Question: need help solving 12 a) b) c) and d) all info to solve is posted below, not sure if i am doing it right abc

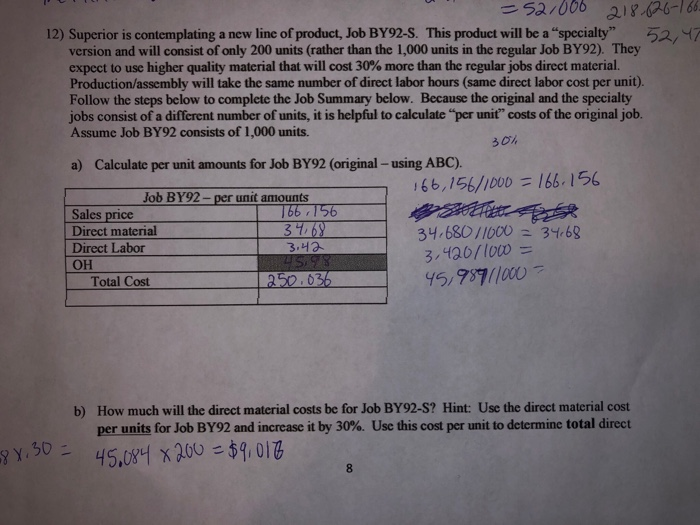

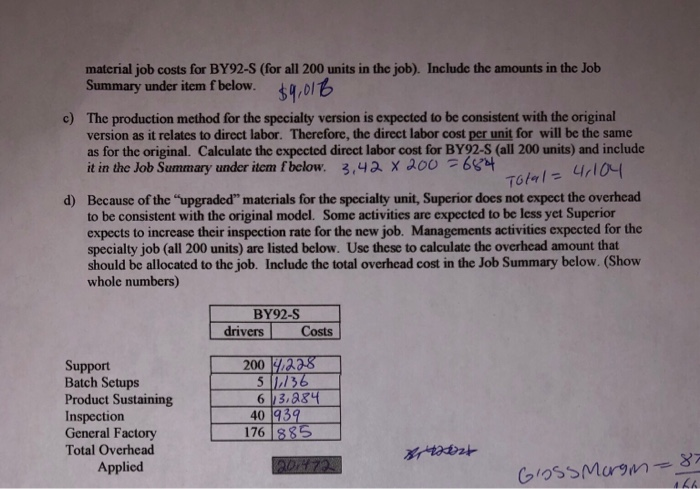

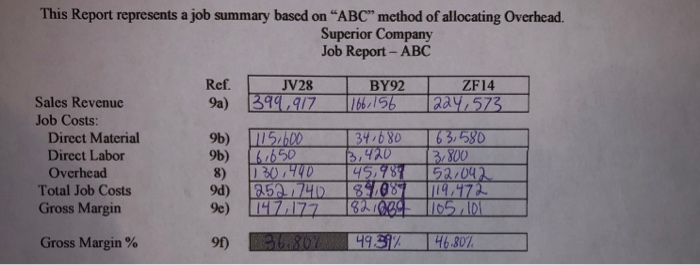

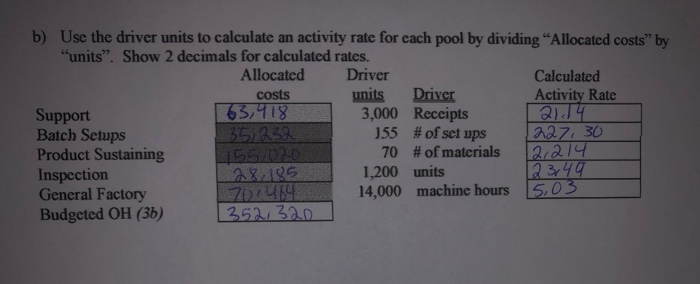

= 52/006 218-626-166. 12) Superior is contemplating a new line of product, Job BY92-S. This product will be a specialty" 52,47 version and will consist of only 200 units (rather than the 1,000 units in the regular Job BY92). They expect to use higher quality material that will cost 30% more than the regular jobs direct material. Production/assembly will take the same number of direct labor hours (same direct labor cost per unit) Follow the steps below to complete the Job Summary below. Because the original and the specialty jobs consist of a different number of units, it is helpful to calculate "per unit costs of the original job. Assume Job BY92 consists of 1,000 units. a) Calculate per unit amounts for Job BY92 (original - using ABC). 166,156/1000 = 166.156 Job BY92- per unit amounts Sales price T66, 156 Direct material 34.68 34.680/1000 = 3468 Direct Labor 3.42 OH 4.5/98 Total Cost 250.036 304 3,420/100 = 45,987710007 b) How much will the direct material costs be for Job BY92-S? Hint: Use the direct material cost per units for Job BY92 and increase it by 30%. Use this cost per unit to determine total direct 45.084 x 200 = $9,016 8 588.30 = material job costs for BY92-S (for all 200 units in the job). Include the amounts in the Job Summary under item f below. $9,016 Total = c) The production method for the specialty version is expected to be consistent with the original version as it relates to direct labor. Therefore, the direct labor cost per unit for will be the same as for the original. Calculate the expected direct labor cost for BY92-S (all 200 units) and include it in the Job Summary under item below. 3.42 x 200 -6844 4,104 d) Because of the "upgraded" materials for the specialty unit, Superior does not expect the overhead to be consistent with the original model. Some activities are expected to be less yet Superior expects to increase their inspection rate for the new job. Managements activities expected for the specialty job (all 200 units) are listed below. Use these to calculate the overhead amount that should be allocated to the job. Include the total overhead cost in the Job Summary below. (Show whole numbers) BY92-S drivers Costs Support Batch Setups Product Sustaining Inspection General Factory Total Overhead Applied 200 1.228 51,736 63.884 40 939 176 885 201472 GiossMorgm=87 42A This Report represents a job summary based on "ABC" method of allocating Overhead. Superior Company Job Report - ABC Ref. 9a) JV28 399,917 BY92 1166.156 ZF14 [224, 573 Sales Revenue Job Costs: Direct Material Direct Labor Overhead Total Job Costs Gross Margin 9b) 9b) 1115,600 16,650 1130,440 252740 147,177 336.807 34,680 13,420 45,987 82081 1827069 49.92 63,580 3.800 52,042 119,472 11050 Gross Margin % 91) 46.807 b) Use the driver units to calculate an activity rate for each pool by dividing "Allocated costs" by "units". Show 2 decimals for calculated rates. Allocated Driver Calculated costs units Driver Activity Rate Support 63,418 3,000 Receipts Batch Setups 35232 155 # of set ups 1227, 30 Product Sustaining 70 # of materials 12,214 Inspection 28285 1,200 units 12349 General Factory 701464 14,000 machine hours 5,03 Budgeted OH (36) 3521320

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts