Question: Need help with 2 accounting questions! 1. 2. Blue Construction Inc. has poor internal control. Recently, Jim Midas, the owner, has suspected the bookkeeper of

Need help with 2 accounting questions!

1.

2.

2.

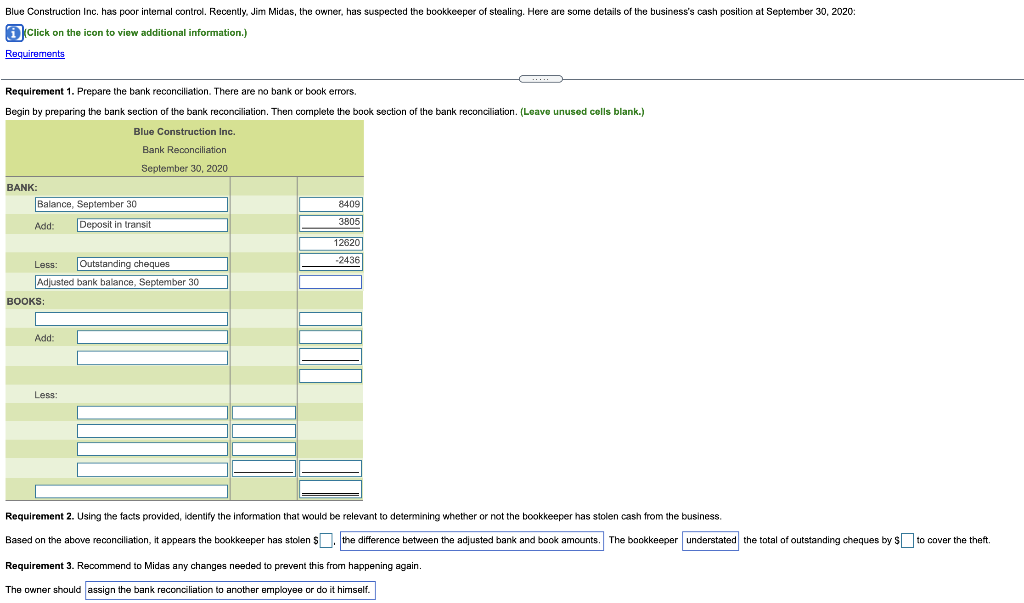

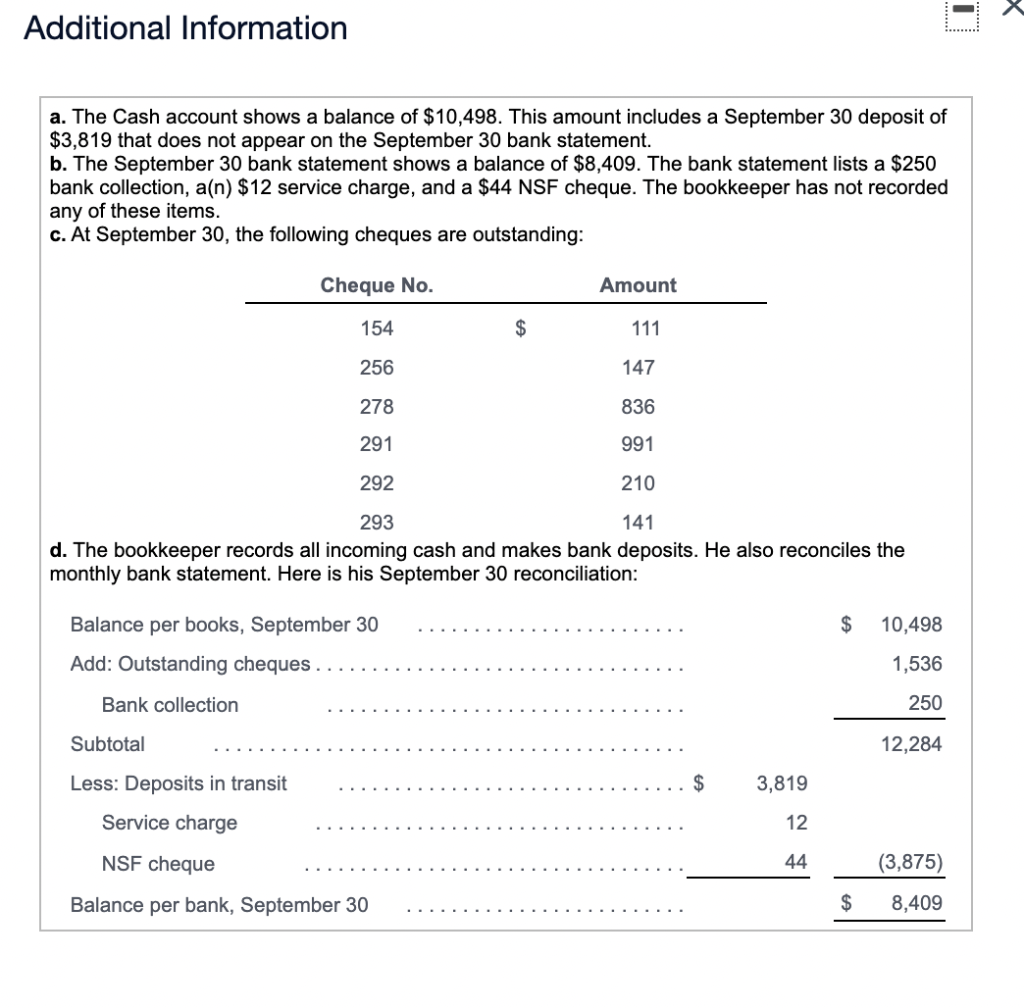

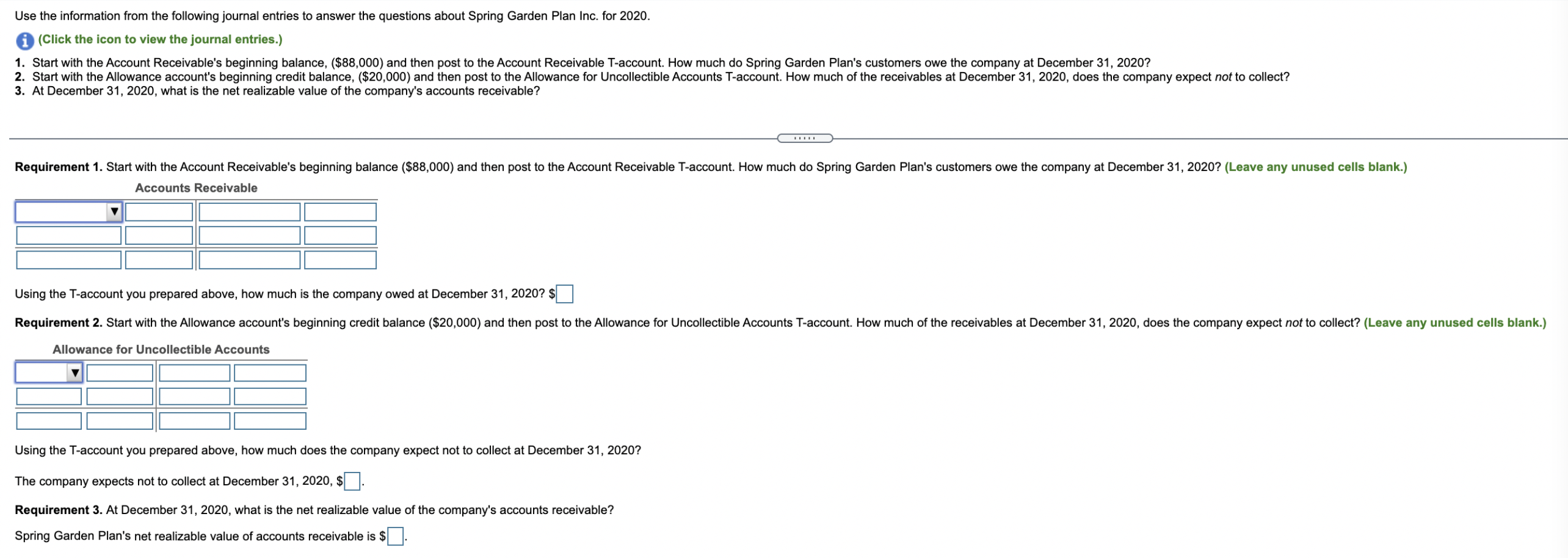

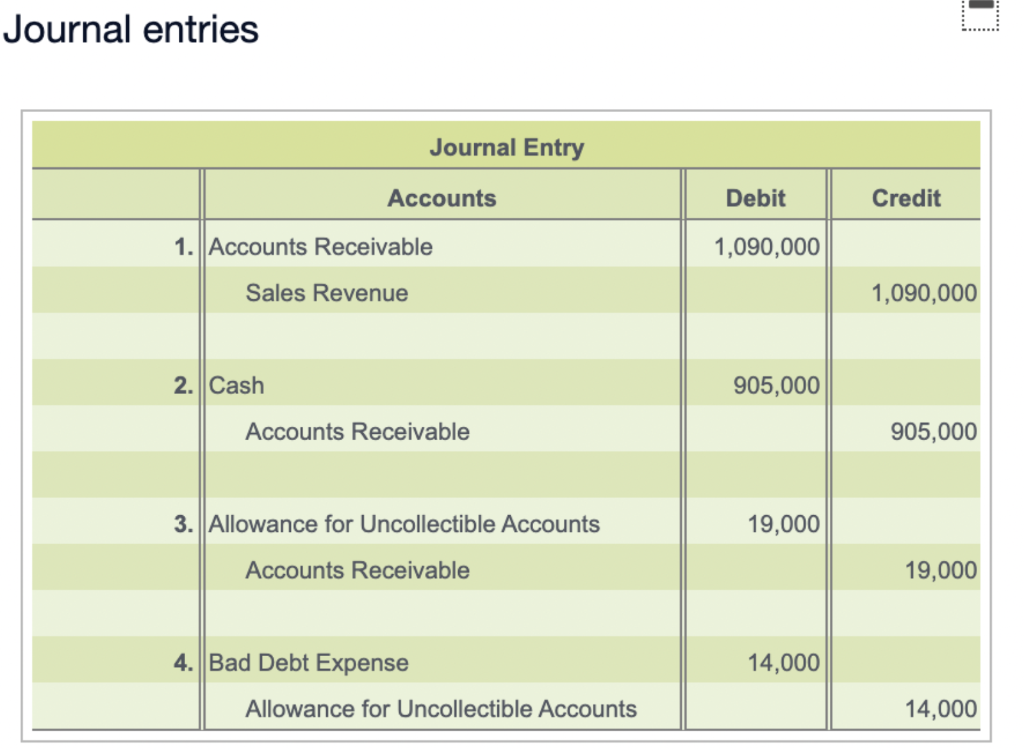

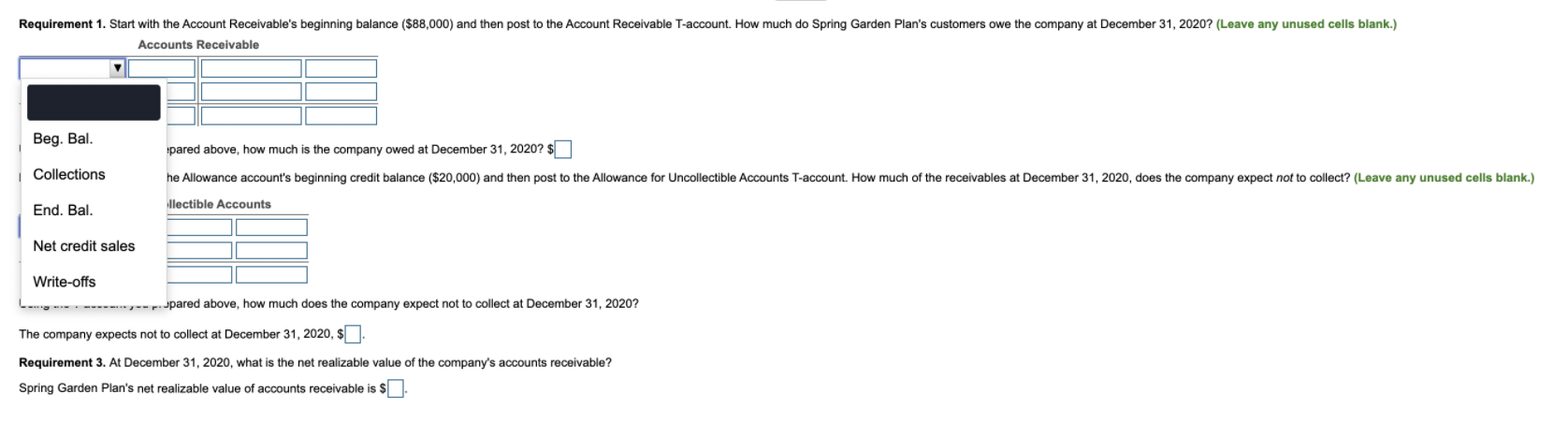

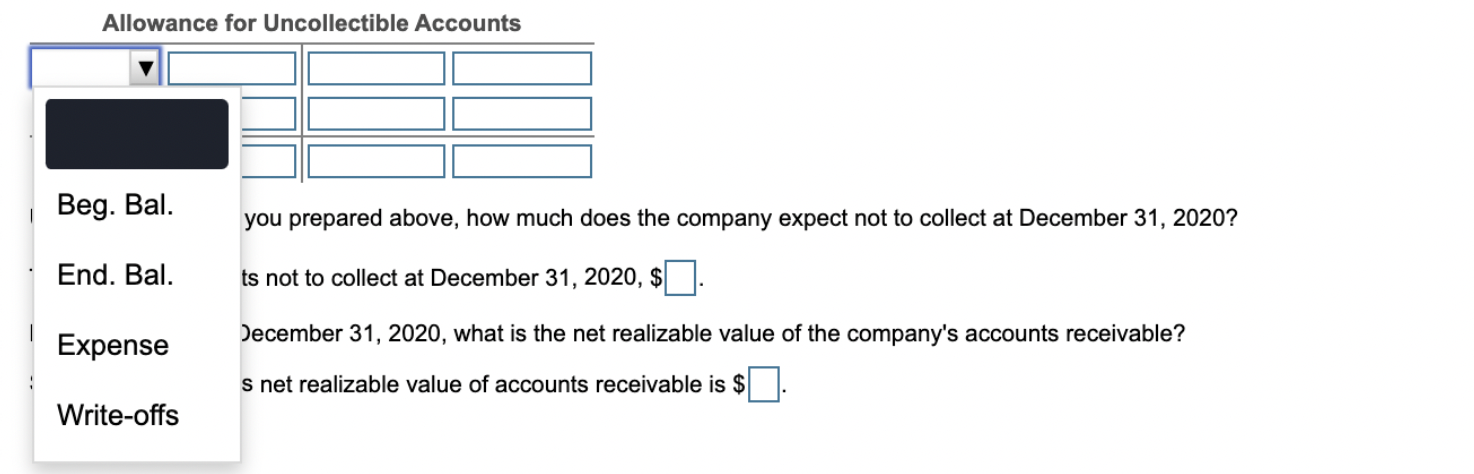

Blue Construction Inc. has poor internal control. Recently, Jim Midas, the owner, has suspected the bookkeeper of stealing. Here are some details of the business's cash position at September 30, 2020: Click on the icon to view additional information.) Requirements CD Requirement 1. Prepare the bank reconciliation. There are no bank or book errors. Begin by preparing the bank section of the bank reconciliation. Then complete the book section of the bank reconciliation. (Leave unused cells blank.) Blue Construction Inc. Bank Reconciliation September 30, 2020 BANK: Balance, September 30 Add: Deposit in transit 8409 38051 12620 2436 Less: Outstanding cheques Adjusted bank balance, September 30 BOOKS: Add Less: Requirement 2. Using the facts provided, identify the information that would be relevant to determining whether or not the bookkeeper has stolen cash from the business. Based on the above reconciliation, it appears the bookkeeper has stolen $. the difference between the adjusted bank and book amounts. The bookkeeper understated the total of outstanding cheques by to cover the theft Requirement 3. Recommend to Midas any changes needed to prevent this from happening again. The owner should assign the bank reconciliation to another employee or do it himself. Additional Information a. The Cash account shows a balance of $10,498. This amount includes a September 30 deposit of $3,819 that does not appear on the September 30 bank statement. b. The September 30 bank statement shows a balance of $8,409. The bank statement lists a $250 bank collection, a(n) $12 service charge, and a $44 NSF cheque. The bookkeeper has not recorded any of these items. c. At September 30, the following cheques are outstanding: Cheque No. Amount 154 $ 111 256 147 278 836 291 991 292 210 293 141 d. The bookkeeper records all incoming cash and makes bank deposits. He also reconciles the monthly bank statement. Here is his September 30 reconciliation: $ 10,498 Balance per books, September 30 Add: Outstanding cheques.. 1,536 Bank collection 250 Subtotal 12,284 Less: Deposits in transit $ 3,819 Service charge 12 NSF cheque 44 (3,875) Balance per bank, September 30 $ 8,409 Use the information from the following journal entries to answer the questions about Spring Garden Plan Inc. for 2020. (Click the icon to view the journal entries.) 1. Start with the Account Receivable's beginning balance, ($88,000) and then post to the Account Receivable T-account. How much do Spring Garden Plan's customers owe the company at December 31, 2020? 2. Start with the Allowance account's beginning credit balance, ($20,000) and then post to the Allowance for Uncollectible Accounts T-account. How much of the receivables at December 31, 2020, does the company expect not to collect? 3. At December 31, 2020, what is the net realizable value of the company's accounts receivable? Requirement 1. Start with the Account Receivable's beginning balance ($88,000) and then post to the Account Receivable T-account. How much do Spring Garden Plan's customers owe the company at December 31, 2020? (Leave any unused cells blank.) Accounts Receivable Using the T-account you prepared above, how much is the company owed at December 31, 2020? Requirement 2. Start with the Allowance account's beginning credit balance ($20,000) and then post to the Allowance for Uncollectible Accounts T-account. How much of the receivables at December 31, 2020, does the company expect not to collect? (Leave any unused cells blank.) Allowance for Uncollectible Accounts Using the T-account you prepared above, how much does the company expect not to collect at December 31, 2020? The company expects not to collect at December 31, 2020, $. Requirement 3. At December 31, 2020, what is the net realizable value of the company's accounts receivable? Spring Garden Plan's net realizable value of accounts receivable is $ Requirement 1. Start with the Account Receivable's beginning balance ($88,000) and then post to the Account Receivable T-account. How much do Spring Garden Plan's customers owe the company at December 31, 2020? (Leave any unused cells blank.) Accounts Receivable Beg. Bal. pared above, how much is the company owed at December 31, 2020? $ Collections he Allowance account's beginning credit balance ($20,000) and then post to the Allowance for Uncollectible Accounts T-account. How much of the receivables at December 31, 2020, does the company expect not to collect? (Leave any unused cells blank.) llectible Accounts End. Bal. Net credit sales Write-offs upared above, how much does the company expect not to collect at December 31, 2020? The company expects not to collect at December 31, 2020, $ Requirement 3. At December 31, 2020, what is the net realizable value of the company's accounts receivable? Spring Garden Plan's net realizable value of accounts receivable is $ Allowance for Uncollectible Accounts Beg. Bal. you prepared above, how much does the company expect not to collect at December 31, 2020? End. Bal. ts not to collect at December 31, 2020, $ Expense December 31, 2020, what is the net realizable value of the company's accounts receivable? s net realizable value of accounts receivable is $ Write-offs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts