Question: need help with #4 a. b. c. and d. and all the information to solve the problem is listed below. please show work on how

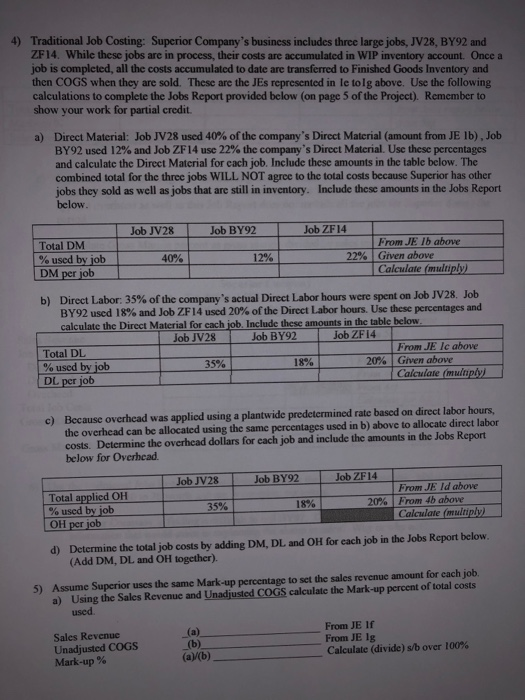

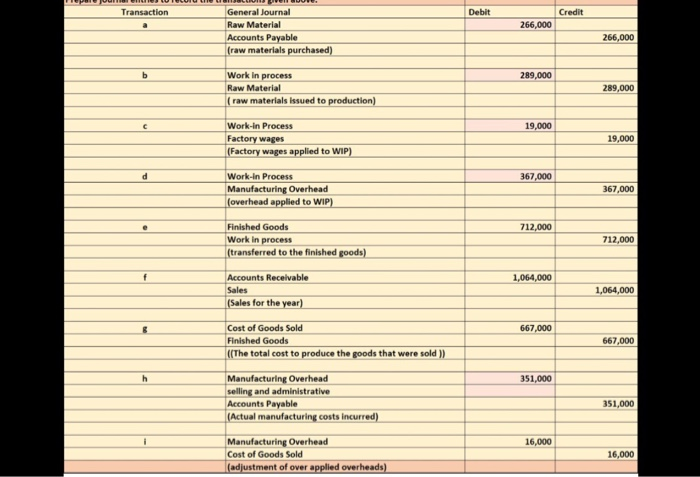

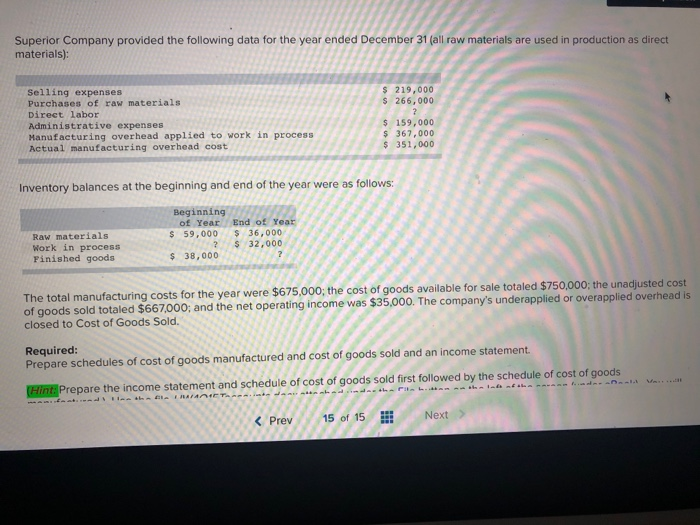

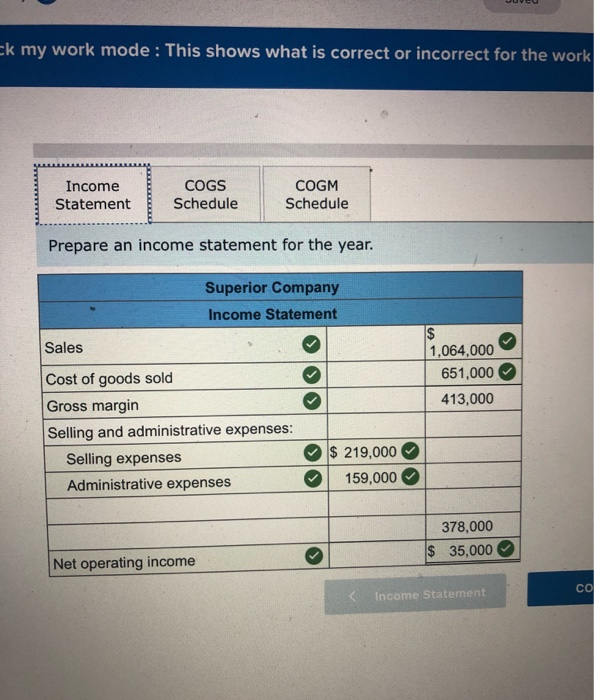

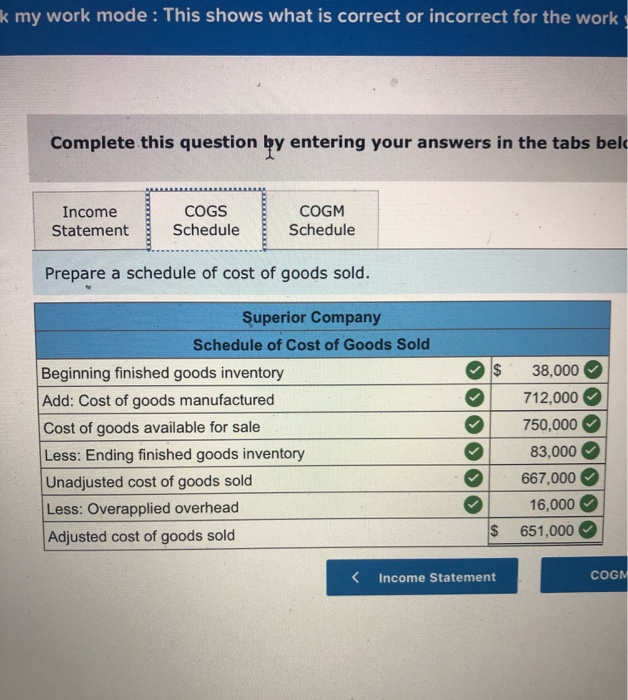

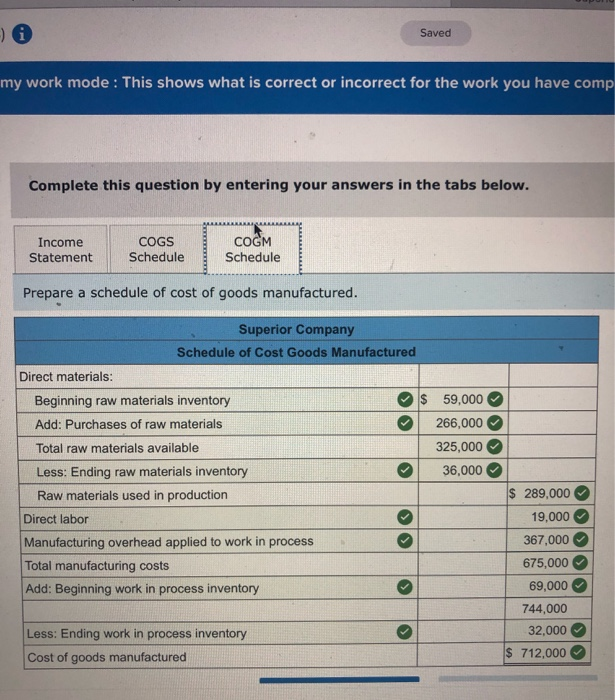

4) Traditional Job Costing: Superior Company's business includes three large jobs, JV28, BY92 and ZF 14. While these jobs are in process, their costs are accumulated in WIP inventory account. Once a job is completed, all the costs accumulated to date are transferred to Finished Goods Inventory and then COGS when they are sold. These are the JEs represented in le tolg above. Use the following calculations to complete the Jobs Report provided below (on page 5 of the Project). Remember to show your work for partial credit. a) Direct Material: Job JV28 used 40% of the company's Direct Material (amount from JE 1b), Job BY92 used 12% and Job ZF14 use 22% the company's Direct Material. Use these percentages and calculate the Direct Material for each job. Include these amounts in the table below. The combined total for the three jobs WILL NOT agree to the total costs because Superior has other jobs they sold as well as jobs that are still in inventory. Include these amounts in the Jobs Report below. Job JV28 Job BY92 Total DM % used by job DM per job Job ZF14 From JE Ib above 22% Given above Calculate (multiply 40% 12% b) Direct Labor: 35% of the company's actual Direct Labor hours were spent on Job JV28. Job BY92 used 18% and Job ZF 14 used 20% of the Direct Labor hours. Use these percentages and calculate the Direct Material for each job. Include these amounts in the table below. Job JV28 Job BY92 Job ZF14 Total DL From JE le above % used by job 35% 18% 20% Given above DL per job Calculate mulnply c) Because overhead was applied using a plantwide predetermined rate based on direct labor hours, the overhead can be allocated using the same percentages used in b) above to allocate direct labor costs. Determine the overhead dollars for each job and include the amounts in the Jobs Report below for Overhead. Job JV28 Job BY92 Job ZF 14 From JE Id above 20% From 4b above Calculate multiply Total applied OH % used by job OH per job 18% 35% d) Determine the total job costs by adding DM, DL and OH for each job in the Jobs Report below. (Add DM, DL and OH together). 5) Assume Superior uses the same Mark-up percentage to set the sales revenue amount for each job, a) Using the Sales Revenue and Unadjusted COGS calculate the Mark-up percent of total costs used Sales Revenue Unadjusted COGS Mark-up % (b) (a) (b) From JE If From JE lg Calculate (divide) s/b over 100% Transaction Debit Credit 266,000 General Journal Raw Material Accounts Payable (raw materials purchased) 266,000 b 289,000 Work in process Raw Material ( raw materials issued to production) 289,000 c 19,000 Work in Process Factory wages (Factory wages applied to WIP) 19,000 d 367,000 Work in Process Manufacturing Overhead (overhead applied to WIP) 367,000 712,000 Finished Goods Work in process (transferred to the finished goods) 712,000 1,064,000 Accounts Receivable Sales (Sales for the year) 1,064,000 8 667,000 667,000 h Cost of Goods Sold Finished Goods ((The total cost to produce the goods that were sold )) Manufacturing Overhead selling and administrative Accounts Payable (Actual manufacturing costs incurred) 351,000 351,000 16,000 Manufacturing Overhead Cost of Goods Sold (adjustment of over applied overheads) 16,000 Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials): Selling expenses Purchases of raw materials Direct labor Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead cost $ 219,000 $ 266,000 ? $ 159,000 $ 367,000 $ 351,000 Inventory balances at the beginning and end of the year were as follows: Raw materials Work in process Finished goods Beginning of Year End of Year $ 59,000 $ 36,000 $ 32,000 $ 38,000 The total manufacturing costs for the year were $675,000; the cost of goods available for sale totaled $750,000; the unadjusted cost of goods sold totaled $667,000; and the net operating income was $35,000. The company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts