Question: Need Help with 4 and 5 Part A: Stock Valuation Relationships Calculate the value of each stock below: D R G STOCK VALUE $1 6%

Need Help with 4 and 5

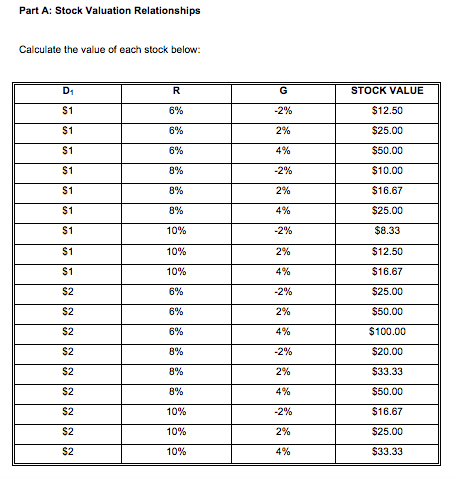

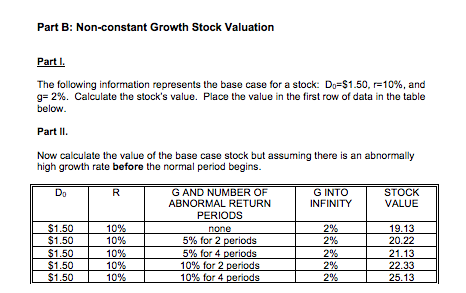

Part A: Stock Valuation Relationships Calculate the value of each stock below: D R G STOCK VALUE $1 6% -2% $12.50 $1 6% 2% $25.00 $1 6% 4% $50.00 $1 8% -2% $10.00 $1 8% 2% $16.67 $1 8% 4% $25.00 $1 10% -2% $8.33 $1 10% 2% $12.50 $1 10% 4% $16.67 $2 6% -2% $25.00 $2 6% 2% $50.00 $2 6% 4% $100.00 $2 8% -2% $20.00 $2 8% 2% $33.33 $2 8% 4% $50.00 $2 10% -2% $16.67 $2 10% 2% $25.00 $2 10% 4% $33.33 Part B: Non-constant Growth Stock Valuation Part I The following information represents the base case for a stock: D =$1.50, r=10%, and g=2%. Calculate the stock's value. Place the value in the first row of data in the table below. Part II. Now calculate the value of the base case stock but assuring there is an abnormally high growth rate before the normal period begins. D. R G INTO INFINITY STOCK VALUE 2% $1.50 $1.50 $1.50 $1.50 $1.50 10% 10% 10% 10% 10% G AND NUMBER OF ABNORMAL RETURN PERIODS none 5% for 2 periods 5% for 4 periods 10% for 2 periods 10% for 4 periods 2% 2% 2% 2% 19.13 20.22 21.13 22.33 25.13 4. 5. How do the number of years of non-constant growth combined with the rate of growth affect value? What factors may cause a stock to have positive or negative non-constant growth? Can these factors last forever? Part A: Stock Valuation Relationships Calculate the value of each stock below: D R G STOCK VALUE $1 6% -2% $12.50 $1 6% 2% $25.00 $1 6% 4% $50.00 $1 8% -2% $10.00 $1 8% 2% $16.67 $1 8% 4% $25.00 $1 10% -2% $8.33 $1 10% 2% $12.50 $1 10% 4% $16.67 $2 6% -2% $25.00 $2 6% 2% $50.00 $2 6% 4% $100.00 $2 8% -2% $20.00 $2 8% 2% $33.33 $2 8% 4% $50.00 $2 10% -2% $16.67 $2 10% 2% $25.00 $2 10% 4% $33.33 Part B: Non-constant Growth Stock Valuation Part I The following information represents the base case for a stock: D =$1.50, r=10%, and g=2%. Calculate the stock's value. Place the value in the first row of data in the table below. Part II. Now calculate the value of the base case stock but assuring there is an abnormally high growth rate before the normal period begins. D. R G INTO INFINITY STOCK VALUE 2% $1.50 $1.50 $1.50 $1.50 $1.50 10% 10% 10% 10% 10% G AND NUMBER OF ABNORMAL RETURN PERIODS none 5% for 2 periods 5% for 4 periods 10% for 2 periods 10% for 4 periods 2% 2% 2% 2% 19.13 20.22 21.13 22.33 25.13 4. 5. How do the number of years of non-constant growth combined with the rate of growth affect value? What factors may cause a stock to have positive or negative non-constant growth? Can these factors last forever

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts