Question: Need help trying to figure out how to solve this problem. Small World Advertising is an advertising and public relations agency located in Portland, Oregon.

Need help trying to figure out how to solve this problem.

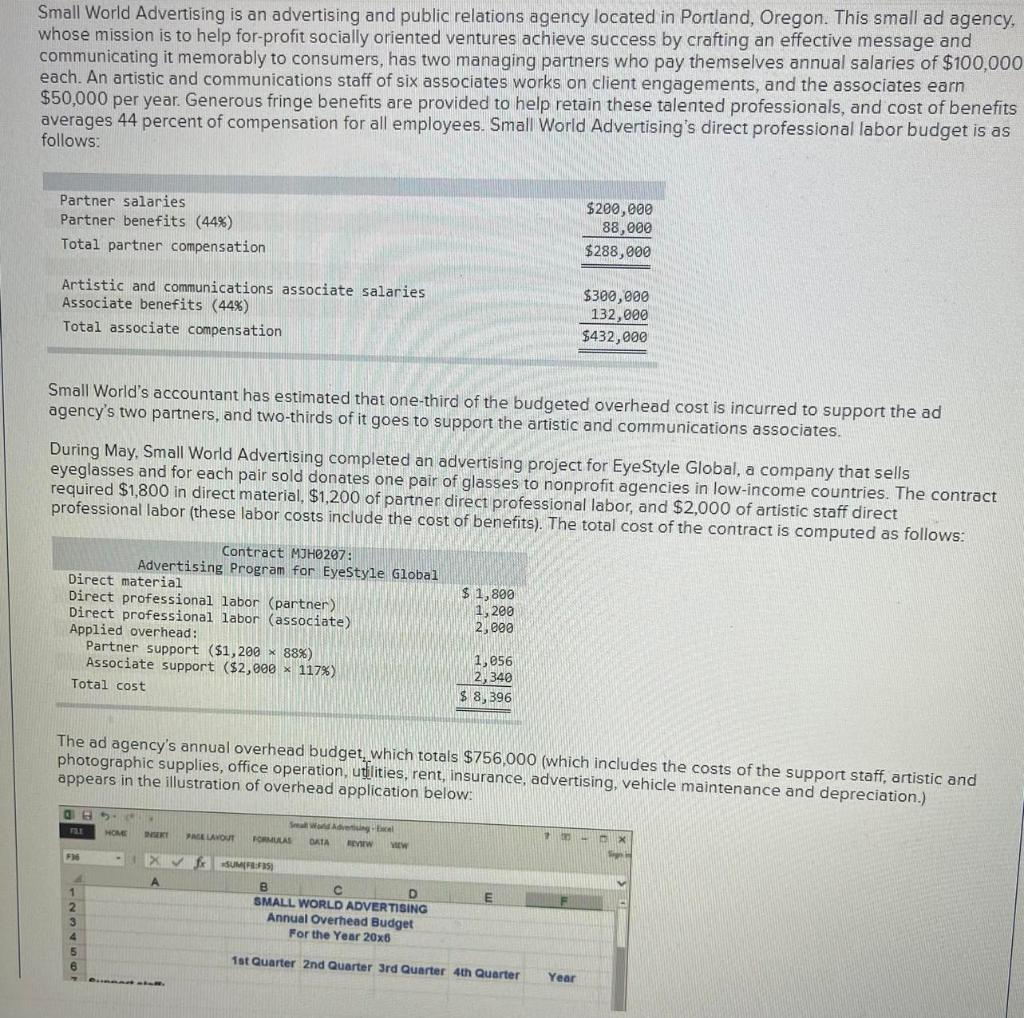

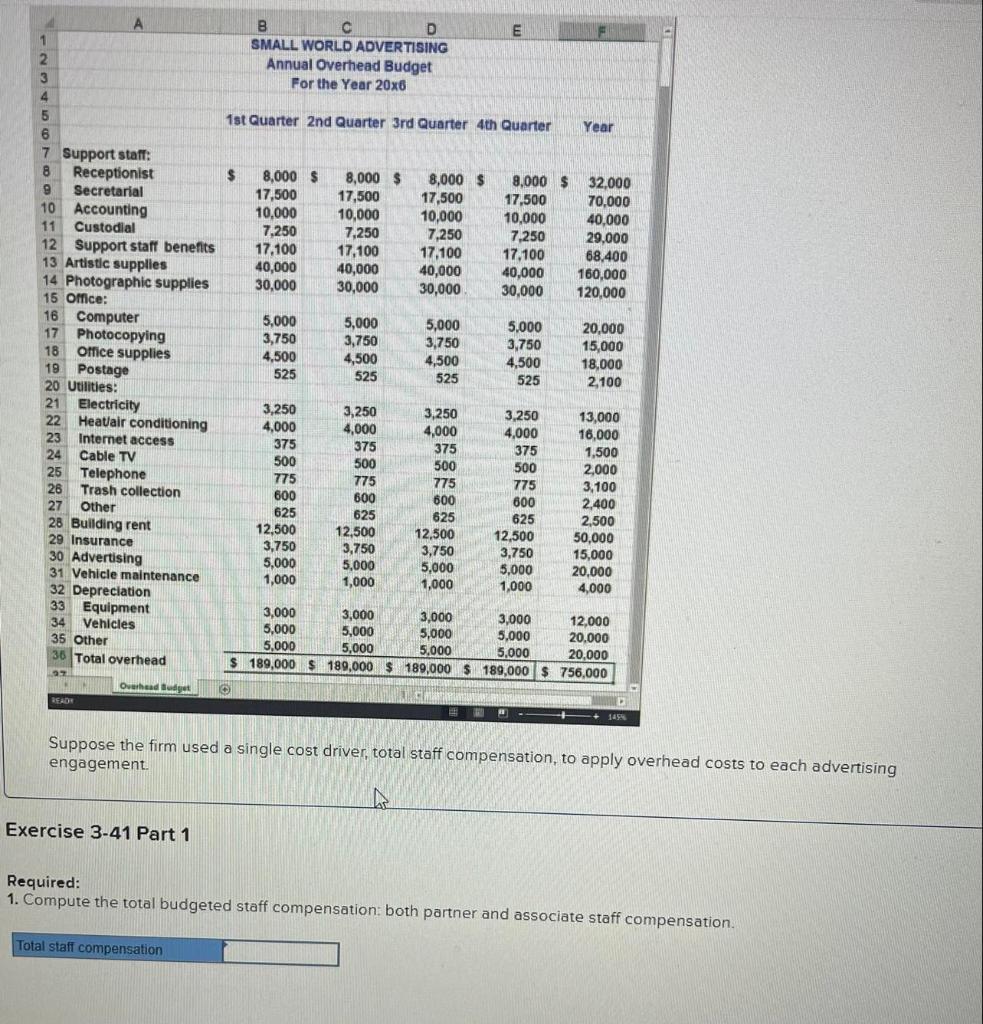

Small World Advertising is an advertising and public relations agency located in Portland, Oregon. This small ad agency, whose mission is to help for-profit socially oriented ventures achieve success by crafting an effective message and communicating it memorably to consumers, has two managing partners who pay themselves annual salaries of $100,000 each. An artistic and communications staff of six associates works on client engagements, and the associates earn $50,000 per year. Generous fringe benefits are provided to help retain these talented professionals, and cost of benefits averages 44 percent of compensation for all employees. Small World Advertising's direct professional labor budget is as follows: Partner salaries Partner benefits (44%) Total partner compensation $200,000 88,000 $288,000 Artistic and communications associate salaries Associate benefits (44%) Total associate compensation $300,000 132,000 $432,000 Small World's accountant has estimated that one-third of the budgeted overhead cost is incurred to support the ad agency's two partners, and two-thirds of it goes to support the artistic and communications associates. During May, Small World Advertising completed an advertising project for EyeStyle Global, a company that sells eyeglasses and for each pair sold donates one pair of glasses to nonprofit agencies in low-income countries. The contract required $1,800 in direct material, $1,200 of partner direct professional labor, and $2,000 of artistic staff direct professional labor (these labor costs include the cost of benefits). The total cost of the contract is computed as follows: Contract MJH0207: Advertising Program for EyeStyle Global Direct material Direct professional labor (partner) Direct professional labor (associate) Applied overhead: Partner support ($1,200 x 8896) Associate support ($2,900 x 117%) Total cost $ 1,800 1,200 2,000 1,056 2,340 $ 8, 396 The ad agency's annual overhead budget, which totals $756,000 (which includes the costs of the support staff, artistic and photographic supplies, office operation, utilities, rent, insurance, advertising, vehicle maintenance and depreciation.) appears in the illustration of overhead application below: Q SEK MELAYOUT Watce FORMULAS DATA VIEW OX F16 SUM FF35 B D SMALL WORLD ADVERTISING Annual Overhead Budget For the Year 20x6 E 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 6 Year B C D E SMALL WORLD ADVERTISING 2 Annual Overhead Budget 3 For the Year 20x8 4 5 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year 6 7 Support staff: 8 Receptionist $ 8,000 $ 8,000 $ 8,000 $ 8,000 $ 32,000 9 Secretarial 17,500 17,500 17,500 17,500 70,000 10 Accounting 10,000 10,000 10,000 10,000 40,000 11 Custodial 7,250 7,250 7,250 7.250 29,000 12 Support staff benefits 17,100 17,100 17,100 17.100 68.400 13 Artistic supplies 40,000 40,000 40,000 40,000 160,000 14 Photographic supplies 30,000 30,000 30,000 30,000 15 Office: 120,000 16 Computer 5,000 5,000 5,000 5,000 17 Photocopying 20,000 3,750 3,750 3,750 3,750 15,000 18 Office supplies 4,500 4,500 4,500 4,500 19 Postage 18,000 525 525 525 525 20 Utilities: 2.100 21 Electricity 3,250 3,250 3,250 3.250 22 Heatlair conditioning 13,000 4,000 4,000 23 Internet access 4,000 4,000 16,000 375 375 24 375 Cable TV 375 1,500 500 500 25 Telephone 500 500 2,000 775 775 775 775 26 Trash collection 3,100 600 27 Other 600 600 600 2,400 625 625 28 Building rent 625 625 2,500 12.500 29 Insurance 12.500 12,500 50.000 3,750 30 Advertising 3,750 3,750 3,750 15,000 5,000 31 Vehicle maintenance 5,000 5,000 5,000 20,000 1,000 1,000 1,000 32 Depreciation 1,000 4,000 33 Equipment 3,000 3,000 3,000 Vehicles 3,000 34 12,000 5,000 5,000 5,000 35 Other 5,000 5,000 20,000 5,000 5,000 36 Total overhead 5,000 20.000 $ 189,000 $ 189,000 $ 189,000 $ 189,000 $ 756,000 Overhead Budget READ 12,500 27 Suppose the firm used a single cost driver, total staff compensation, to apply overhead costs to each advertising engagement Exercise 3-41 Part 1 Required: 1. Compute the total budgeted staff compensation: both partner and associate staff compensation Total staff compensation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts