Question: Need help with 1 d n this chapter, such as sinking funds and call features. e problemial payments, to solve the ems have questions that

Need help with 1

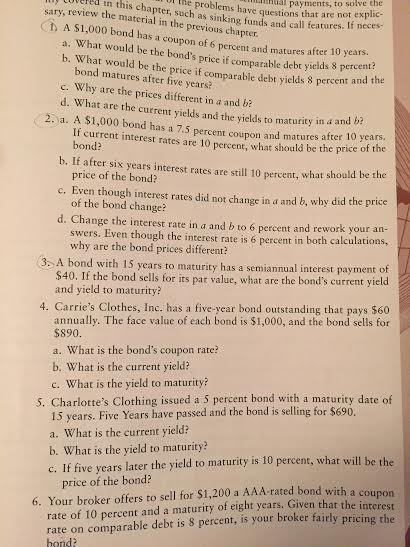

d n this chapter, such as sinking funds and call features. e problemial payments, to solve the ems have questions that are not explic sary, review the material in the previous chapter. uch as sinking funds and call features. If neces h A $1.000 bond has a coupon of o percent and matures after 10 yearn 2 t A $1,000 bond has a coupon s chapternd call features. If a. What would be the bond's price if comparable debt yields 8 perce b. What would be the price if comparable debt yields 8 percent an nt? bond matures after five years? c. Why are the prices different in a and b d. What are the current yields and the yields to maturity in 4 an 2. a. A $1,000 bond has a 7.s percent coupon and matures aterice 000 pond has a 7.5 percent coupon and matures after 10 years. f current i interest rates are 10 percent, what should be the price of the bond? b. If after six years interest rates are still 10 percent, what should be the price of the bond? c. Even though interest rates did not change in a and b, why did the price of the bond change? d. Change the interest rate in a and b to 6 percent and rework your an swers. Even though the interest rate is 6 percent in both calculations, why are the bond prices different? 3. A bond with 15 years to maturity has a semiannual interest payment of he bond sells for its par value, what are the bond's current yield $40. If t and yield to maturity? 4. Carrie's Clothes, Inc. has a five-year bond outstanding that pays $60 annually. The face value of each bond is $1,000, and the bond sells for $890 a. What is the bond's coupon rate? b. What is the current yield? c. What is the yield to maturity? 15 years. Five Years have passed and the bond is selling for $69 a. What is the current yield? b. What is the yield to maturity? c. If five years later the yield to matu 5. Charlotte's Clothing issued a 5 percent bond with a maturity date of rity is 10 percent, what will be the price of the bond? o sell for $1,200 a AAA rated bond with a coupon rate of 10 percent and a maturity of eight years, Given that the inte rate on comparable debt is 8 percent, is your broker fairly pricing the rest 6. Your broker offers to sell for $1,200 a AAA-rated bond with a cou

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts