Question: Use and show the formulas please! not linear regression from a software. Instructions. Show all of your work for maximum credit using the formulas. There

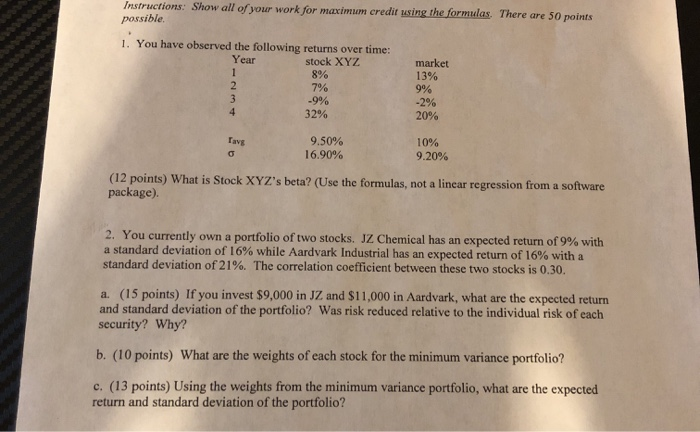

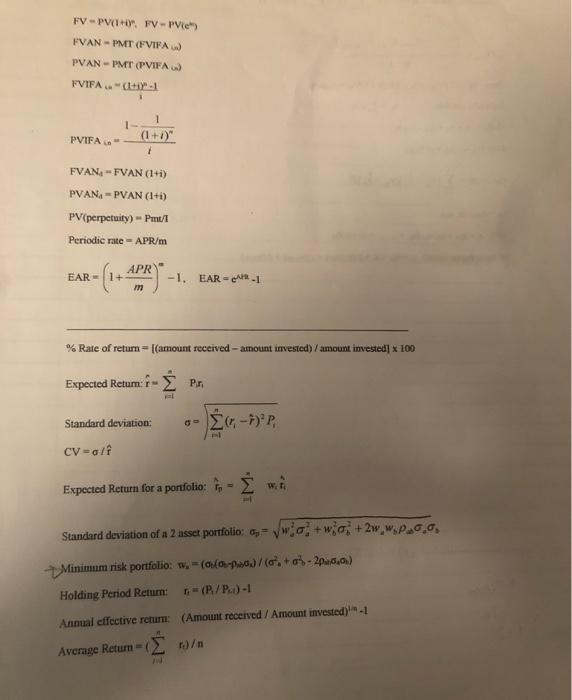

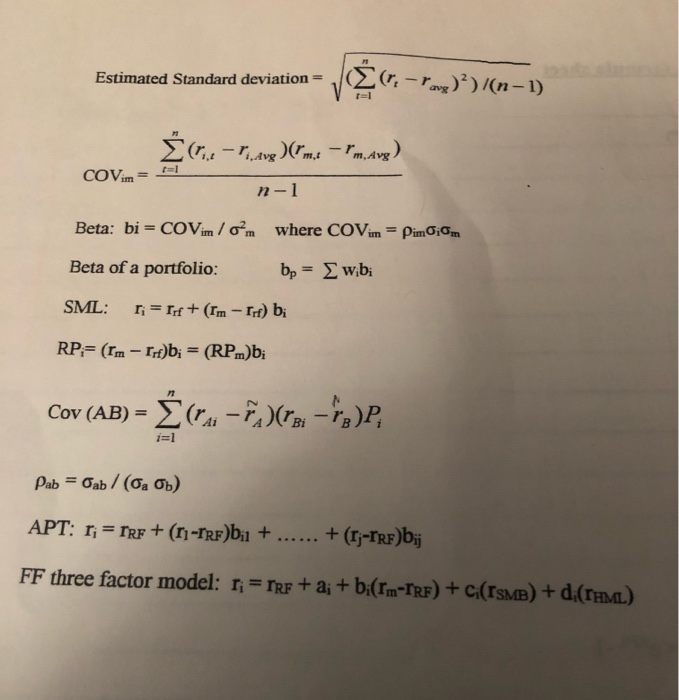

Instructions. Show all of your work for maximum credit using the formulas. There are 50 points possible, 1. You have observed the following returns over time: Year stock XYZ 8% 7% -9% 32% market 13% 9% -2% 20% Tavs 9.50% 16.90% 10% 9.20% (12 points) What is Stock XYZ's beta? (Use the formulas, not a linear regression from a software package). 2. You currently own a portfolio of two stocks. JZ Chemical has an expected return of 9% with a standard deviation of 16% while Aardvark Industrial has an expected return of 16% with a standard deviation of 21%. The correlation coefficient between these two stocks is 0.30. a. (15 points) If you invest $9,000 in JZ and $11,000 in Aardvark, what are the expected return and standard deviation of the portfolio? Was risk reduced relative to the individual risk of each security? Why? b. (10 points) What are the weights of each stock for the minimum variance portfolio? c. (13 points) Using the weights from the minimum variance portfolio, what are the expected return and standard deviation of the portfolio? FV-PVI. FV-PVe) FVAN - PMT (FVIFA) PVAN - PMT (PVIFA) FVIFACI PVIFA. (1+1)" FVAN - FVAN (1+i) PVANA-PVAN (1+i) PV(perpetuity) - Pmt/I Periodic rate = APR/m EAR - (1+ APR) -1, EAR =wX-1 % Rate of return= [(amount received - amount invested) / amount invested] x 100 Expected Retum: 1- Por Standard deviation: 0-3c-?p. Standard deviation: CV=o/f Expected Return for a portfolio: 9, - wi Standard deviation of a 2 asset portfolio: 6-7w o+w;q; +2w.w.2.0.0 Minimum risk portfolio: w.- (-w..)/(c', +o1-2020,0) Holding Period Return: = (P/P.:)-1 Annual effective return: (Amount received / Amount invested)-1 Average Retum = ( )/ Estimated Standard deviation avg)?)/(n-1) Estimated Standard deviation - V C --)/(n-1) G- P. Aug ('ms - rm. Avg) COVm = 1 n-1 Beta: bi = COVim/om where COVim = Pimon Beta of a portfolio: bp = wibi SML: r;= Tf+ (rm -rf) b; RP,= (Im - Tb; = (RPm)b; CoV (AB) = (ta: -)(ta: -)P, = Pab = Oab/(Ob) APT: r;=rRF + (11-IRF)b;1 + ...... + (;-IRF)bij FF three factor model: r.=rre + a; +b(Im-IRF) + C(ISMB) + d(THML)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts