Question: Need help with a mortgage refinancing question. Suppose you purchased you first house 2 years ago and took out a mortgage for $160,000 with a

Need help with a mortgage refinancing question.

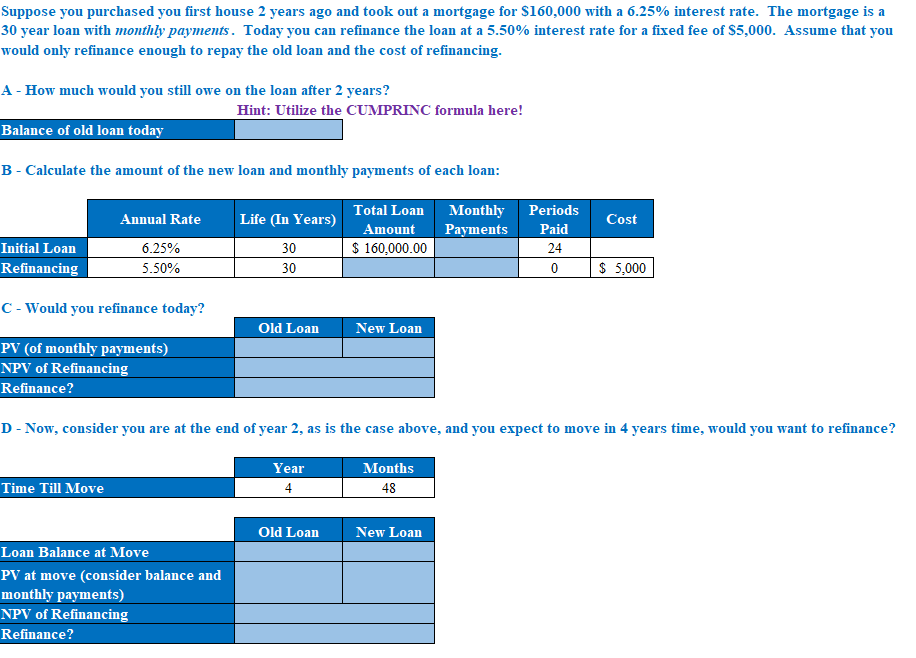

Suppose you purchased you first house 2 years ago and took out a mortgage for $160,000 with a 6.25% interest rate. The mortgage is a 30 year loan with monthly payments. Today you can refinance the loan at a 5.50% interest rate for a fixed fee of $5,000. Assume that you would only refinance enough to repay the old loan and the cost of refinancing A How much would you still owe on the loan after 2 years? Balance of old loan today B - Calculate the amount of the new loan and monthly payments of each loan: Hint: Utilize the CUMPRINC formula here! Total Loan Monthly Periods Annual RateLife (In Years) Cost Amount Payments Paid 24 625% 5.50% 30 30 Initial Loan S160,000.00 Refinancing S 5,000 C - Would you refinance today? Old Loarn New Loan PV (of monthly payments) NPV of Refinancing Refinance? D - Now, consider you are at the end of year 2, as is the case above, and you expect to move in 4 years time, would you want to refinance? Year 4 Months 48 Time Till Move Old Loarn New Loan Loan Balance at Move PV at move (consider balance and monthly payments) NPV of Refinancing Refinance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts