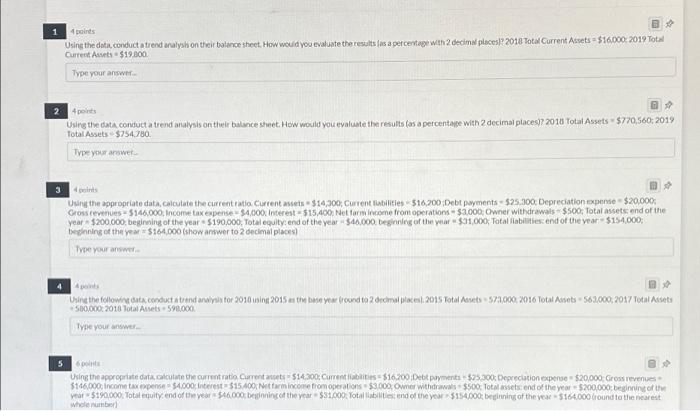

Question: need help, thanks 4 points BU Using the data conduct a trend analysh on their balance sheet How would you evaluate the results is a

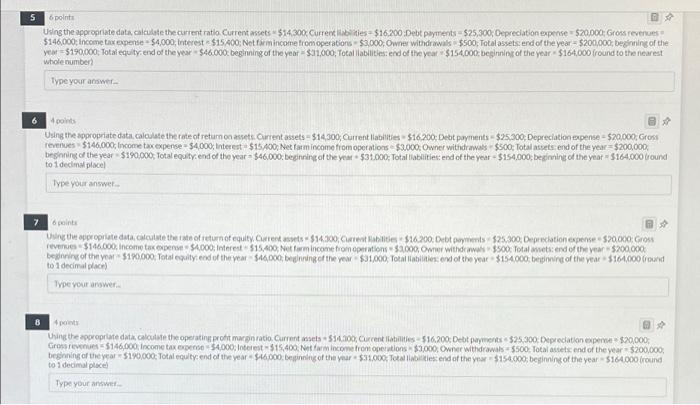

4 points BU Using the data conduct a trend analysh on their balance sheet How would you evaluate the results is a percentage with 2 decimn places 2018 Total Current Assets $16.000-2019 Tot Current Arts $19.000 Type your answer 2 portas Using the data conducta trend analysis on their balance sheet. How would you evaluate the results (as a percentage with 2 decimal places)? 2018 Total Assets $770,560, 2019 Total Assets $754.780. Type you arswer 3 it Using the appropriate data, calculate the current ratio. Current aets $14,300 Current abilities $16,200 Debt payments - $25.300 Depreciation expense $20,000 Gross revenues-5146,000 Income tax expense-$4.000 Interest - $15.400 Netfarm income from operations $3.000Owner withdrawals $500, Total assets end of the year $200.000 beginning of the year $190,000 Total equilty end of the year $40.000 beginning of the $31.000 Total abilities: end of the year $154.000; Iseinning of the year $164.000 (show answer to 2 decimal places Type your answer Using the following conduct and analysis for 2010 in 2015 as these year round to 2 decimal places. 2015 Total Asets572.000. 2016 Totale 563.000, 2017 Total Assets 550.000 2016 Total Assets 598.00 Type your answer 5 Using the appropriate data, calculate the current ratio. Current aets $14.300. Current abilities = $16.700 :Debt payments $25.300: Depreciation expense $20,000 Gross revenues $146.000,Income tax pense 34.000 Interest $15400 Netfarmincome from operations $3.000 Omer withdrawal $500 Total se end of the year $200,000: beginning of the year $190,000. Totaleguity end of the years being the year $1.000. Totabilities end of the you515400obning of the year-5164.000 round to the rest Wil number S 6 points Using the appropriate data, calculate the current ratio Current assets 514 300 Current ties- $16.200 Debt payments -$25,300, Depreciation expense $20.000 Gross revenues $146.000 Income tax expense - $4,000, Interest - $15400 Netfarmincome from operations $3,000, Owner withdrawals $500 Total assets endof the year = $200,000, beginning of the year = $190,000, Total equilty. end of the year $46.000 beginning of the year $11.000, Total abilities: end of the year $154.000 beginning of the year $164,000 fround to the nearest whole number Type your answer Using the appropriate data calculate the rate of return on assets. Current assets - $14.300 Current abilities $16.200: Deot payments - $25.300 Depreciation expense = $20,000, Gross revenues $146.000 Income tax expense - $4.000, Interest - $15.00 Netfarmincome from operations $3.000. Owner withdrawals $50oTotalets end of the year = $200,000 beginning of the year $190.000, Total equity end of the year - $46.000: beginning of the yem $31.000: Total abilities: end of the year - $154.000, beginning of the year = $164.000 bound to 1 decimal place Type your answer 7 points the peopriate data calculate the ste of return of equity. Current assets $14.300 Current abilities $14.200 Debt wymients $25.300 Depreciation expense S20000 GON revenues $146.000. Income OS1000Interest $15.400 Netfarmincome homoption2.000, Owner withdwww $500: Total weisend of the year $200.000 being of the year $160.000 Total equity end of the year $46000, being of the year $31.00 Total abilities: end of the year $154.000 being of the year $164.000 Ground to 1 decimal place) Type your rower 8 @ Using the appropriate data calculate the operating profit margratio. Current ses 4000, Correntes - $16.200 Debt payments $25.300 Deprecatione $20,000 Grosses $146,000 Income tax $4.000 Interest - $15.400 Netfarm Income front operations $3,000, Owner withdrawals 5500 Total des end of the year $200,000, beginning of the year $190,000: Total equity end of the year $1.000 bining of the year $1.000, Totalles end of the year $154.000; beginning of the year $164.000 fround to 1 decimal place Type your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts