Question: need help, what I have so far is correct. I can't figure out the ones left blank. Each of the four independent situations below describes

need help, what I have so far is correct. I can't figure out the ones left blank.

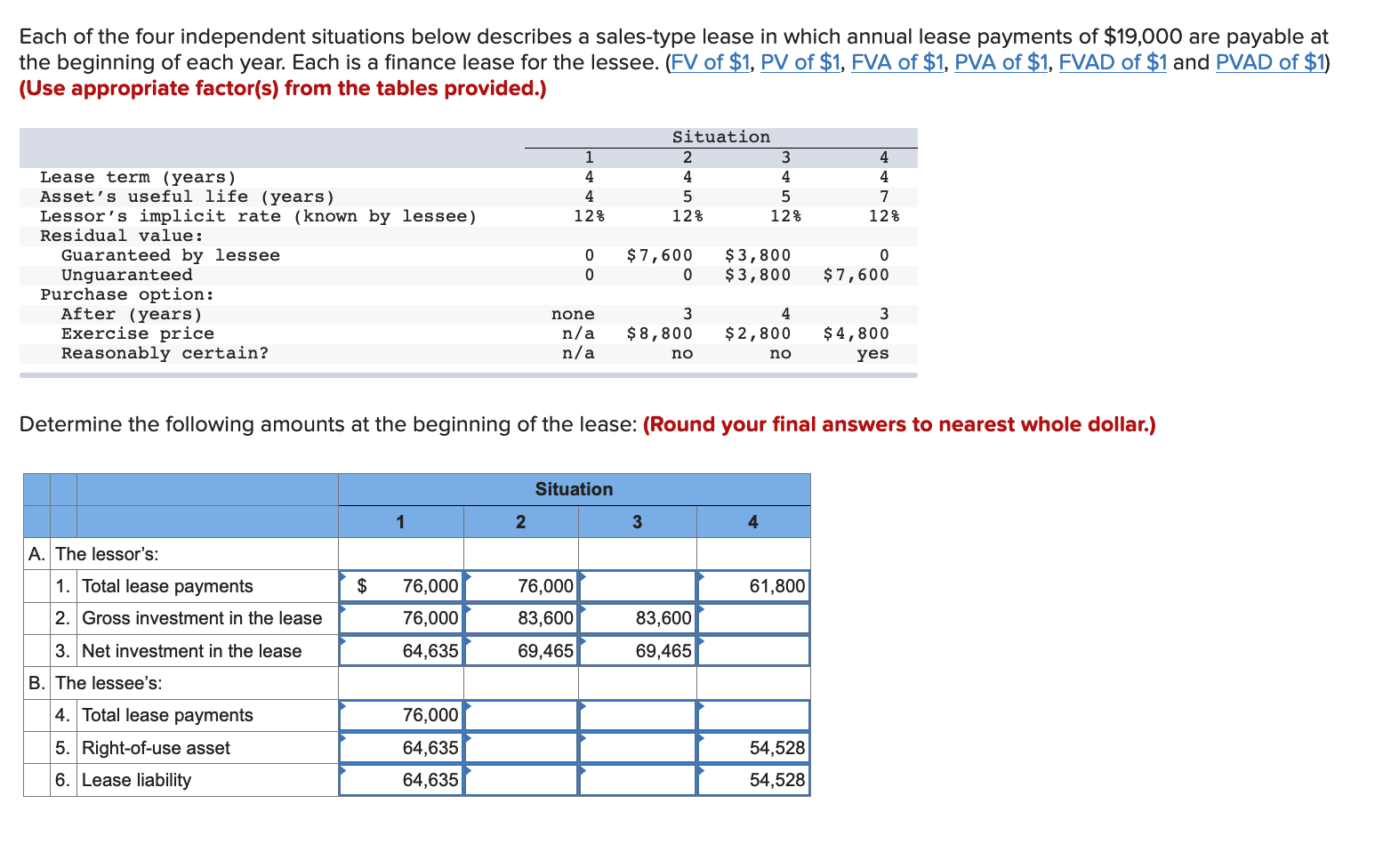

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $19,000 are payable at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1 4 4 12% Situation 2 3 4 4 5 5 12% 12% 4 4 7 12% Lease term (years) Asset's useful life (years) Lessor's implicit rate (known by lessee) Residual value: Guaranteed by lessee Unguaranteed Purchase option: After (years) Exercise price Reasonably certain? 0 0 $ 7,600 0 $3,800 $3,800 0 $ 7,600 4 none n/a n/a $8,800 no $ 2,800 3 $ 4,800 yes no Determine the following amounts at the beginning of the lease: (Round your final answers to nearest whole dollar.) Situation 1 2 3 4 A. The lessor's: 1. Total lease payments 2. Gross investment in the lease $ 61,800 76,000 76,000 64,635 76,000 83,600 69,465 83,600 69,465 3. Net investment in the lease B. The lessee's: 4. Total lease payments 5. Right-of-use asset 6. Lease liability 76,000 64,635 64,635 54,528 54,528 Each of the four independent situations below describes a sales-type lease in which annual lease payments of $19,000 are payable at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1 4 4 12% Situation 2 3 4 4 5 5 12% 12% 4 4 7 12% Lease term (years) Asset's useful life (years) Lessor's implicit rate (known by lessee) Residual value: Guaranteed by lessee Unguaranteed Purchase option: After (years) Exercise price Reasonably certain? 0 0 $ 7,600 0 $3,800 $3,800 0 $ 7,600 4 none n/a n/a $8,800 no $ 2,800 3 $ 4,800 yes no Determine the following amounts at the beginning of the lease: (Round your final answers to nearest whole dollar.) Situation 1 2 3 4 A. The lessor's: 1. Total lease payments 2. Gross investment in the lease $ 61,800 76,000 76,000 64,635 76,000 83,600 69,465 83,600 69,465 3. Net investment in the lease B. The lessee's: 4. Total lease payments 5. Right-of-use asset 6. Lease liability 76,000 64,635 64,635 54,528 54,528

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts