Question: Need help with 18, 19 and 20 uwe s sequt o s new anning ts maks sne year from soduy in a t 18. (30pts)

Need help with 18, 19 and 20

Need help with 18, 19 and 20

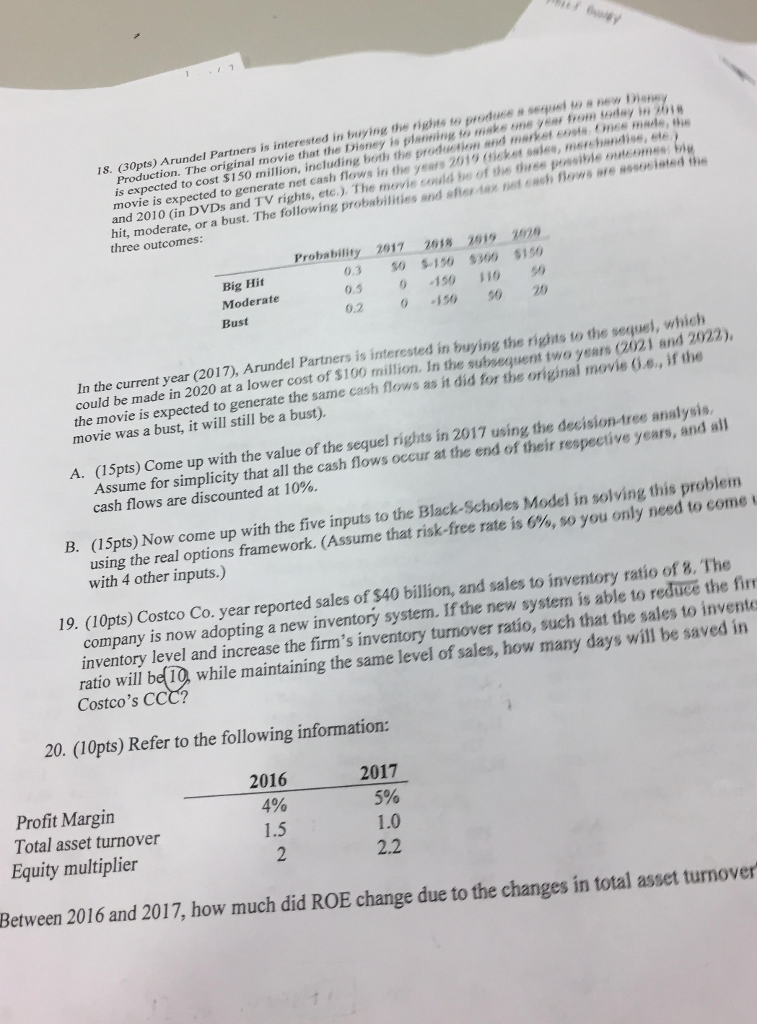

uwe s sequt o s new anning ts maks sne year from soduy in a t 18. (30pts) Arundel Partners is interested in buying the nigs uction. The original movie that the Disney is pl made ise, the produetion and market cost is expected to cost $150 million, including both t movie is expected to generate r and 2010 (in DVDs and TV rights, etc.). The movie se hit, moderate, or a bust. followir three outcomes et cash flows in the years 2019 ieket sales, merchand ench fhows sre nesuisted the a bust. The following probabilities and afer tax net Probability 2017 2018 29 Big Hit Moderate Bust 03 150 900 $150 05 0 10 0 0.2 15050 2 In the current year (2017), Arundel Partners is interested in buying the rights to the sequel, which could be made in 2020 at a lower cost of $100 million. In the subsequent two years (2021 and 2022), the movie is expected to generate the same cash flows as it did for the original movie (G.s., if the movie was a bust, it will still be a bust). A. (15pts) Come up with the value of the sequel rights in 2017 using the decision tree analysis Assume for simplicity that all the cash flows occur at the end of their respective years, and al cash flows are discounted at 10%. B. (15pts) Now come up with the five inputs to the Black-Scholes Model in solving this problem using the real options framework (Assume that risk-free rate is 6%, so you only need to come i with 4 other inputs.) 19. (10pts) Costco Co. year reported sales of $40 billion, and sales to inventory ratio of 8. The company is now adopting a new inventory system. If the new system is able to reduce the fin inventory level and increase the firm's inventory turnover ratio, such that the sales to invento ratio will bellO while maintaining the same level of sales, how many days will be saved in Costco's CCC? 20. (10pts) Refer to the following information: Profit Margin Total asset turnover Equity multiplier 2016 4% 1.5 2017 5% 1.0 2.2 Between 2016 and 2017, how much did ROE change due to the changes in total asset turnover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts