Question: need help with 2,3 plz need help with 2,3 2 on March 4, joumalize the entry to record the sale assuming the manager chose the

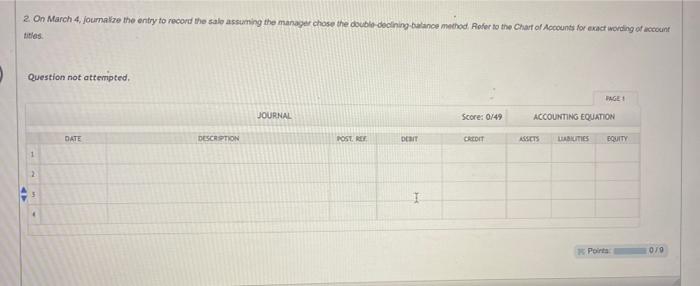

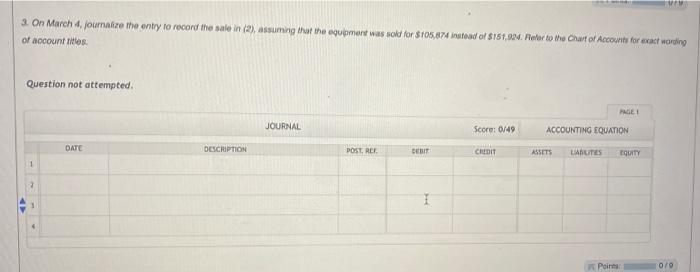

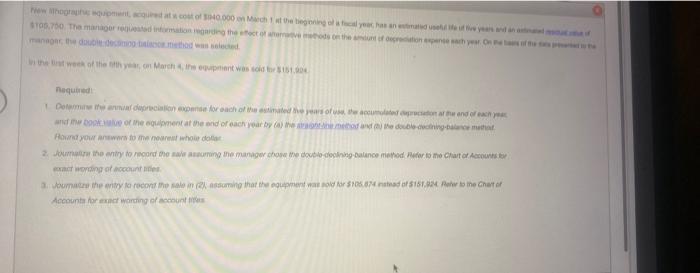

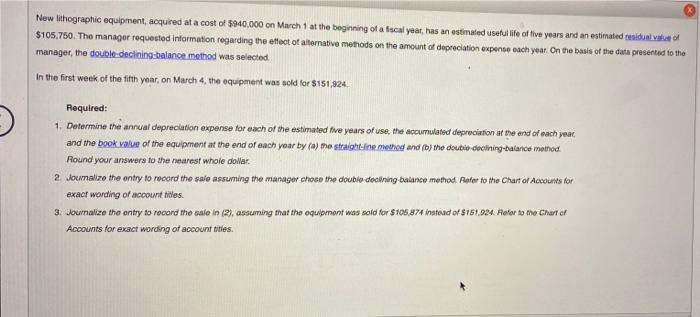

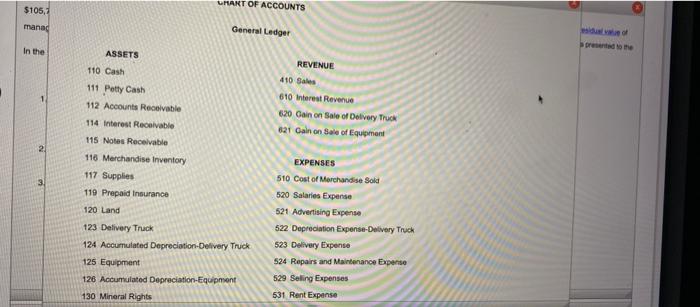

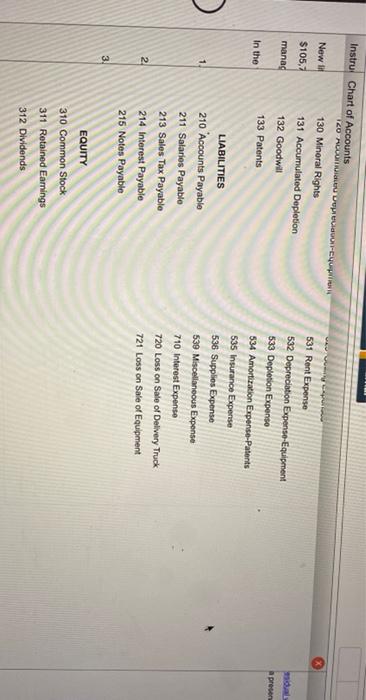

2 on March 4, joumalize the entry to record the sale assuming the manager chose the double declining balance method Refer to the Chart of Accounts for exact worting of account titles Question not attempted. PAGE 1 JOURNAL Score: 0:49 ACCOUNTING EQUATION DATE DESCRITION POST REI DEBIT CREDIT ASSETS SITIES EQUITY 1 2 5 1 Point 019 3. On March 4, journalize the entry to record the sale in (2), assuming that the equipment was sold for $105.874 instead of $1510. Refer to the Chart of Accounts for exact wording of account titles Question not attempted. HEI JOURNAL Score: 0749 ACCOUNTING EQUATION DATE DESCRIPTION POST, RET BEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 I Painel 0/0 who otcf000 cheyenne 105.750 The managers and the content on the thod was with two of the year on March, then we oor 1.00 Required Damar ce for each of the estimated tears of the accurate and reaches and book of the guiment at the end of each your by the mechat Round your answer to me now who do 2. Juretze the entry to record the male anauming the manager choo ne dobilo doplning-bulance method for one Chat et Accounts wong of account durate the entry to recover mo ako sa surmong that the wees was now br 3706.06 ad of 169.9 Pater to the Charter Account for exact warning of account New lithographic equipment, acquired at a cost of $940.000 on March 1 at the beginning of a fiscal year, has an estimated useful life of five years and an estimated residur value of $105,750. The manager requested information regarding the effect of alternative methods on the amount of depreciation expense each year. On the basis of the data presented to the manager, the double declining balance method was selected In the first week of the fifth year, on March 4, the equipment was sold for $151,924. Required: 1. Determine the annual depreciation expense for each of the estimated five years of use, the accumulated depreciation at the end of each year and the book value of the equipment at the end of each year by (a) me straight line method and (b) the double declining-balance method Round your answers to the nearest whole dollar 2. Journalize the entry to record the salo assuming the manager chose the double declining balance method. Poter to the Chart of Accounts for exact wording of account titles 3. Journalize the entry to record the sale in (2), assuming that the equipment was sold for $105,874 instead of $161.924. Refer to the Chart of Accounts for exact wording of account bles. URANT OF ACCOUNTS $105,1 mana General Ledger In the REVENUE 410 Sales 610 Interest Revenue 620 Gain on Sale of Delvery Truck 621 Gain on Sale of Equipment 2 ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Interest Receivable 115 Notes Receivable 116 Merchandise Inventory 117 Supplies 119 Prepaid Insurance 120 Land 123 Delivery Truck 124 Accumulated Depreciation Delivery Truck 125 Equipment 126 Accumulated Depreciation Equipment 130 Mineral Rights EXPENSES 510 Cost of Merchandise Sold 520 Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Delivery Truck 523 Delivery Expense 524 Repairs and Maintenance Experise 529 Seling Expenses 531 Rent Expense Instrui Chart of Accounts 120 ARI Depuicy New it 130 Mineral Rights $105, 131 Accumulated Depletion manac mida 132 Goodwill 531 Rent Expense 532 Depreciation Expense-Equipment 533 Depletion Expenso 534 Amortization Expense-Patents a presen In the 133 Patents 1 LIABILITIES 210 Accounts Payable 211 Salarios Payable 213 Sales Tax Payable 214 Interest Payable 215 Notos Payable 535 Insurance Expense 536 Supplies Expense 539 Miscellaneous Expense 710 Interest Expense 720 Loss on Sale of Delivery Truck 721 Loss on Sale of Equipment 2. 3 EQUITY 310 Common Stock 311 Retained Eamings 312 Dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts