Question: need help understanding how we got to this answer thanks :) The Precise Printing Corporation is contemplating the acquisition of a state of the art

need help understanding how we got to this answer

thanks :)

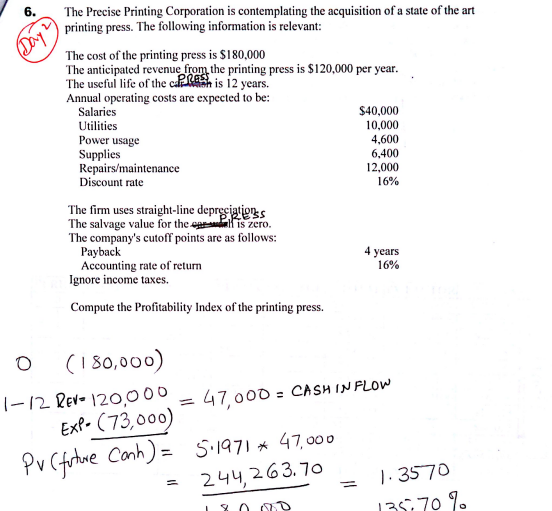

The Precise Printing Corporation is contemplating the acquisition of a state of the art printing press. The following information is relevant: The cost of the printing press is $180,000 The anticipated revenue from the printing press is $120,000 per year. The useful life of the Annual operating costs are expected to be: is 12 years. $40,000 10,000 4,600 6,400 12,000 16% Salaries Utilities Power usage Supplies Repairs/maintenance Discount rate The firm uses straight-line d The salvage value for the The company's cutoff points are as follows: is zero Payback Accounting rate of return 4 years 16% Ignore income taxes. Compute the Profitability Index of the printing press. O CI8o,0oo = 47 OOD: CASH IN PLow Ex (73,000) 244,2 63.7o .35 70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts