Question: Need help with all parts of this problem please! Problem 3 Problem #3 Company A issues twenty-year bond with a face value of $300,000 on

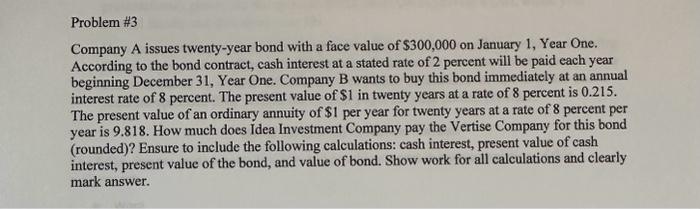

Problem \#3 Company A issues twenty-year bond with a face value of $300,000 on January 1, Year One. According to the bond contract, cash interest at a stated rate of 2 percent will be paid each year beginning December 31, Year One. Company B wants to buy this bond immediately at an annual interest rate of 8 percent. The present value of $1 in twenty years at a rate of 8 percent is 0.215 . The present value of an ordinary annuity of $1 per year for twenty years at a rate of 8 percent per year is 9.818 . How much does Idea Investment Company pay the Vertise Company for this bond (rounded)? Ensure to include the following calculations: cash interest, present value of cash interest, present value of the bond, and value of bond. Show work for all calculations and clearly mark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts