Question: need help with B-1 AND B-2 Question 2: (40%) Your firm is considering two projects with the following cash flows. WACC 12% 12% year Project

need help with B-1 AND B-2

need help with B-1 AND B-2

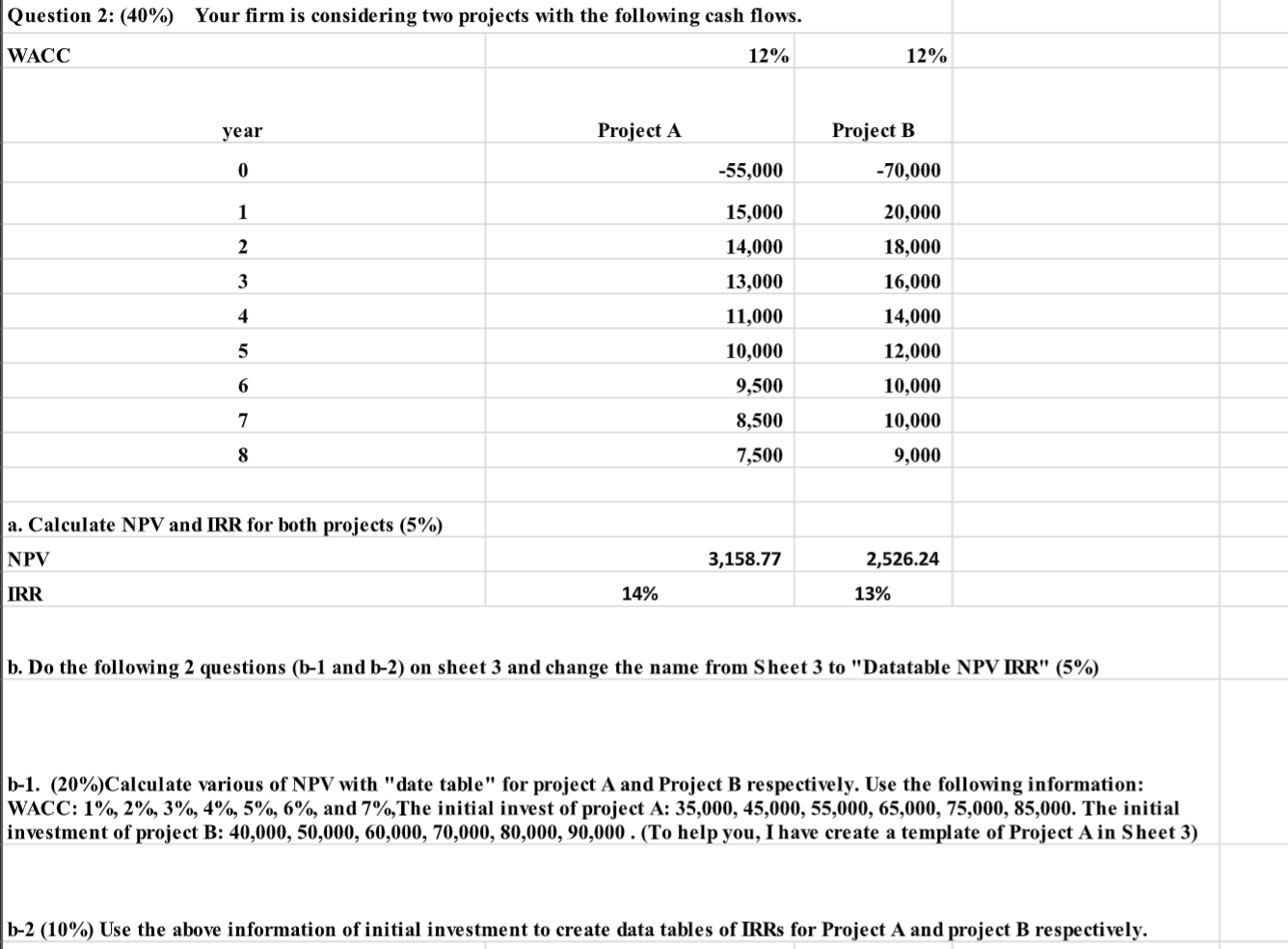

Question 2: (40%) Your firm is considering two projects with the following cash flows. WACC 12% 12% year Project A Project B 0 -55,000 -70,000 1 20,000 2 15,000 14,000 13,000 11,000 3 4 18,000 16,000 14,000 12,000 10,000 5 6 10,000 9,500 8,500 7 10,000 8 7,500 9,000 a. Calculate NPV and IRR for both projects (5%) NPV 3,158.77 2,526.24 IRR 14% 13% b. Do the following 2 questions (b-1 and b-2) on sheet 3 and change the name from Sheet 3 to "Datatable NPV IRR" (5%) b-1. (20%)Calculate various of NPV with "date table" for project A and Project B respectively. Use the following information: WACC: 1%, 2%, 3%, 4%, 5%, 6%, and 7%,The initial invest of project A: 35,000, 45,000, 55,000, 65,000, 75,000, 85,000. The initial investment of project B: 40,000, 50,000, 60,000, 70,000, 80,000, 90,000. (To help you, I have create a template of Project A in Sheet 3) b-2 (10%) Use the above information of initial investment to create data tables of IRRs for Project A and project B respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts