Question: Need help with a and b? In a binomial tree with n time steps, the price of the underlying asset S (with an initial price

Need help with a and b?

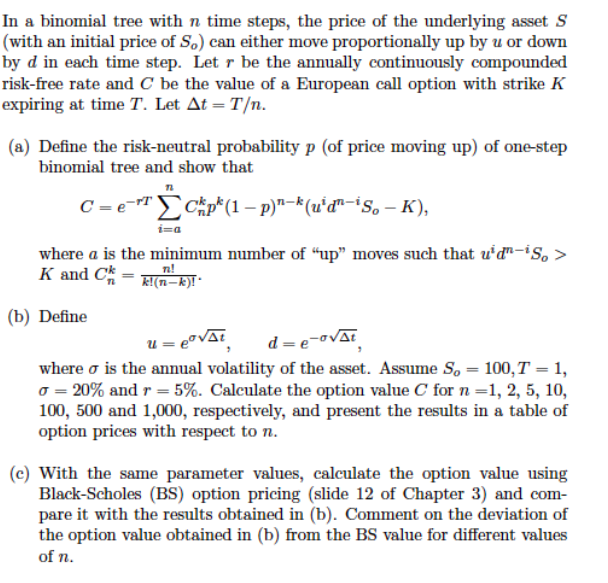

In a binomial tree with n time steps, the price of the underlying asset S (with an initial price of S_o) can either move proportionally up by u or down by d in each time step. Let r be the annually continuously compounded risk-free rate and C be the value of a European call option with strike K expiring at time T. Let Delta t = T. (a) Define the risk-neutral probability p (of price moving up) of one-step binomial tree and show that C = e^-rT sigma^n_i = a C^k_np^k(1 - p) (u^I d^n - I S_o - k), where a is the minimum number of "up" moves such that u^i d^n - iS_o > K and C6k_n = n!/k!(n - k)!. (b) Define u = e^sigma Squareroot Delta t, d = e^-sigma Squareroot Delta t, where sigma is the annual volatility of the asset. Assume S_o = 100 T = 1, sigma = 20% and r = 5%. Calculate the option value C for n = 1, 2, 5, 10, 100, 500 and 1,000, respectively, and present the results in a table of option prices with respect to n. (c) With the same parameter values, calculate the option value using Black-Scholes (BS) option pricing (slide 12 of Chapter 3) and compare it with the results obtained in (b). Comment on the deviation of the option value obtained in (b) from the BS value for different values of n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts