Question: need help will rate 13) When a bond seie at a premium A) The contract rate is above the market rate. B) The contract rate

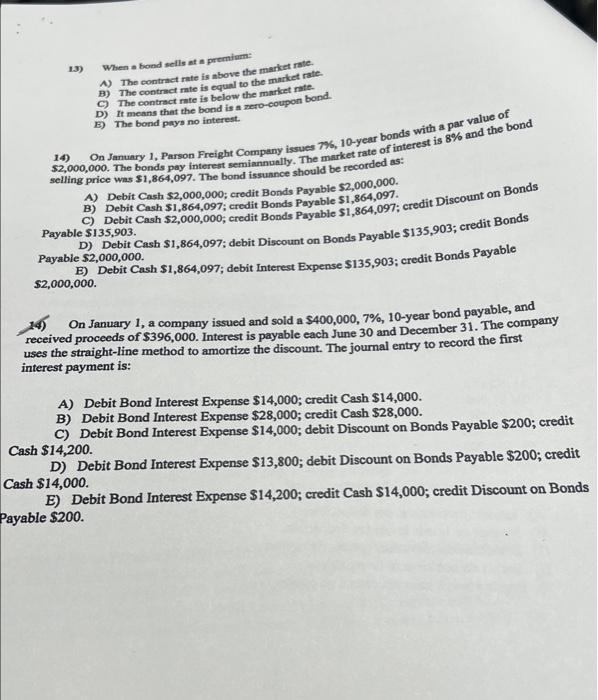

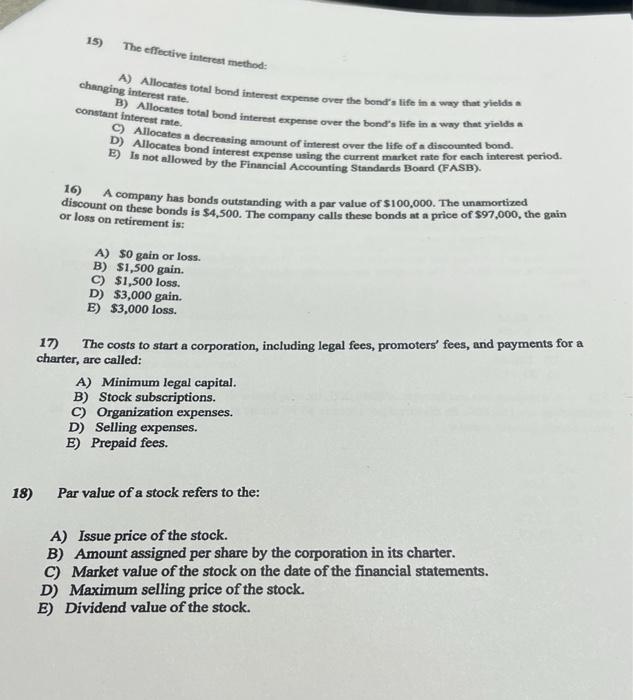

13) When a bond seie at a premium A) The contract rate is above the market rate. B) The contract rate is equal to the market rate The contract rate is below the market rate D) It means that the bond is zero-coupon bond E) The bond pays no interest 14) selling price was $1,864,097. The bond issuance should be recorded as: $2,000,000. The bonds pay interest semiannually. The market rate of interest is 8% and the bond On January 1, Parson Freight Company issues 7%, 10-year bonds with a par value of A) Debit Cash $2,000,000; credit Bonds Payable $2,000,000. B) Debit Cash $1,864,097 Credit Bonds Payable $1,864,097. Payable $135,903. c) Debit Cash $2,000,000; credit Bonds Payable S1,864,097; credit Discount on Bonds Payable $2,000,000 D) Debit Cash $1,864,097; debit Discount on Bonds Payable $135,903; credit Bonds $2,000,000 Debit Cash $1,864,097; debit interest Expense $135,903; credit Bonds Payable 14) On January 1, a company issued and sold a $400,000, 7%, 10-year bond payable, and received proceeds of $396,000. Interest is payable each June 30 and December 31. The company uses the straight-line method to amortize the discount. The journal entry to record the first interest payment is: A) Debit Bond Interest Expense $14,000; credit Cash $14,000. B) Debit Bond Interest Expense $28,000; credit Cash $28,000. C) Debit Bond Interest Expense $14,000; debit Discount on Bonds Payable $200; credit Cash $14,200. D) Debit Bond Interest Expense $13,800; debit Discount on Bonds Payable $200; credit Cash $14,000. E) Debit Bond Interest Expense $14,200; credit Cash S14,000; credit Discount on Bonds Payable $200. 15) The effective interest method: changing interest rate. A) Allocates total bond interest expense over the band's life in a way that yields a constant interest rate. C) Allocates a decreasing amount of interest over the life of a discounted bond. mit Allocate total bond interest expenne over the bond's life in a way that yields period. E) Is not allowed by the Financial Accounting Standards Board (FASB). 16) A company has bonds outstanding with a par value of $100,000. The unamortized di scount on these bonds is $4,500. The company calls these bonds at a price of $97,000, the pain or loss on retirement is: A) so gain or loss. B) $1,500 gain. C) $1,500 loss. D) $3,000 gain. E) $3,000 loss. 17) The costs to start a corporation, including legal fees, promoters' fees, and payments for a charter, are called: A) Minimum legal capital. B) Stock subscriptions. C) Organization expenses. D) Selling expenses. E) Prepaid fees. 18) Par value of a stock refers to the: A) Issue price of the stock. B) Amount assigned per share by the corporation in its charter. C) Market value of the stock on the date of the financial statements. D) Maximum selling price of the stock. E) Dividend value of the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts