Question: Need help solving without excel A 30-year maturity bond making annual coupon payments with a coupon rate of 12% has duration of 11.54 years and

Need help solving without excel

Need help solving without excel

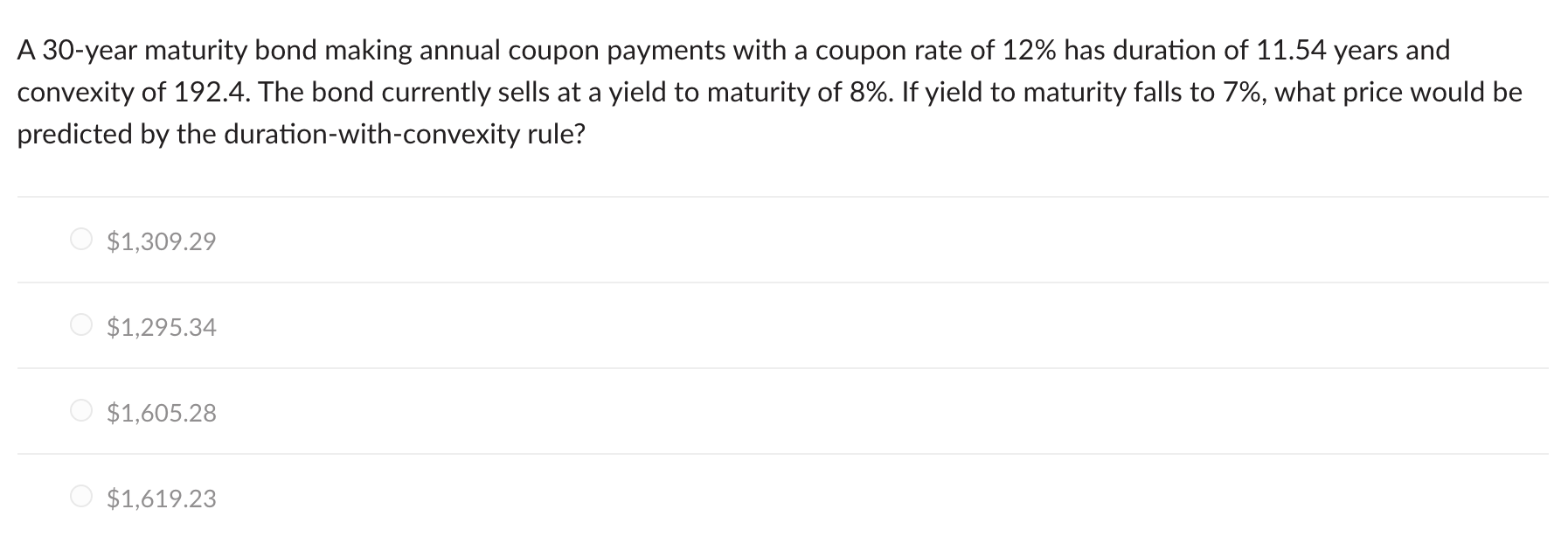

A 30-year maturity bond making annual coupon payments with a coupon rate of 12% has duration of 11.54 years and convexity of 192.4. The bond currently sells at a yield to maturity of 8%. If yield to maturity falls to 7%, what price would be predicted by the duration-with-convexity rule? $1,309.29 $1,295.34 $1,605.28 O $1,619.23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts