Question: Need help with 7-6, please. Thank you! Problems The number in parentheses that follows each problem a. What is the depreciation during the second year?

Need help with 7-6, please. Thank you!

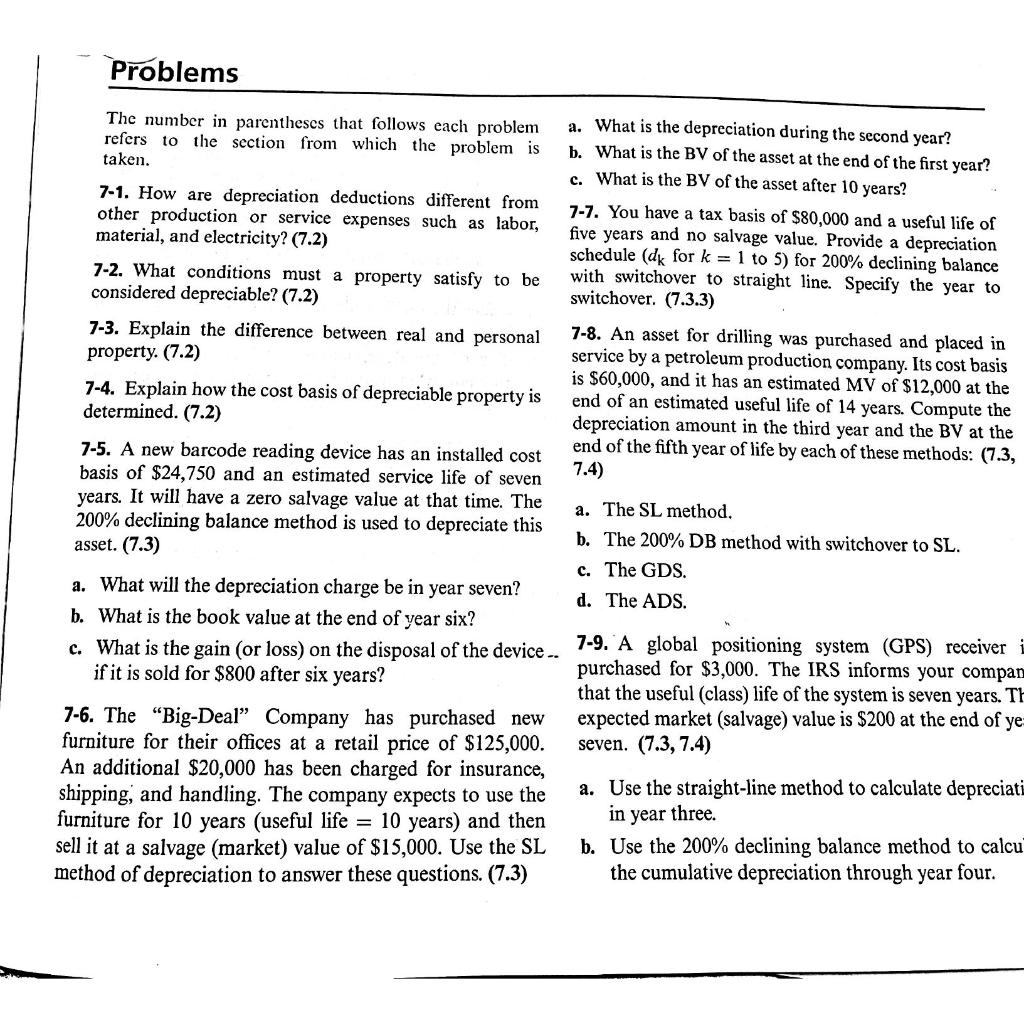

Problems The number in parentheses that follows each problem a. What is the depreciation during the second year? refers to the section from which the problem is b. What is the BV of the asset at the end of the first year? taken. c. What is the BV of the asset after 10 years? 7-1. How are depreciation deductions different from other production or service expenses such as labor, 7-7. You have a tax basis of $80,000 and a useful life of material, and electricity? (7.2) five years and no salvage value. Provide a depreciation schedule (dk for k = 1 to 5) for 200% declining balance 7-2. What conditions must a property satisfy to be with switchover to straight line. Specify the year to considered depreciable? (7.2) switchover. (7.3.3) 7-3. Explain the difference between real and personal 7-8. An asset for drilling was purchased and placed in property. (7.2) service by a petroleum production company. Its cost basis is $60,000, and it has an estimated MV of $12,000 at the 7-4. Explain how the cost basis of depreciable property is end of an estimated useful life of 14 years. Compute the determined. (7.2) depreciation amount in the third year and the BV at the 7-5. A new barcode reading device has an installed cost end of the fifth year of life by each of these methods: (7.3, 7.4) basis of $24,750 and an estimated service life of seven years. It will have a zero salvage value at that time. The a. The SL method. 200% declining balance method is used to depreciate this b. The 200% DB method with switchover to SL. asset. (7.3) c. The GDS. a. What will the depreciation charge be in year seven? d. The ADS. b. What is the book value at the end of year six? c. What is the gain (or loss) on the disposal of the device .. 7-9. A global positioning system (GPS) receiver i if it is sold for $800 after six years? purchased for $3,000. The IRS informs your compan that the useful (class) life of the system is seven years. TH 7-6. The Big-Deal Company has purchased new expected market (salvage) value is $200 at the end of ye furniture for their offices at a retail price of $125,000. seven. (7.3, 7.4) An additional $20,000 has been charged for insurance, a. Use the straight-line method to calculate depreciati shipping, and handling. The company expects to use the furniture for 10 years (useful life = 10 years) and then sell it at a salvage (market) value of $15,000. Use the SL b. Use the 200% declining balance method to calcu the cumulative depreciation through year four. method of depreciation to answer these questions. (7.3) in year three

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts