Question: Need help with a breakdown of each question 1-6 with the explanations. Z Company is planning to purchase a system capable of deploying Artificial Intelligence

Need help with a breakdown of each question 1-6 with the explanations.

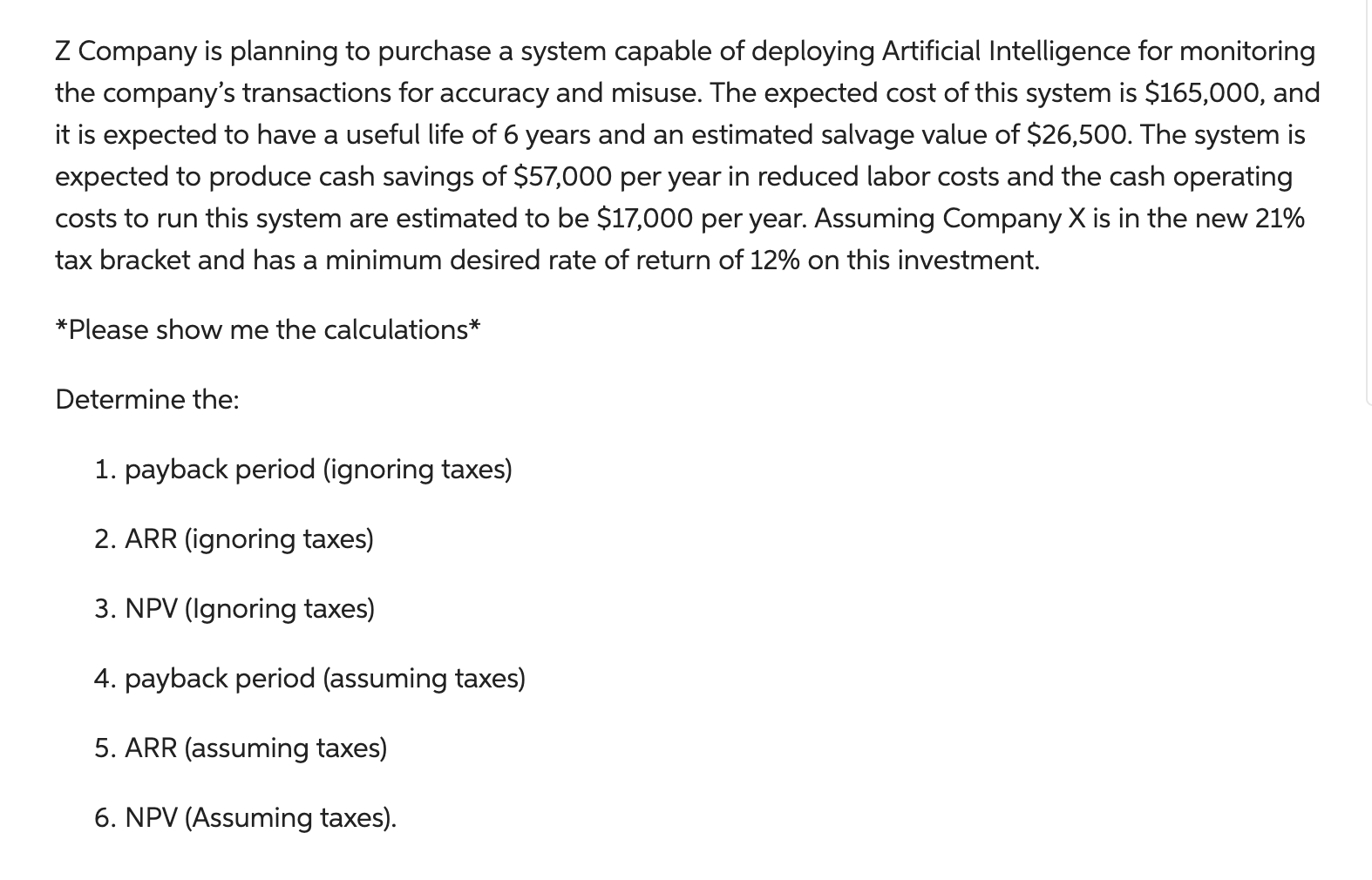

Z Company is planning to purchase a system capable of deploying Artificial Intelligence for monitoring the company's transactions for accuracy and misuse. The expected cost of this system is $165,000, and it is expected to have a useful life of 6 years and an estimated salvage value of $26,500. The system is expected to produce cash savings of $57,000 per year in reduced labor costs and the cash operating costs to run this system are estimated to be $17,000 per year. Assuming Company X is in the new 21% tax bracket and has a minimum desired rate of return of 12% on this investment. *Please show me the calculations* Determine the: 1. payback period (ignoring taxes) 2. ARR (ignoring taxes) 3. NPV (lgnoring taxes) 4. payback period (assuming taxes) 5. ARR (assuming taxes) 6. NPV (Assuming taxes). Z Company is planning to purchase a system capable of deploying Artificial Intelligence for monitoring the company's transactions for accuracy and misuse. The expected cost of this system is $165,000, and it is expected to have a useful life of 6 years and an estimated salvage value of $26,500. The system is expected to produce cash savings of $57,000 per year in reduced labor costs and the cash operating costs to run this system are estimated to be $17,000 per year. Assuming Company X is in the new 21% tax bracket and has a minimum desired rate of return of 12% on this investment. *Please show me the calculations* Determine the: 1. payback period (ignoring taxes) 2. ARR (ignoring taxes) 3. NPV (lgnoring taxes) 4. payback period (assuming taxes) 5. ARR (assuming taxes) 6. NPV (Assuming taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts