Question: Slide 12, chapter 3: In a binomial tree with n time steps, the price of the underlying asset S (with an initial price of So)

Slide 12, chapter 3:

Slide 12, chapter 3:

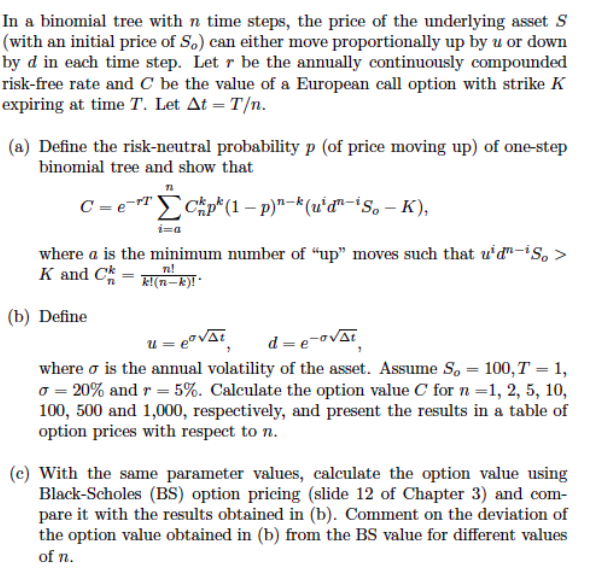

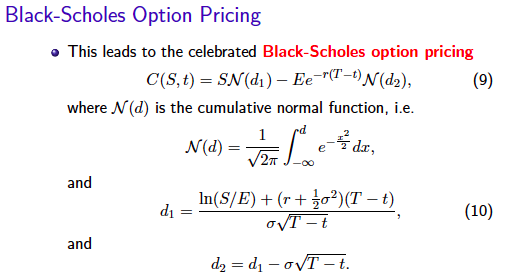

In a binomial tree with n time steps, the price of the underlying asset S (with an initial price of So) can either move proportionally up by u or down by d in each time step. Let r be the annually continuously compounded risk-free rate and C be the value of a European call option with strike K expiring at time T. Let At-T. (a) Define the risk-neutral probability p (of price moving up) of one-step binomial tree and show that 1 a where a is the minimum number of "up" moves such that u dn-iSo K and C (b) Define e ovat a VAAt where o is the annual volatility of the asset. Assume S 100 T 1, 20% and r 5%. Calculate the option value C for n 1, 2, 5, 10, 100, 500 and 1,000, respectively, and present the results in a table of option prices with respect to n. (c) With the same parameter values, calculate the option value using Black-Scholes (BS) option pricing (slide 12 of Chapter 3) and com- pare it with the results obtained in (b). Comment on the deviation of the option value obtained in (b) from the BS value for different values of n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts