Question: need help with all parts please 1. Consider a bond with a 10% coupon rate and a yield to maturity equal to 8%. If the

need help with all parts please

need help with all parts please

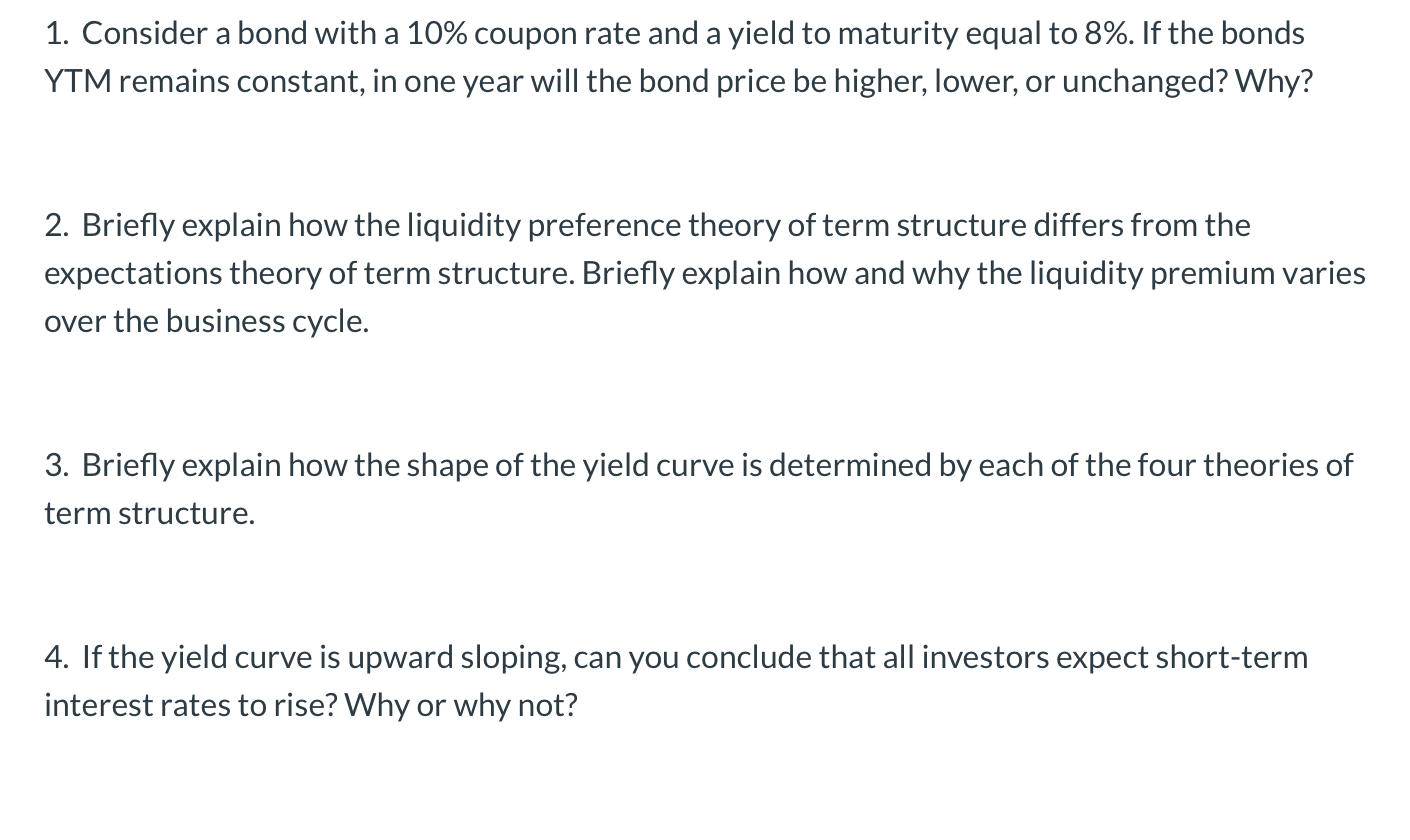

1. Consider a bond with a 10% coupon rate and a yield to maturity equal to 8%. If the bonds YTM remains constant, in one year will the bond price be higher, lower, or unchanged? Why? 2. Briefly explain how the liquidity preference theory of term structure differs from the expectations theory of term structure. Briefly explain how and why the liquidity premium varies over the business cycle. 3. Briefly explain how the shape of the yield curve is determined by each of the four theories of term structure. 4. If the yield curve is upward sloping, can you conclude that all investors expect short-term interest rates to rise? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts