Question: need help with a using the Gordon modelj! 2. Charles Freeman, portfolio manager for Windsor Fund, was considering the purchase of CISCO's common stock. Freeman

need help with a

need help with a

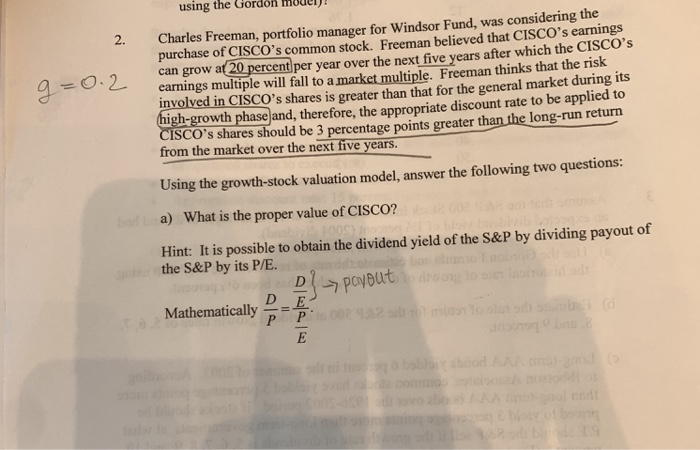

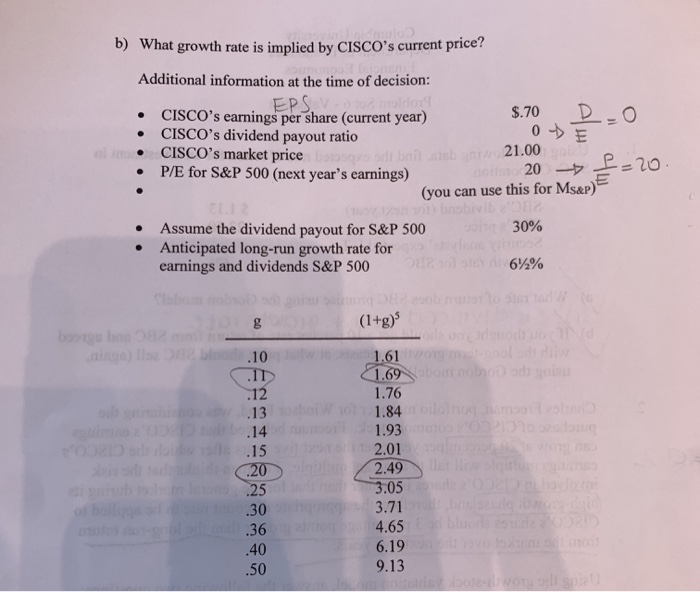

using the Gordon modelj! 2. Charles Freeman, portfolio manager for Windsor Fund, was considering the purchase of CISCO's common stock. Freeman believed that CISCO's earnings earnings multiple will fall to a involved in CISCO's shares is greater than that for the general market during its cangsut per year over the next five years after which the cisco's market multiple. Freeman thinks that the risk igh-growth phaseland, therefore, the appropriate discount rate to be applied to ISCO's shares should be 3 percentage points greater than the long-run return from the market over the next five years Using the growth-stock valuation model, answer the following two questions: a) What is the proper value of CISCO? Hint: It is possible to obtain the dividend yield of the S&P by dividing payout of the S&P by its P/E. Mathematically Payout b) What growth rate is implied by CISCO's current price? Additional information at the time of decision: EPS S.70 -O CISCO's earnings per share (current year) CISCO's dividend payout ratio CISCO's market price P/E for S&P 500 (next year's earnings) 0 -E . 21.00 (you can use this for Ms&p) 30% Assume the dividend payout for S&P 500 Anticipated long-run growth rate for earnings and dividends S&P 500 . . 6 % 1.61 .10 1.76 1.84 1.93 2.01 2.49 .05 3.71 4.65 6.19 9.13 .13 .14 15 .30 .36 40 .50 using the Gordon modelj! 2. Charles Freeman, portfolio manager for Windsor Fund, was considering the purchase of CISCO's common stock. Freeman believed that CISCO's earnings earnings multiple will fall to a involved in CISCO's shares is greater than that for the general market during its cangsut per year over the next five years after which the cisco's market multiple. Freeman thinks that the risk igh-growth phaseland, therefore, the appropriate discount rate to be applied to ISCO's shares should be 3 percentage points greater than the long-run return from the market over the next five years Using the growth-stock valuation model, answer the following two questions: a) What is the proper value of CISCO? Hint: It is possible to obtain the dividend yield of the S&P by dividing payout of the S&P by its P/E. Mathematically Payout b) What growth rate is implied by CISCO's current price? Additional information at the time of decision: EPS S.70 -O CISCO's earnings per share (current year) CISCO's dividend payout ratio CISCO's market price P/E for S&P 500 (next year's earnings) 0 -E . 21.00 (you can use this for Ms&p) 30% Assume the dividend payout for S&P 500 Anticipated long-run growth rate for earnings and dividends S&P 500 . . 6 % 1.61 .10 1.76 1.84 1.93 2.01 2.49 .05 3.71 4.65 6.19 9.13 .13 .14 15 .30 .36 40 .50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts