Question: need help with 18 and 19 Question 18 (1 point) Raspusin Corp is expected to pay a $0.85 per share dividend at the end of

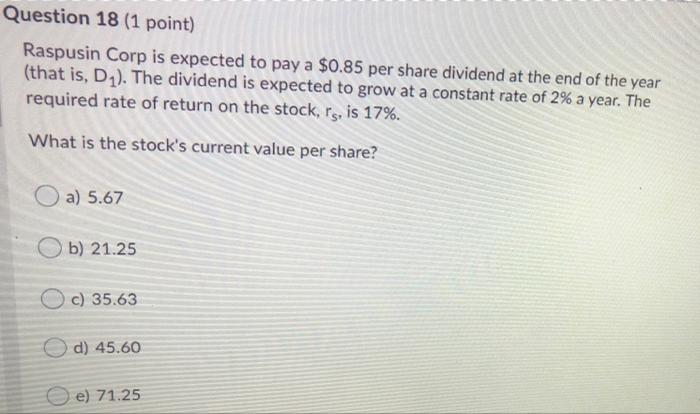

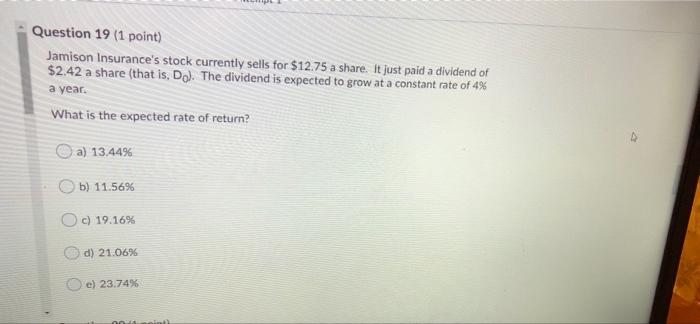

Question 18 (1 point) Raspusin Corp is expected to pay a $0.85 per share dividend at the end of the year (that is, D1). The dividend is expected to grow at a constant rate of 2% a year. The required rate of return on the stock, rs, is 17%. What is the stock's current value per share? a) 5.67 b) 21.25 c) 35.63 Od) 45.60 e) 71.25 Question 19 (1 point) Jamison Insurance's stock currently sells for $12.75 a share. It just paid a dividend of $2.42 a share (that is, Dol. The dividend is expected to grow at a constant rate of 4% a year. What is the expected rate of return? a) 13.44% b) 11.56% O c) 19.16% d) 21.06% e) 23.74% im

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts