Question: Need help with #3: A,B, C Evaluate Martin's situation without any options ... how much money would Martin receive if he simply sold his 1.9

Need help with #3: A,B, C

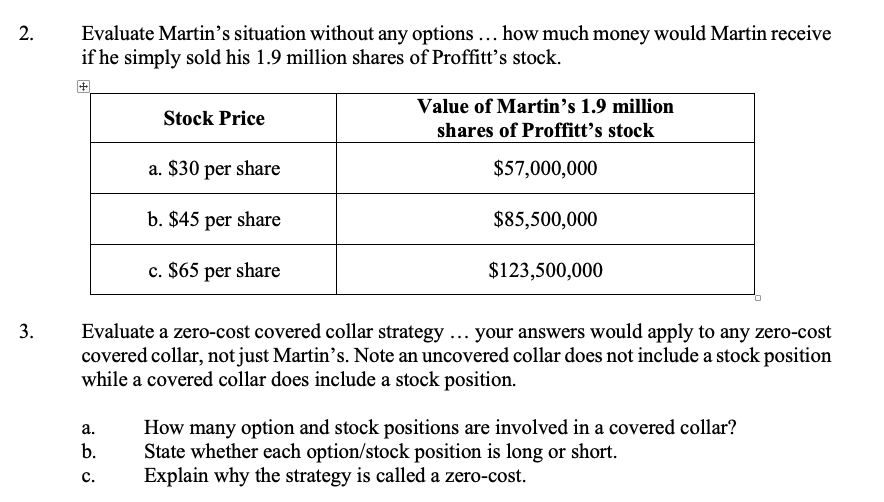

Evaluate Martin's situation without any options ... how much money would Martin receive if he simply sold his 1.9 million shares of Proffitt's stock. Stock Price Value of Martin's 1.9 million shares of Proffitt's stock a. $30 per share $57,000,000 b. $45 per share $85,500,000 c. $65 per share $123,500,000 - 3. Evaluate a zero-cost covered collar strategy... your answers would apply to any zero-cost covered collar, not just Martin's. Note an uncovered collar does not include a stock position while a covered collar does include a stock position. seo How many option and stock positions are involved in a covered collar? State whether each option/stock position is long or short. Explain why the strategy is called a zero-cost. Evaluate Martin's situation without any options ... how much money would Martin receive if he simply sold his 1.9 million shares of Proffitt's stock. Stock Price Value of Martin's 1.9 million shares of Proffitt's stock a. $30 per share $57,000,000 b. $45 per share $85,500,000 c. $65 per share $123,500,000 - 3. Evaluate a zero-cost covered collar strategy... your answers would apply to any zero-cost covered collar, not just Martin's. Note an uncovered collar does not include a stock position while a covered collar does include a stock position. seo How many option and stock positions are involved in a covered collar? State whether each option/stock position is long or short. Explain why the strategy is called a zero-cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts