Question: Please answer this question. Thank you Question 14 1 pts Fran has a high deductible health insurance plan with an annual $1,500 deductible and co-insurance

Please answer this question. Thank you

Please answer this question. Thank you

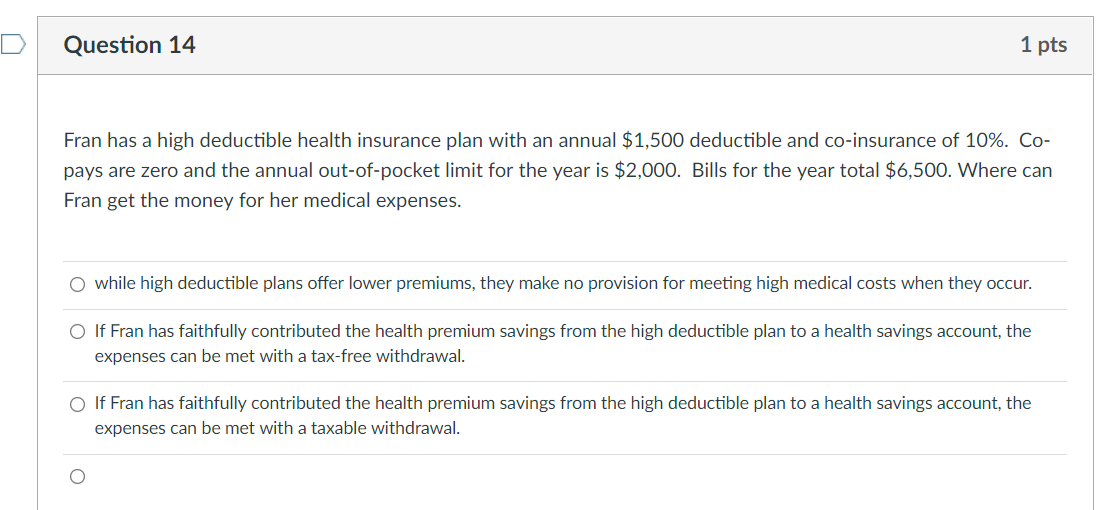

Question 14 1 pts Fran has a high deductible health insurance plan with an annual $1,500 deductible and co-insurance of 10%. Co- pays are zero and the annual out-of-pocket limit for the year is $2,000. Bills for the year total $6,500. Where can Fran get the money for her medical expenses. O while high deductible plans offer lower premiums, they make no provision for meeting high medical costs when they occur. O If Fran has faithfully contributed the health premium savings from the high deductible plan to a health savings account, the expenses can be met with a tax-free withdrawal. O If Fran has faithfully contributed the health premium savings from the high deductible plan to a health savings account, the expenses can be met with a taxable withdrawal. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts