Question: Need help with A - D for question 2 The probability distributions of rates of return for three stocks, C , D , &

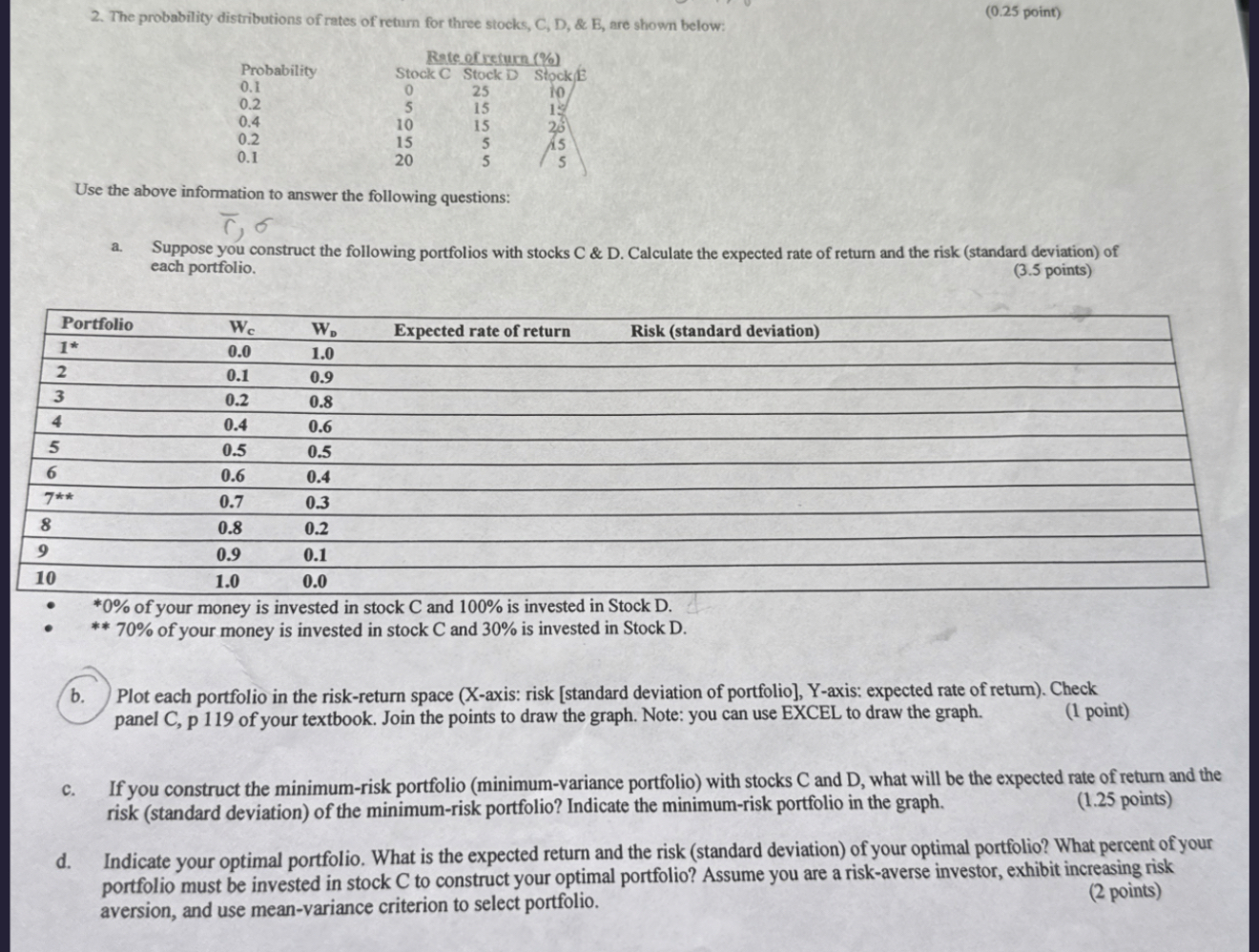

"Need help with AD for question The probability distributions of rates of return for three stocks, C D & E are shown below:

point

Rate of cetum.

Probability

tableStock CStock DStock

Use the above information to answer the following questions:

a Suppose you construct the following portfolios with stocks C & D Calculate the expected rate of return and the risk standard deviation of each portfolio.

points

tablePortfolioExpected rate of return Risk standard deviation

of your money is invested in stock C and is invested in Stock D

of your money is invested in stock C and is invested in Stock D

b Plot each portfolio in the riskreturn space Xaxis: risk standard deviation of portfolio Yaxis: expected rate of return Check panel C p of your textbook. Join the points to draw the graph. Note: you can use EXCEL to draw the graph.

point

c If you construct the minimumrisk portfolio minimumvariance portfolio with stocks C and D what will be the expected rate of return and the risk standard deviation of the minimumrisk portfolio? Indicate the minimumrisk portfolio in the graph.

d Indicate your optimal portfolio. What is the expected return and the risk standard deviation of your optimal portfolio? What percent of your portfolio must be invested in stock C to construct your optimal portfolio? Assume you are a riskaverse investor, exhibit increasing risk aversion, and use meanvariance criterion to select portfolio.

points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock