Question: Need help! Stander Deviation 12 thats all i got ! SD is 12 5. Let's handle an American option. Consider the same underlying asset (MSFT)

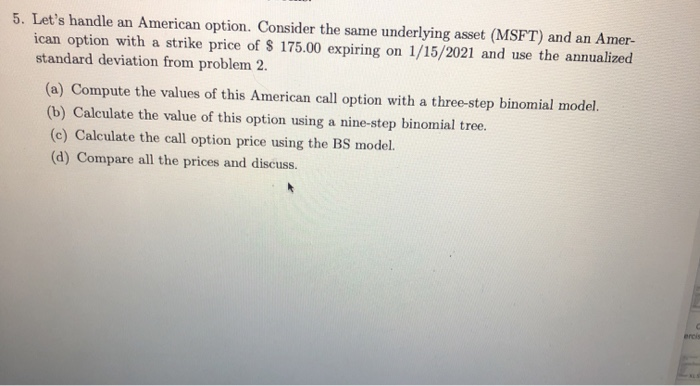

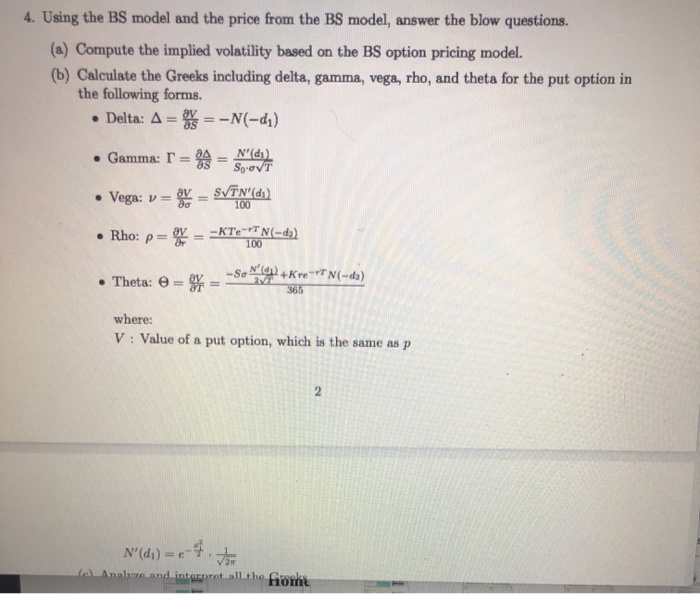

5. Let's handle an American option. Consider the same underlying asset (MSFT) and an Amer- ican option with a strike price of $ 175.00 expiring on 1/15/2021 and use the annualized standard deviation from problem 2. (a) Compute the values of this American call option with a three-step binomial model. (b) Calculate the value of this option using a nine-step binomial tree. (c) Calculate the call option price using the BS model. (d) Compare all the prices and discuss. 4. Using the BS model and the price from the BS model, answer the blow questions. (a) Compute the implied volatility based on the BS option pricing model. (b) Calculate the Greeks including delta, gamma, vega, rho, and theta for the put option in the following forms. Delta: A = * = -N(-d) Gamma: = 84 = N'(d) Soovt Vega: v = = SVN'(d) Rho: p ay = - KTE-TN-da) Theta: OV -S02 +Kre-TN-da) where: V: Value of a put option, which is the same as p N'(d) = -4. (0) Anal and internet all the forht Rho: p= = -KIEN-da) 100 Theta: BYSo +Kre-N(-de) 365 where: V: Value of a put option, which is the same as p N'(di) = - (c) Analyze and interpret all the Greeks. 5. Let's handle an American option. Consider the same underlying asset (MSFT) and an Amer- ican option with a strike price of $ 175.00 expiring on 1/15/2021 and use the annualized standard deviation from problem 2. (a) Compute the values of this American call option with a three-step binomial model. (b) Calculate the value of this option using a nine-step binomial tree. (c) Calculate the call option price using the BS model. (d) Compare all the prices and discuss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts