Question: Please use excel to solve. The problem and the data provided must be clearly laid out in the spreadsheet and cell referencing must be used.

Please use excel to solve. The problem and the data provided must be clearly laid out in the spreadsheet and cell referencing must be used.

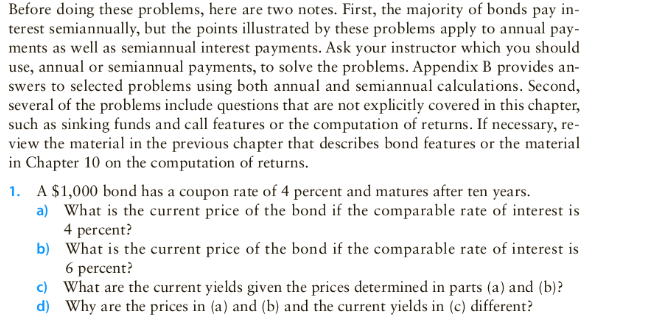

Before doing these problems, here are two notes. First, the majority of bonds pay in- terest semiannually, but the points illustrated by these problems apply to annual pay- ments as well as semiannual interest payments. Ask your instructor which you should use, annual or semiannual payments, to solve the problems. Appendix B provides an- swers to selected problems using both annual and semiannual calculations. Second, several of the problems include questions that are not explicitly covered in this chapter, such as sinking funds and call features or the computation of returns. If necessary, re- view the material in the previous chapter that describes bond features or the material in Chapter 10 on the computation of returns. 1. A $1,000 bond has a coupon rate of 4 percent and matures after ten years. a) What is the current price of the bond if the comparable rate of interest is 4 percent? b) What is the current price of the bond if the comparable rate of interest is 6 percent? c) What are the current yields given the prices determined in parts (a) and (b)? d) Why are the prices in (a) and (b) and the current yields in (c) different

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts