Variable Costing Income Statement Sales Variable cost of Goods Sold: Beginning Inventory Direct materials Direct labor Less: Ending Inventory Variable cost of goods sold Fixed costs: Operating expenses Total Fixed Cost Net Income (Loss) C. Assume that you must decide quickly whether to accept a special one-time order for 1,000 units for $30 per unit. Which income statement presents the most relevant data? Determine the apparent profit or loss on the special order based solely on these data. Use a negative sign with your answer if the special order creates an apparent loss. Round answer to the nearest whole number. $ 0 d. If the ending inventory is destroyed by fire, which costing approach would you use as a basis for filing an insurance claim for the fire loss? Why? Select the most appropriate statement. Absorption costing approach because the cost should include a reasonable portion of fixed manufacturing costs. Variable costing approach because the cost should include a reasonable portion of fixed manufacturing costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts