Question: Need help to understand these exercise. Thank you! AMT Computation. Dylan is a single taxpayer with $600,000 of taxable income, which results in a regular

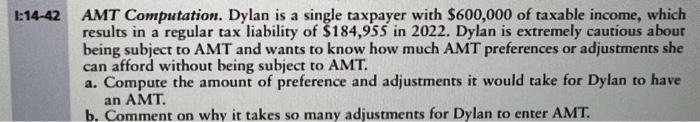

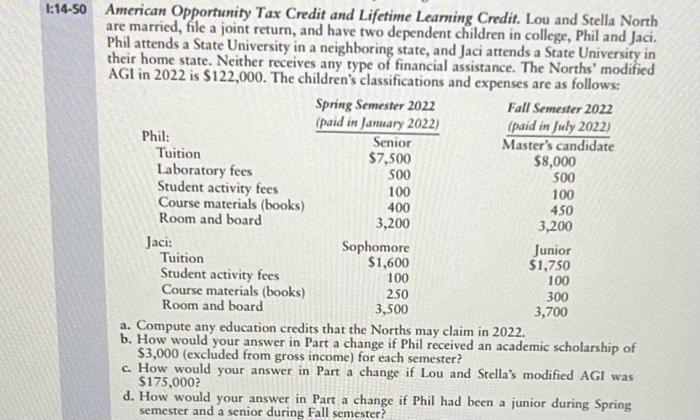

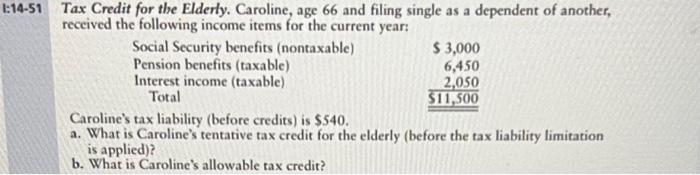

AMT Computation. Dylan is a single taxpayer with $600,000 of taxable income, which results in a regular tax liability of $184,955 in 2022. Dylan is extremely cautious about being subject to AMT and wants to know how much AMT preferences or adjustments she can afford without being subject to AMT. a. Compute the amount of preference and adjustments it would take for Dylan to have an AMT. b. Comment on why it takes so many adjustments for Dylan to enter AMT. American Opportunity Tax Credit and Lifetime Leaming Credit. Lou and Stella North are married, file a joint return, and have two dependent children in college, Phil and Jaci. Phil attends a State University in a neighboring state, and Jaci attends a State University in their home state. Neither receives any type of financial assistance. The Norths' modified AGI in 2022 is $122,000. The children's classifications and expenses are as follows: a. Compute any education credits that the Norths may claim in 2022. b. How would your answer in Part a change if Phil received an academic scholarship of $3,000 (excluded from gross income) for each semester? c. How would your answer in Part a change if Lou and Stella's modified AGI was $175,000 ? d. How would your answer in Part a change if Phil had been a junior during Spring semester and a senior during Fall semester? Tax Credit for the Elderly. Caroline, age 66 and filing single as a dependent of another, reccived the following income items for the current year: Caroline's tax liability (before credits) is $540. a. What is Caroline's tentative tax credit for the elderly (before the tax liability limitation is applied)? b. What is Caroline's allowable tax credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts