Question: NEED HELP someone please answer quick! Peach Corporation's only cash receipts are those derived from customer sales. Peach makes both cash sales and sales on

NEED HELP someone please answer quick!

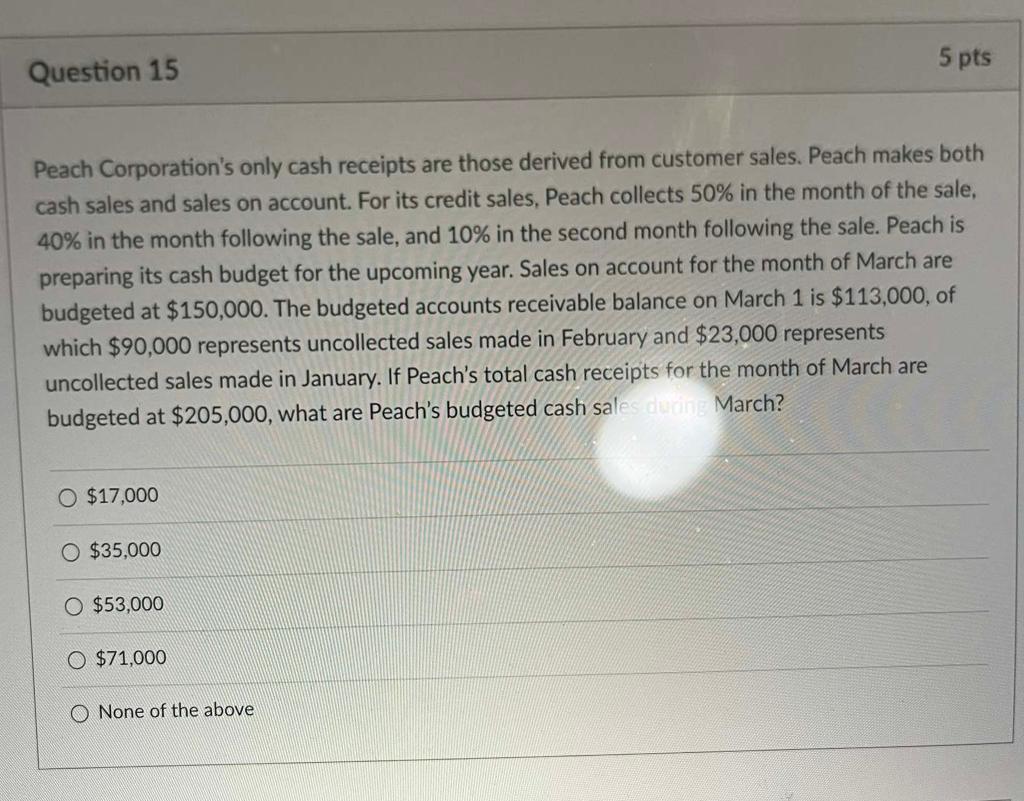

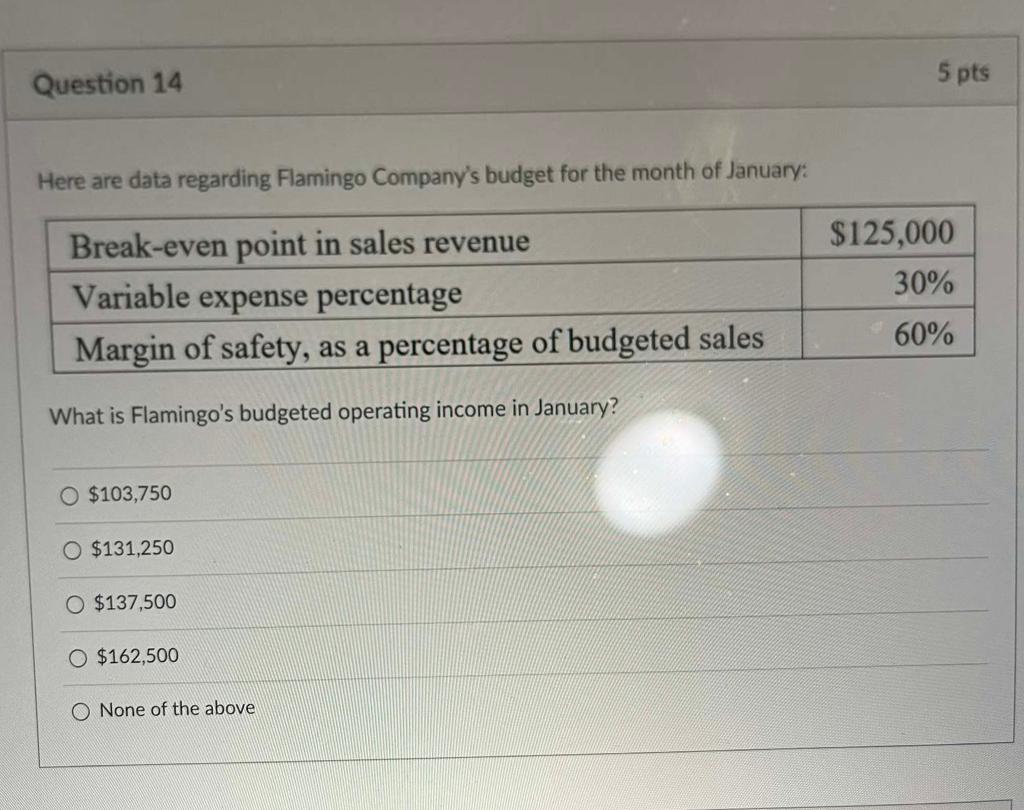

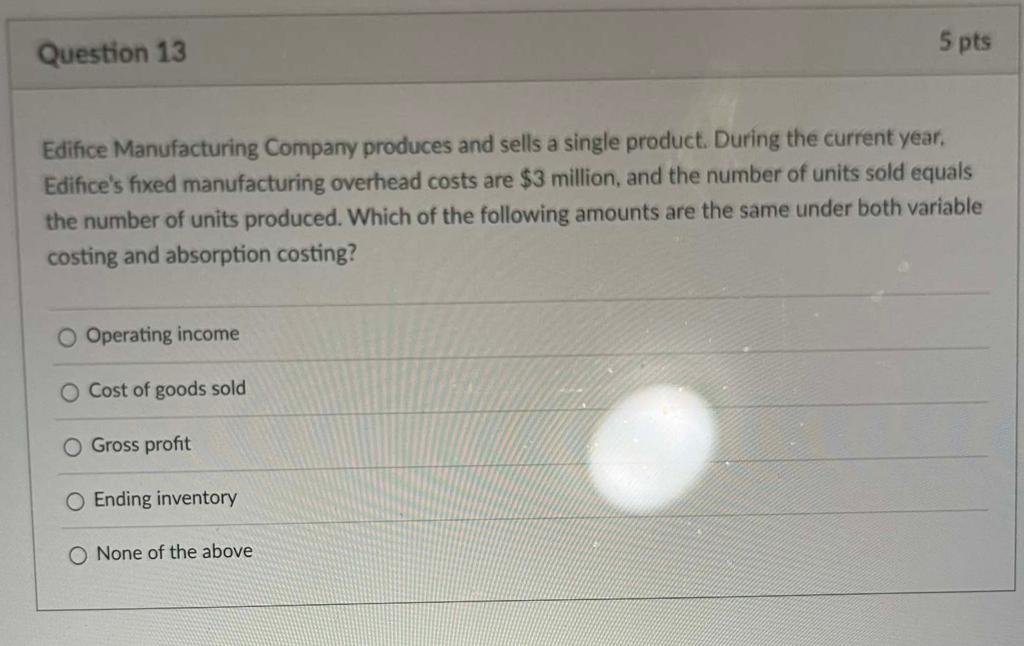

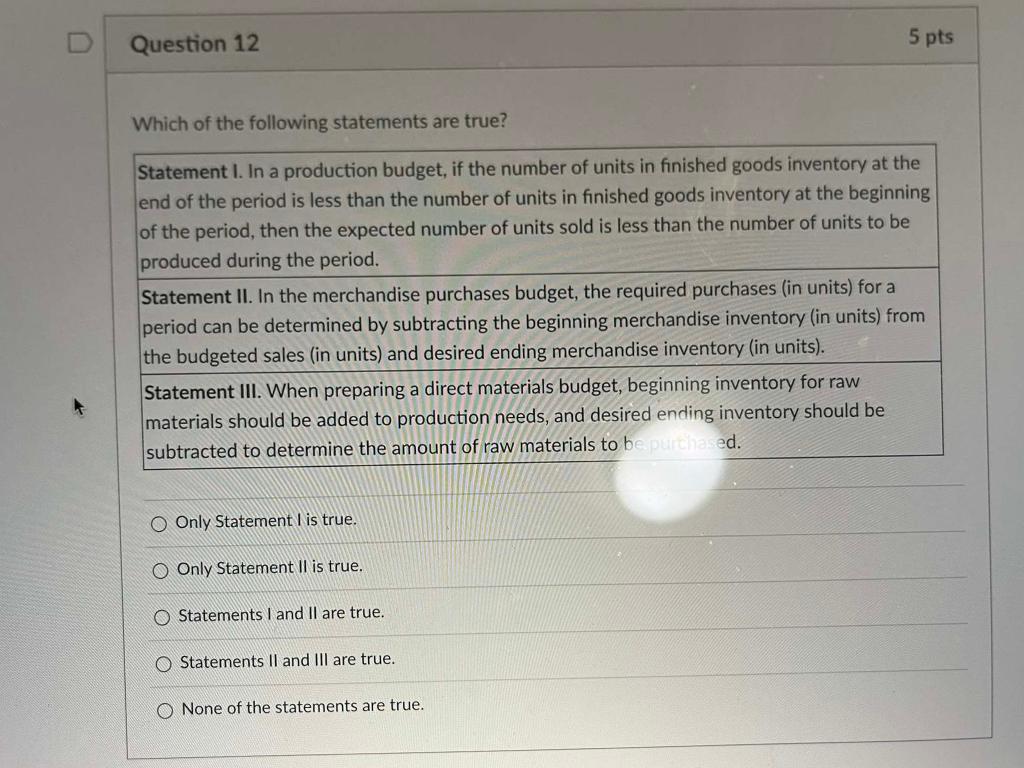

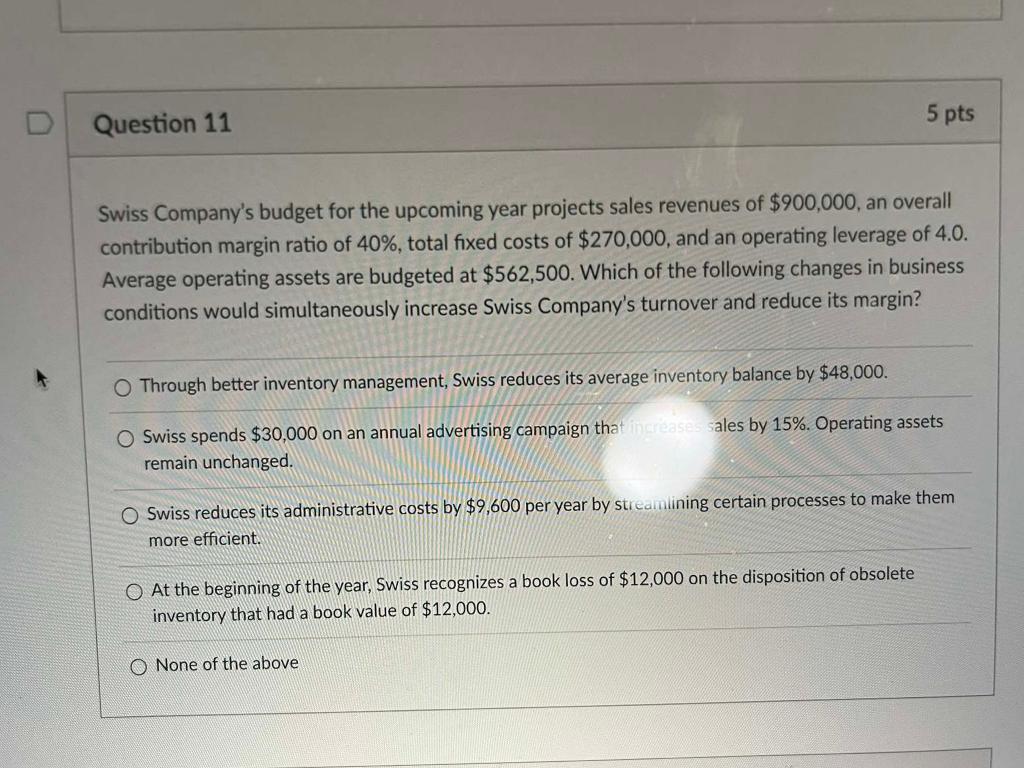

Peach Corporation's only cash receipts are those derived from customer sales. Peach makes both cash sales and sales on account. For its credit sales, Peach collects 50% in the month of the sale, 40% in the month following the sale, and 10% in the second month following the sale. Peach is preparing its cash budget for the upcoming year. Sales on account for the month of March are budgeted at $150,000. The budgeted accounts receivable balance on March 1 is $113,000, of which $90,000 represents uncollected sales made in February and $23,000 represents uncollected sales made in January. If Peach's total cash receipts for the month of March are budgeted at $205,000, what are Peach's budgeted cash sale March? $17,000 $35,000 $53,000 $71,000 None of the above Here are data regarding Flamingo Company's budget for the month of January: What is Flamingo's budgeted operating income in January? $103,750 $131,250 $137,500 $162,500 None of the above Edifice Manufacturing Company produces and sells a single product. During the current year. Edifice's fixed manufacturing overhead costs are $3 million, and the number of units sold equals the number of units produced. Which of the following amounts are the same under both variable costing and absorption costing? Operating income Cost of goods sold Gross profit Ending inventory None of the above Which of the following statements are true? Statement I. In a production budget, if the number of units in finished goods inventory at the end of the period is less than the number of units in finished goods inventory at the beginning of the period, then the expected number of units sold is less than the number of units to be produced during the period. Statement II. In the merchandise purchases budget, the required purchases (in units) for a period can be determined by subtracting the beginning merchandise inventory (in units) from the budgeted sales (in units) and desired ending merchandise inventory (in units). Statement III. When preparing a direct materials budget, beginning inventory for raw materials should be added to production needs, and desired ending inventory should be subtracted to determine the amount of raw materials to by Only Statement 1 is true. Only Statement II is true. Statements I and II are true. Statements II and III are true. None of the statements are true. Swiss Company's budget for the upcoming year projects sales revenues of $900,000, an overall contribution margin ratio of 40%, total fixed costs of $270,000, and an operating leverage of 4.0. Average operating assets are budgeted at $562,500. Which of the following changes in business conditions would simultaneously increase Swiss Company's turnover and reduce its margin? Through better inventory management, Swiss reduces its average inventory balance by $48,000. Swiss spends $30,000 on an annual advertising campaign tha ales by 15%. Operating assets remain unchanged. Swiss reduces its administrative costs by $9,600 per year by streamining certain processes to make them more efficient. At the beginning of the year, Swiss recognizes a book loss of $12,000 on the disposition of obsolete inventory that had a book value of $12,000. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts