Question: need help with 8 and 9 Question 8 (1 point) A bond has a $1,000 par value, 22 years to maturity, and a 7.00% annual

need help with 8 and 9

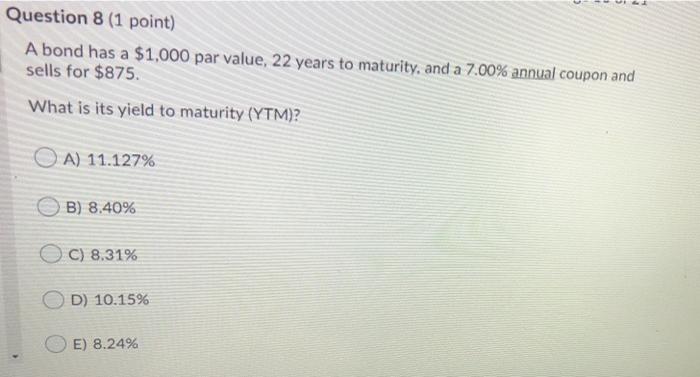

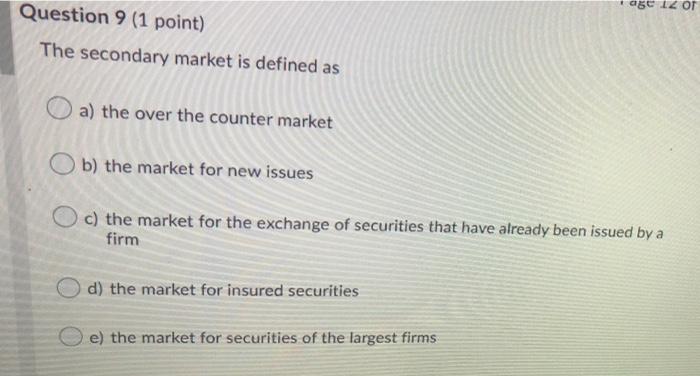

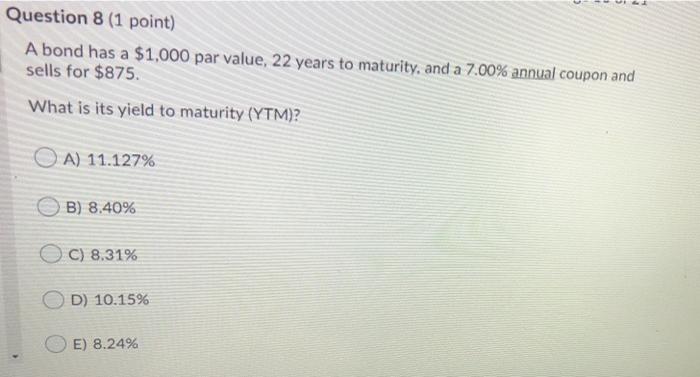

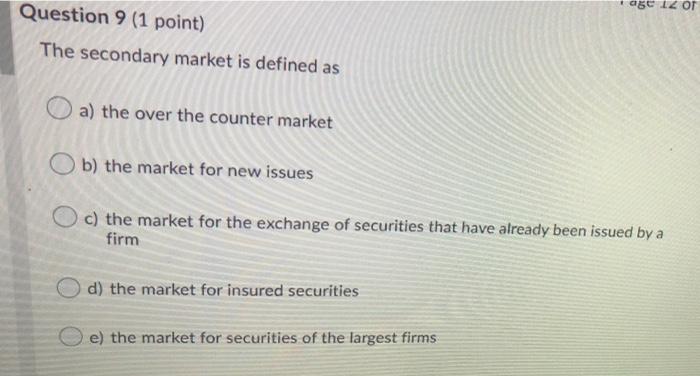

Question 8 (1 point) A bond has a $1,000 par value, 22 years to maturity, and a 7.00% annual coupon and sells for $875. What is its yield to maturity (YTM)? A) 11.127% B) 8.40% C) 8.31% OD) 10.15% E) 8.24% 1050 12 OT Question 9 (1 point) The secondary market is defined as a) the over the counter market b) the market for new issues c) the market for the exchange of securities that have already been issued by a firm d) the market for insured securities e) the market for securities of the largest firms

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock